As global markets navigate the complexities of monetary policy shifts and economic uncertainties, Asian stock markets have shown resilience, with countries like China experiencing bullish sentiment driven by domestic liquidity and technological advancements. In this dynamic environment, dividend stocks can offer investors a measure of stability and income potential, making them an appealing consideration for those looking to diversify their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.03% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.28% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.70% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.76% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.95% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.97% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.38% | ★★★★★★ |

Click here to see the full list of 1024 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

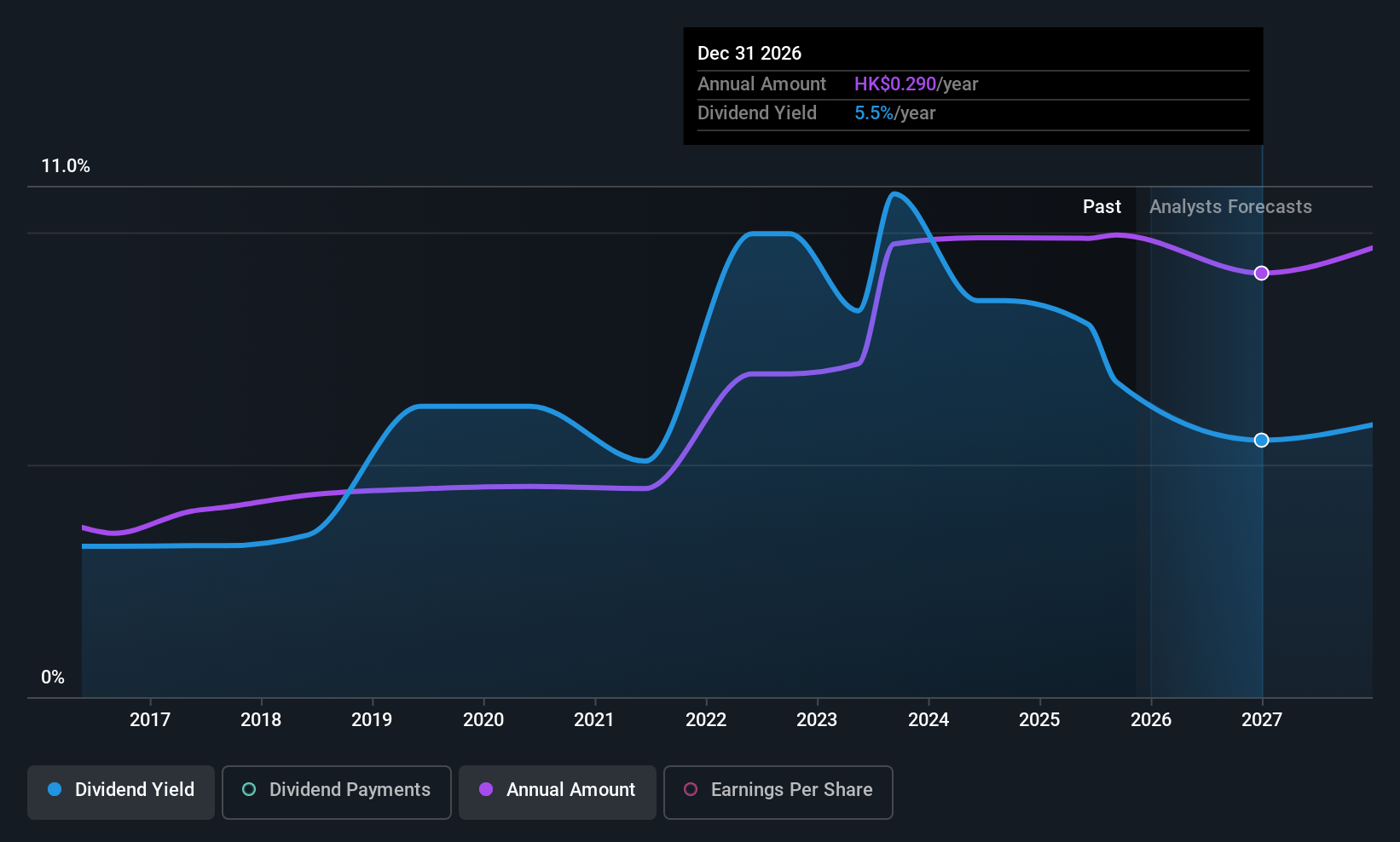

Sinotrans (SEHK:598)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinotrans Limited offers integrated logistics services mainly in the People’s Republic of China and has a market cap of approximately HK$47.03 billion.

Operations: Sinotrans Limited generates revenue from several segments, including Agent and Related services (CN¥69.17 billion), E-Commerce Business (CN¥12.67 billion), and Professional Logistics (CN¥28.14 billion).

Dividend Yield: 6.3%

Sinotrans' dividend payments have been volatile over the past decade, despite a general increase. The current yield of 6.26% is slightly below the top quartile in Hong Kong, but dividends are well-covered by earnings and cash flows with payout ratios of 53.5% and 49%, respectively. Recent earnings showed a slight decline in revenue to CNY 50.52 billion but stable net income at CNY 1.95 billion, supporting interim dividends of RMB 0.145 per share announced for October payment.

- Unlock comprehensive insights into our analysis of Sinotrans stock in this dividend report.

- Our valuation report here indicates Sinotrans may be undervalued.

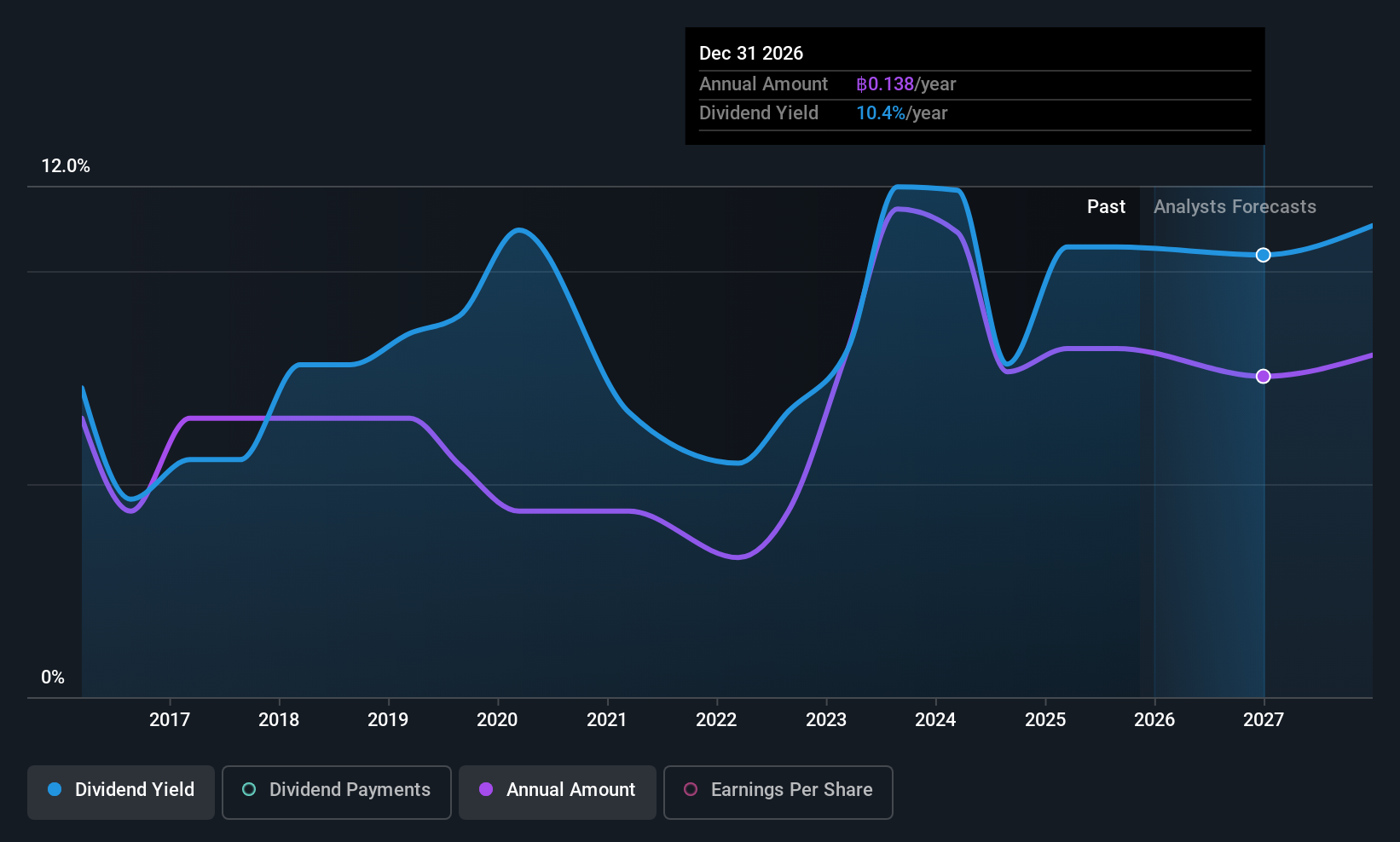

Sansiri (SET:SIRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sansiri Public Company Limited, along with its subsidiaries, operates in the property development sector in Thailand and has a market capitalization of THB27.35 billion.

Operations: Sansiri Public Company Limited generates revenue from Real Estate (THB30.96 billion), Building Management, Project Management and Real Estate Brokerage (THB2.78 billion), and Hotel Business (THB753 million).

Dividend Yield: 9.6%

Sansiri's dividend payments have been volatile over the past decade, yet they remain well-covered by earnings and cash flows, with payout ratios of 53.8% and 25.4%, respectively. Despite a recent decrease in dividends to THB 0.05 per share, the yield remains high at 9.55%, ranking in the top quartile of Thailand's market. Recent strategic expansions include forming new joint ventures and subsidiaries in property development, potentially enhancing future cash flow stability for dividends.

- Dive into the specifics of Sansiri here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sansiri shares in the market.

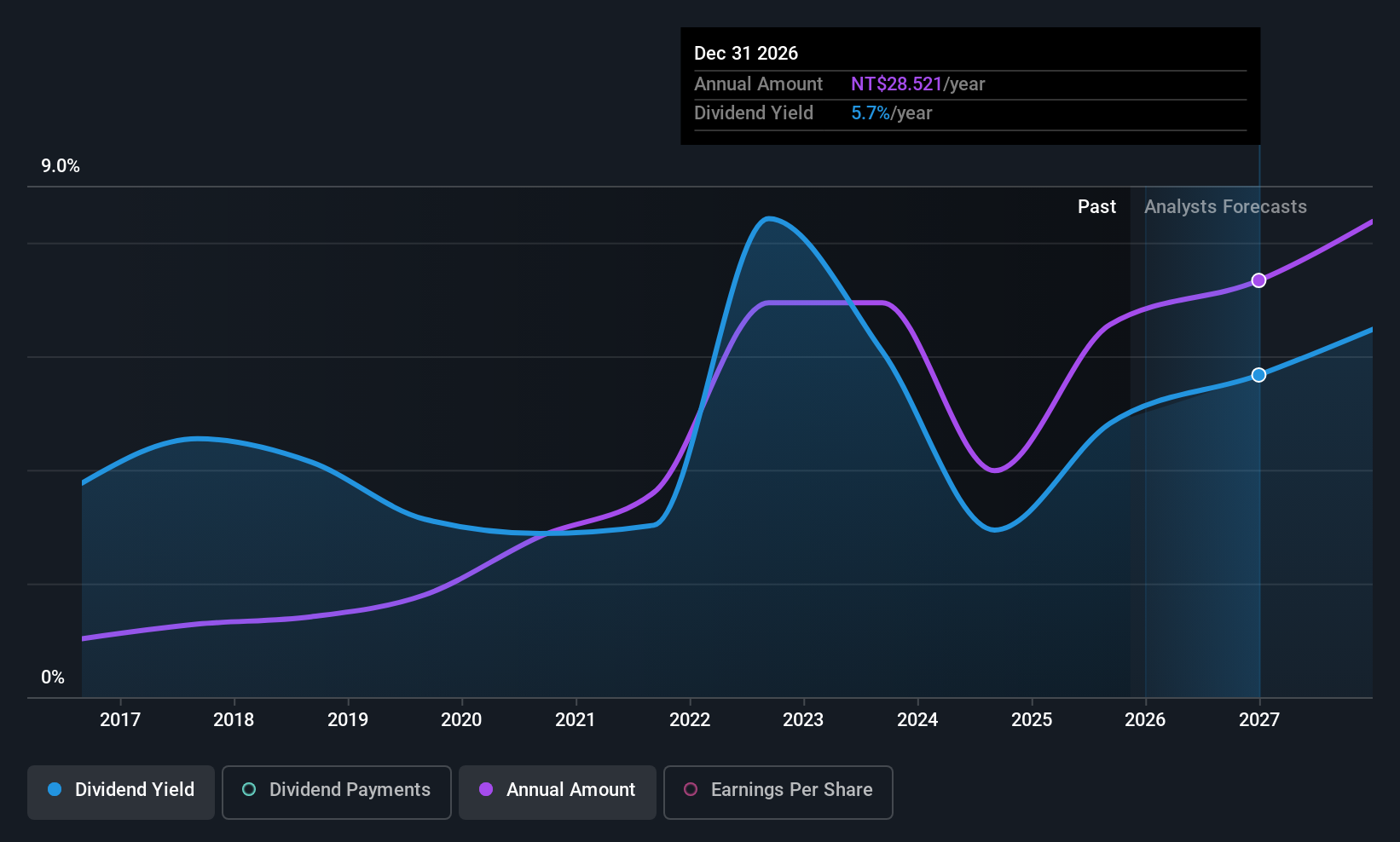

Realtek Semiconductor (TWSE:2379)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Realtek Semiconductor Corp. is involved in the research, development, production, and sale of integrated circuits and related application software globally, with a market cap of NT$277.97 billion.

Operations: Realtek Semiconductor Corp. generates its revenue primarily from the microcircuit and related application software segment, which accounted for NT$124.03 billion.

Dividend Yield: 4.7%

Realtek Semiconductor's dividends are covered by earnings and cash flows, with payout ratios of 79.5% and 59.5%, respectively. However, the dividend track record has been volatile over the past decade despite growth in payments. The current yield of 4.7% is below Taiwan's top quartile benchmark of 5.3%. Recent earnings show increased sales but decreased quarterly net income year-over-year, reflecting potential challenges in maintaining consistent dividend growth amidst fluctuating profits.

- Delve into the full analysis dividend report here for a deeper understanding of Realtek Semiconductor.

- The valuation report we've compiled suggests that Realtek Semiconductor's current price could be quite moderate.

Taking Advantage

- Navigate through the entire inventory of 1024 Top Asian Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:598

Sinotrans

Provides integrated logistics services primarily in the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives