- Hong Kong

- /

- Infrastructure

- /

- SEHK:548

Beyond Lackluster Earnings: Potential Concerns For Shenzhen Expressway's (HKG:548) Shareholders

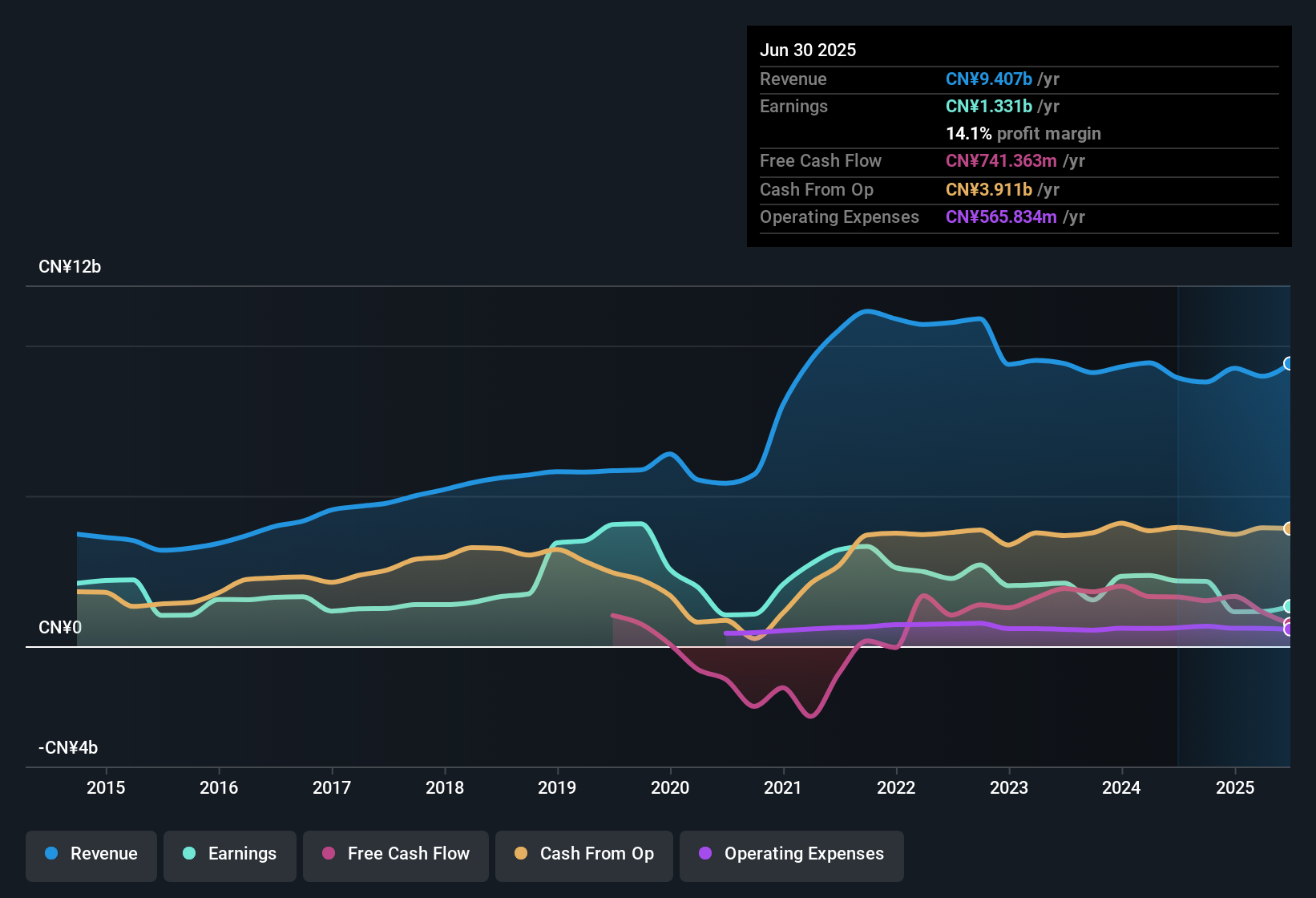

Shenzhen Expressway Corporation Limited (HKG:548) recently posted soft earnings but shareholders didn't react strongly. Our analysis suggests that they may be missing some concerning details underlying the profit numbers.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Shenzhen Expressway issued 16% more new shares over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Shenzhen Expressway's EPS by clicking here.

A Look At The Impact Of Shenzhen Expressway's Dilution On Its Earnings Per Share (EPS)

Shenzhen Expressway's net profit dropped by 41% per year over the last three years. Even looking at the last year, profit was still down 39%. Sadly, earnings per share fell further, down a full 44% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Shenzhen Expressway's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Power Of Non-Operating Revenue

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. As well as the aforementioned dilution, Shenzhen Expressway saw a spike in non-operating revenue, over the last year. In fact, our data indicates that non-operating revenue increased from CN¥1.53b to CN¥2.78b. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Our Take On Shenzhen Expressway's Profit Performance

In the last year Shenzhen Expressway's non-operating revenue really gave it a boost, but not in a way that is necessarily going to be sustained. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For the reasons mentioned above, we think that a perfunctory glance at Shenzhen Expressway's statutory profits might make it look better than it really is on an underlying level. So while earnings quality is important, it's equally important to consider the risks facing Shenzhen Expressway at this point in time. To help with this, we've discovered 4 warning signs (1 is a bit concerning!) that you ought to be aware of before buying any shares in Shenzhen Expressway.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:548

Shenzhen Expressway

Primarily invests in, constructs, operates, and manages toll highways and roads, as well as other urban and transportation infrastructure in the People’s Republic of China.

Slight risk second-rate dividend payer.

Market Insights

Community Narratives