- Hong Kong

- /

- Transportation

- /

- SEHK:525

Shareholders Will Probably Be Cautious Of Increasing Guangshen Railway Company Limited's (HKG:525) CEO Compensation At The Moment

The disappointing performance at Guangshen Railway Company Limited (HKG:525) will make some shareholders rather disheartened. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 17 June 2021. The data we gathered below shows that CEO compensation looks acceptable for now.

See our latest analysis for Guangshen Railway

Comparing Guangshen Railway Company Limited's CEO Compensation With the industry

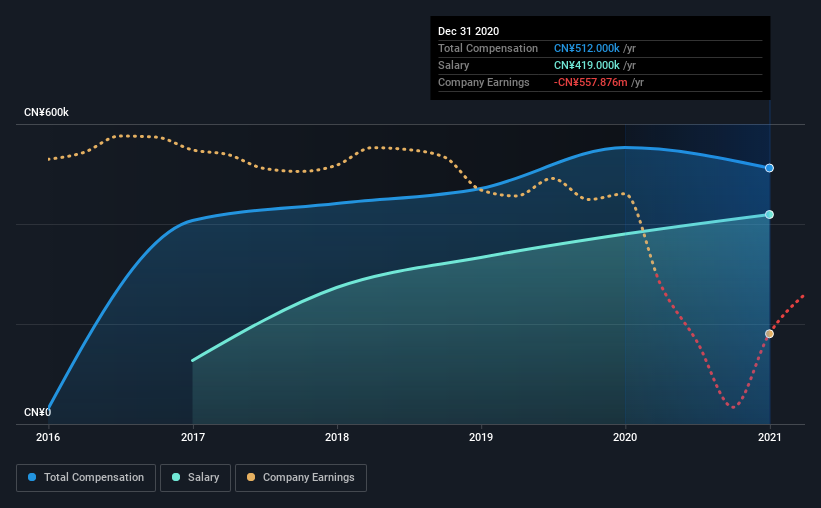

Our data indicates that Guangshen Railway Company Limited has a market capitalization of HK$17b, and total annual CEO compensation was reported as CN¥512k for the year to December 2020. That's slightly lower by 7.4% over the previous year. In particular, the salary of CN¥419.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between HK$7.8b and HK$25b, we discovered that the median CEO total compensation of that group was CN¥5.5m. In other words, Guangshen Railway pays its CEO lower than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥419k | CN¥380k | 82% |

| Other | CN¥93k | CN¥173k | 18% |

| Total Compensation | CN¥512k | CN¥553k | 100% |

Talking in terms of the industry, salary represented approximately 80% of total compensation out of all the companies we analyzed, while other remuneration made up 20% of the pie. There isn't a significant difference between Guangshen Railway and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Guangshen Railway Company Limited's Growth Numbers

Over the last three years, Guangshen Railway Company Limited has shrunk its earnings per share by 92% per year. Its revenue is down 14% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Guangshen Railway Company Limited Been A Good Investment?

With a total shareholder return of -61% over three years, Guangshen Railway Company Limited shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Guangshen Railway.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:525

Guangshen Railway

Engages in the railway passenger and freight transportation businesses in the People’s Republic of China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion