- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:3683

Great Harvest Maeta Holdings Limited (HKG:3683) May Have Run Too Fast Too Soon With Recent 34% Price Plummet

Great Harvest Maeta Holdings Limited (HKG:3683) shareholders won't be pleased to see that the share price has had a very rough month, dropping 34% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

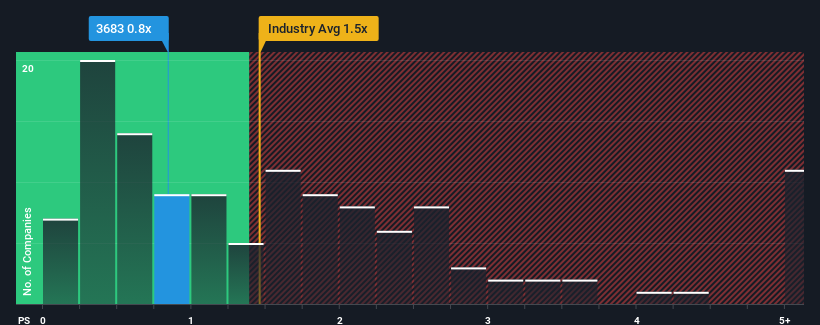

In spite of the heavy fall in price, there still wouldn't be many who think Great Harvest Maeta Holdings' price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in Hong Kong's Shipping industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Great Harvest Maeta Holdings

How Great Harvest Maeta Holdings Has Been Performing

Great Harvest Maeta Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Great Harvest Maeta Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Great Harvest Maeta Holdings?

In order to justify its P/S ratio, Great Harvest Maeta Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. Revenue has also lifted 7.3% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 5.7% shows it's noticeably less attractive.

In light of this, it's curious that Great Harvest Maeta Holdings' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

With its share price dropping off a cliff, the P/S for Great Harvest Maeta Holdings looks to be in line with the rest of the Shipping industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Great Harvest Maeta Holdings revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Great Harvest Maeta Holdings (1 can't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3683

Great Harvest Maeta Holdings

An investment holding company, provides dry bulk vessel chartering services worldwide.

Very low and overvalued.

Market Insights

Community Narratives