- Italy

- /

- Capital Markets

- /

- BIT:ANIM

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets continue to experience gains, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, investors are navigating a landscape shaped by domestic policy shifts and geopolitical developments. In this context of economic stability concerns and tariff discussions, dividend stocks can offer a reliable income stream, appealing to those seeking steady returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.18% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

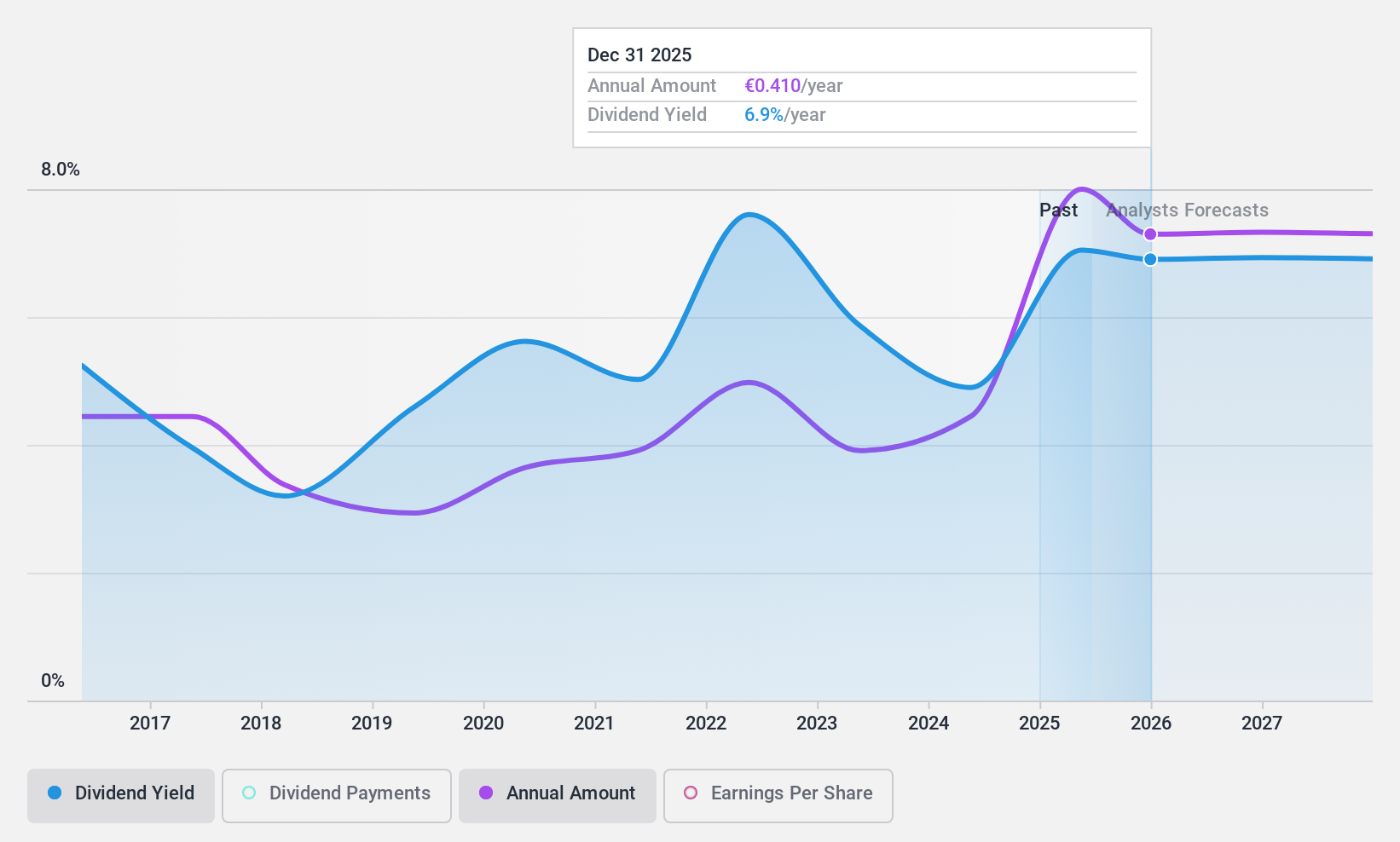

Anima Holding (BIT:ANIM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anima Holding S.p.A. is a publicly owned investment manager with a market cap of €1.99 billion.

Operations: Anima Holding S.p.A. generates its revenue primarily through its Asset Management segment, which accounts for €1.25 billion.

Dividend Yield: 3.9%

Anima Holding's dividend sustainability is supported by a low cash payout ratio of 19.9% and earnings coverage at 35.8%, indicating strong coverage by both cash flows and profits. However, its dividend track record has been volatile over the past decade, with inconsistent growth and occasional significant drops. Recent earnings show robust performance with net income rising to €172 million for the first nine months of 2024, but an impending acquisition by Banco BPM Vita S.p.A., valued at €1.49 billion, could impact future dividends depending on strategic shifts post-acquisition completion in mid-2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Anima Holding.

- Insights from our recent valuation report point to the potential undervaluation of Anima Holding shares in the market.

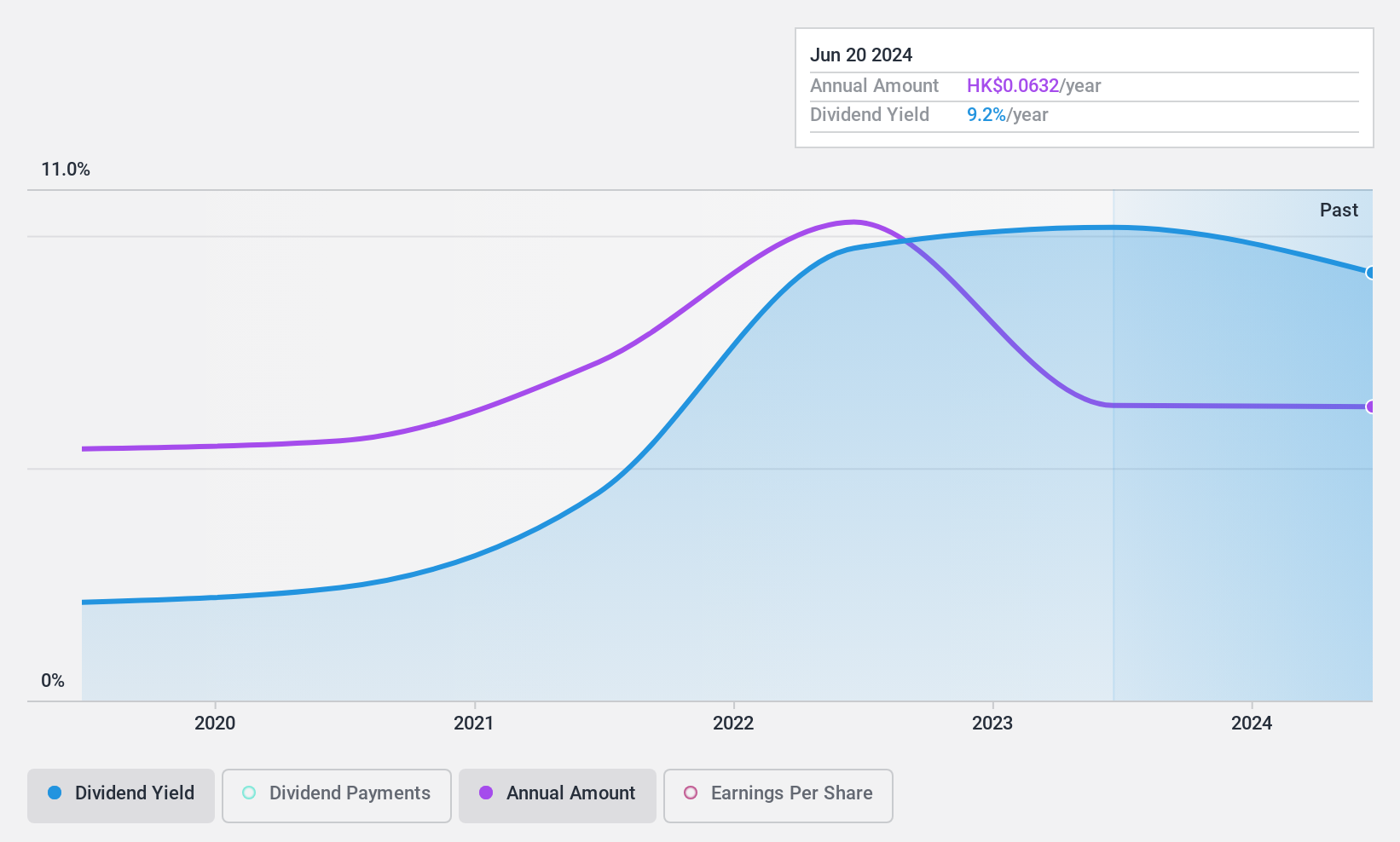

Pacific Basin Shipping (SEHK:2343)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pacific Basin Shipping Limited is an investment holding company that provides dry bulk shipping services globally, with a market cap of HK$9.73 billion.

Operations: Pacific Basin Shipping Limited generates revenue primarily from its dry bulk shipping services, amounting to $2.43 billion.

Dividend Yield: 5.1%

Pacific Basin Shipping's dividend is well-covered by earnings, with a payout ratio of 44.6%, and cash flows, with a cash payout ratio of 30.2%. Despite this solid coverage, its dividend yield of 5.06% lags behind the top Hong Kong payers at 8.05%. The company's dividends have been volatile over the past decade despite growth in payments during that period. Currently trading significantly below estimated fair value, it shows potential for capital appreciation alongside dividend income.

- Click to explore a detailed breakdown of our findings in Pacific Basin Shipping's dividend report.

- Upon reviewing our latest valuation report, Pacific Basin Shipping's share price might be too pessimistic.

China Xinhua Education Group (SEHK:2779)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Xinhua Education Group Limited offers higher and secondary vocational education services in the People's Republic of China with a market cap of HK$1.09 billion.

Operations: The company generates revenue of CN¥647.30 million from its educational services in China.

Dividend Yield: 8.9%

China Xinhua Education Group offers a dividend yield of 8.85%, placing it among the top 25% in Hong Kong, with dividends well-covered by earnings and cash flows, evidenced by low payout ratios of 27.2% and 24.6%, respectively. However, its dividend history is less reliable due to volatility over six years of payments. Trading at a substantial discount to estimated fair value suggests potential for capital gains alongside dividend income despite an unstable track record.

- Get an in-depth perspective on China Xinhua Education Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that China Xinhua Education Group's current price could be quite moderate.

Turning Ideas Into Actions

- Investigate our full lineup of 1943 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ANIM

Anima Holding

Anima Holding S.p.A. is a publicly owned investment manager.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives