How Investors Are Reacting To J&T Global Express (SEHK:1519) Surging Parcel Volumes and Double-Digit Growth

Reviewed by Sasha Jovanovic

- J&T Global Express Limited recently reported its operating results for the third quarter ended September 30, 2025, achieving a total parcel volume of approximately 7.68 billion, a 23.1% increase from the prior year, with all major markets experiencing double-digit growth, particularly in Southeast Asia and New Markets.

- The surge in parcel volumes highlights not only the strong momentum behind e-commerce in J&T’s core regions but also the company’s expanding footprint in emerging logistics markets.

- We’ll explore how J&T’s robust parcel volume growth in Southeast Asia and new markets could affect its longer-term investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

J&T Global Express Investment Narrative Recap

To be a shareholder in J&T Global Express, you need to believe in the long-term expansion of e-commerce in Southeast Asia and emerging markets, and the company's ability to leverage automation and scale to maintain profitability. The latest surge in parcel volume reflects strong underlying demand, but does not materially change the immediate risk: persistent price competition and pressure on revenue per parcel in China remains the central short-term catalyst and risk that could impact earnings and margins.

Among recent events, J&T Global Express activating a significant share buyback program is particularly relevant. While this initiative emphasizes a commitment to boosting shareholder value, it does not directly offset the margin risks from China or guarantee higher returns in the near term, especially if cost pressures persist.

Yet when you consider the competitive headwinds the company faces in China, investors should also be mindful of...

Read the full narrative on J&T Global Express (it's free!)

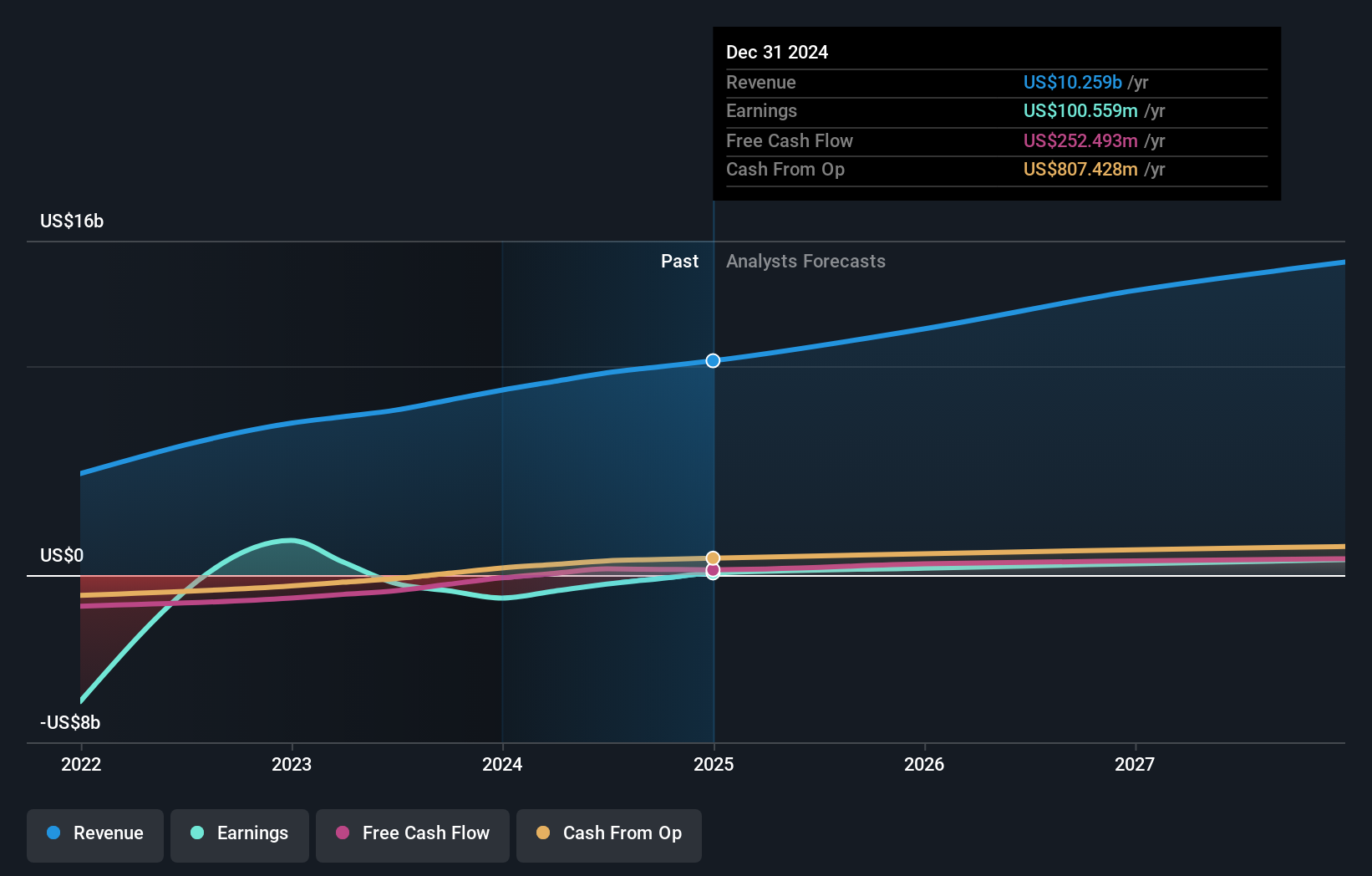

J&T Global Express' narrative projects $17.1 billion revenue and $916.4 million earnings by 2028. This requires 16.3% yearly revenue growth and a $757.1 million earnings increase from $159.3 million today.

Uncover how J&T Global Express' forecasts yield a HK$10.93 fair value, a 5% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced one fair value estimate for J&T Global Express at HK$23.60, far above current levels. With intense price competition in China threatening margins, opinions may vary, explore how community projections stack up against ongoing risks.

Explore another fair value estimate on J&T Global Express - why the stock might be worth just HK$23.60!

Build Your Own J&T Global Express Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your J&T Global Express research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free J&T Global Express research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate J&T Global Express' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1519

J&T Global Express

An investment holding company, offers integrated express delivery services in the People’s Republic of China, Indonesia, the Philippines, Malaysia, Thailand, Vietnam, Saudi Arabia, the United Arab Emirates, Mexico, Brazil, and Egypt.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives