- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:762

Can China Unicom (SEHK:762) Sustain Its Digital Ambitions After Leadership Change?

Reviewed by Sasha Jovanovic

- China Unicom (Hong Kong) Limited announced that Mr. Chen Zhongyue resigned as Executive Director, Chairman, Chief Executive, and Nomination Committee member effective 29 October 2025, citing a change in work arrangement and confirming no disagreement with the Board.

- Mr. Chen's departure marks the end of a leadership period defined by a focus on network innovation, digital transformation, and enhanced international presence.

- We'll examine how the sudden departure of Mr. Chen Zhongyue impacts China Unicom's investment narrative and future leadership direction.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

China Unicom (Hong Kong) Investment Narrative Recap

To hold China Unicom (Hong Kong), an investor needs confidence in the company’s ability to deliver growth through digital services and network upgrades, outpacing domestic peers facing similar market headwinds. The recent resignation of Mr. Chen Zhongyue is unlikely to materially affect the immediate focus on new technology rollouts, but leadership transitions remain a near-term risk to execution and strategic continuity.

A relevant recent announcement is the October 22 earnings report, which showed both revenue and net income growth over the nine months ended September 30, 2025. This supports the existing catalyst around expanding digital services and IoT connections, suggesting that operational momentum has been maintained through leadership changes and strengthens the short-term case for continued business growth.

However, it is important for investors to remember that, in contrast with positive revenue growth, leadership changes can introduce uncertainties that...

Read the full narrative on China Unicom (Hong Kong) (it's free!)

China Unicom (Hong Kong)'s narrative projects CN¥433.1 billion in revenue and CN¥25.8 billion in earnings by 2028. This requires 3.3% yearly revenue growth and an earnings increase of CN¥4.5 billion from the current CN¥21.3 billion.

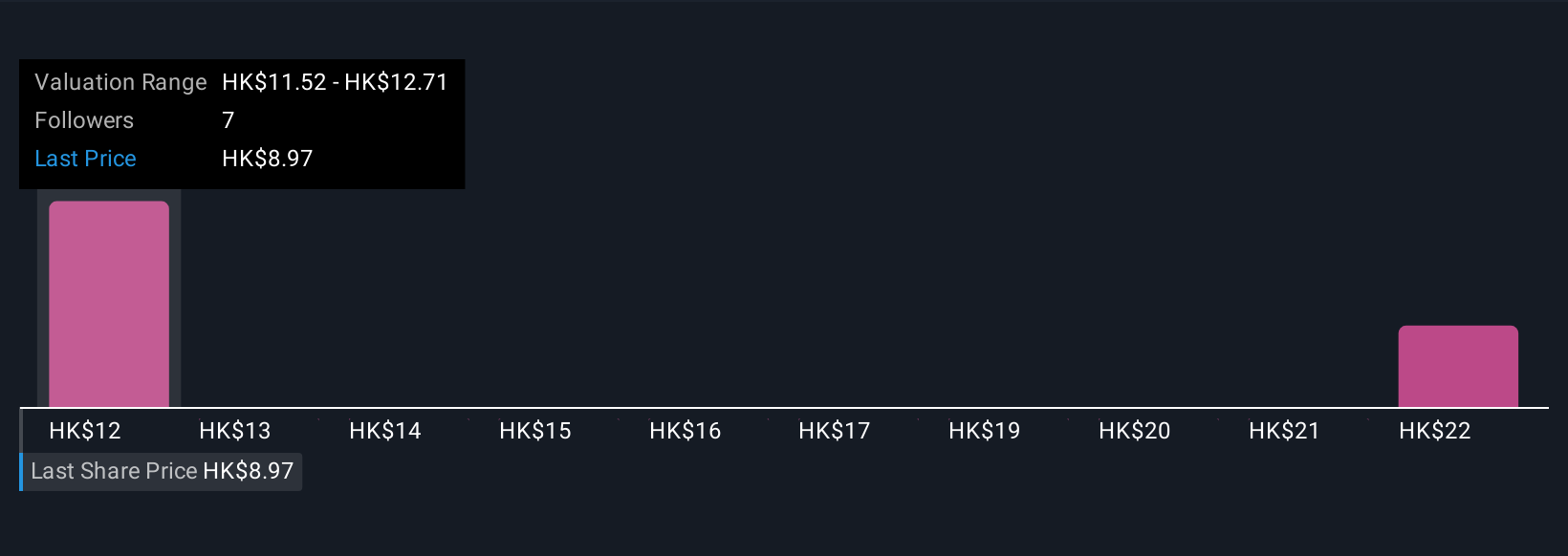

Uncover how China Unicom (Hong Kong)'s forecasts yield a HK$11.52 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates ranging from HK$11.52 to HK$27.83 per share. Despite recent progress in digital services and network deployment, short-term execution risk from management turnover could influence future performance, so explore alternative viewpoints to inform your own conclusion.

Explore 2 other fair value estimates on China Unicom (Hong Kong) - why the stock might be worth over 2x more than the current price!

Build Your Own China Unicom (Hong Kong) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Unicom (Hong Kong) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Unicom (Hong Kong) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Unicom (Hong Kong)'s overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:762

China Unicom (Hong Kong)

An investment holding company, provides telecommunications and related value-added services in the People’s Republic of China.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives