As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tensions, many investors are turning their attention to dividend stocks as a potential source of steady income. In the current environment, characterized by volatile tech sectors and shifting interest rate policies, high-yield dividend stocks can offer an attractive option for those seeking stability and regular returns amidst market uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.56% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

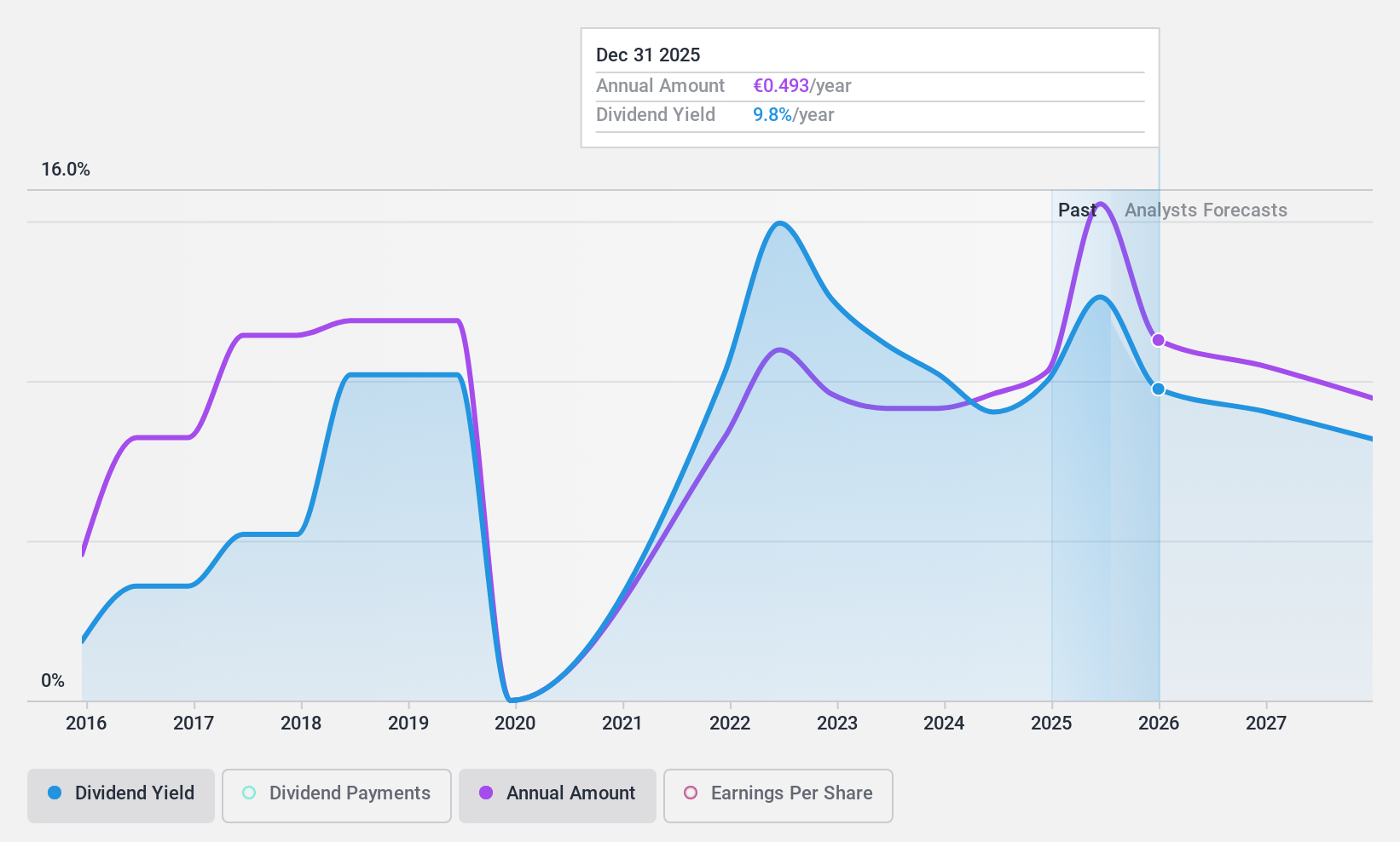

Atresmedia Corporación de Medios de Comunicación (BME:A3M)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Atresmedia Corporación de Medios de Comunicación, S.A. is an audiovisual company involved in television, radio, digital and multimedia development, cinema, and events organization in Spain and internationally, with a market cap of approximately €994.16 million.

Operations: Atresmedia Corporación de Medios de Comunicación generates revenue from its Radio segment (€79.53 million) and Audiovisual segment (€950.52 million).

Dividend Yield: 10%

Atresmedia Corporación de Medios de Comunicación offers a high dividend yield, ranking in the top 25% of Spanish dividend payers. Despite this, its dividends have been volatile and unreliable over the past decade. The company's payout ratios indicate dividends are well-covered by earnings and cash flows, suggesting sustainability despite historical volatility. Recent board discussions included distributing profits as dividends, further emphasizing commitment to shareholder returns amidst forecasted earnings decline.

- Get an in-depth perspective on Atresmedia Corporación de Medios de Comunicación's performance by reading our dividend report here.

- Our expertly prepared valuation report Atresmedia Corporación de Medios de Comunicación implies its share price may be lower than expected.

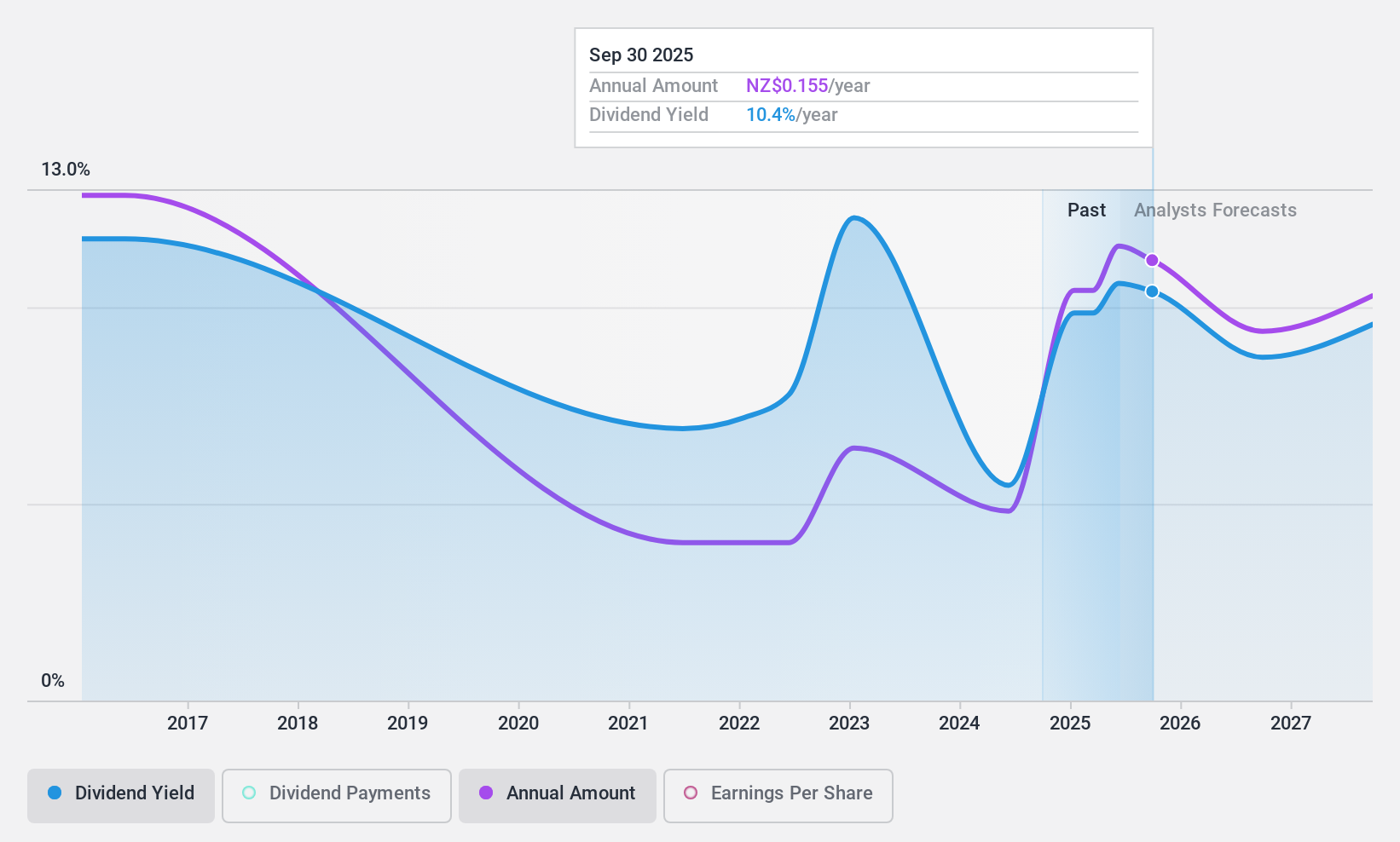

Tower (NZSE:TWR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tower Limited offers general insurance products in New Zealand and the Pacific Islands, with a market capitalization of NZ$493.33 million.

Operations: Tower Limited's revenue primarily comes from its operations in New Zealand, contributing NZ$535.53 million, and the Pacific Islands, adding NZ$43.33 million.

Dividend Yield: 10%

Tower Limited's dividend yield ranks in the top 25% of New Zealand payers, with a payout ratio of 50.9%, indicating dividends are well-covered by earnings and cash flows. Despite this coverage, its dividend history has been volatile and unreliable over the past decade. The recent earnings surge to NZ$74.29 million from a loss last year supports current payouts, but executive changes could impact future stability as Tower navigates leadership transitions.

- Navigate through the intricacies of Tower with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Tower's share price might be too optimistic.

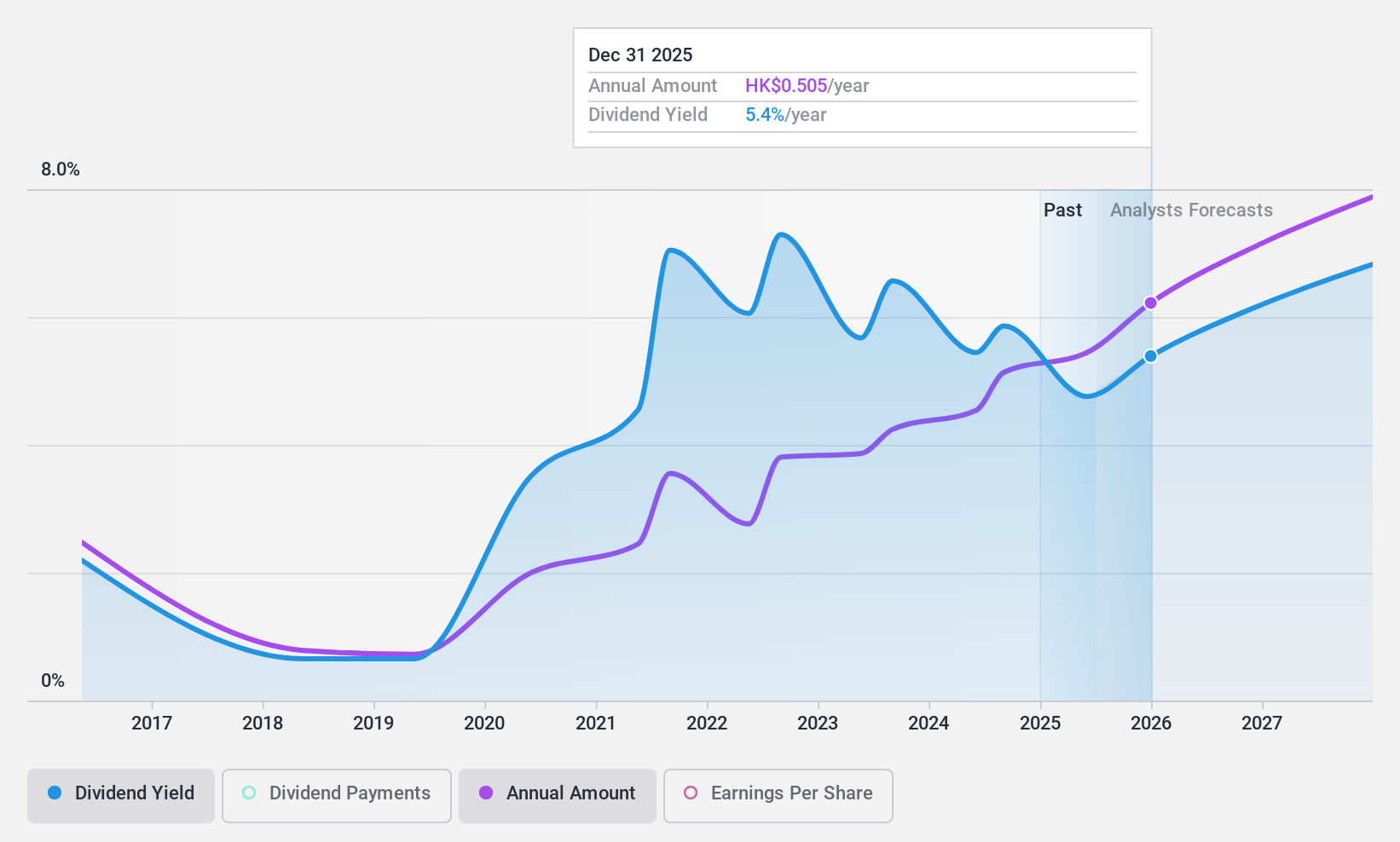

China Unicom (Hong Kong) (SEHK:762)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Unicom (Hong Kong) Limited is an investment holding company that offers telecommunications and related value-added services in the People's Republic of China, with a market capitalization of HK$223.06 billion.

Operations: The company generates revenue from its Wireless Communications Services segment, amounting to CN¥381.03 billion.

Dividend Yield: 5.5%

China Unicom's dividend payments are covered by earnings and cash flows, with payout ratios of 56.9% and 75.9%, respectively. However, the dividends have been unreliable and volatile over the past decade despite recent growth in earnings by 11.9%. The stock trades at a significant discount to its estimated fair value but offers a lower yield (5.54%) compared to top-tier Hong Kong dividend payers (8.03%). Recent operational metrics highlight robust subscriber growth across various services.

- Dive into the specifics of China Unicom (Hong Kong) here with our thorough dividend report.

- Upon reviewing our latest valuation report, China Unicom (Hong Kong)'s share price might be too pessimistic.

Make It Happen

- Explore the 1972 names from our Top Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:A3M

Atresmedia Corporación de Medios de Comunicación

An audiovisual company, engages in the television, radio, digital and multimedia development, cinema, and events organization businesses in Spain and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives