- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:728

China Telecom (HKG:728) Seems To Use Debt Quite Sensibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies China Telecom Corporation Limited (HKG:728) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for China Telecom

How Much Debt Does China Telecom Carry?

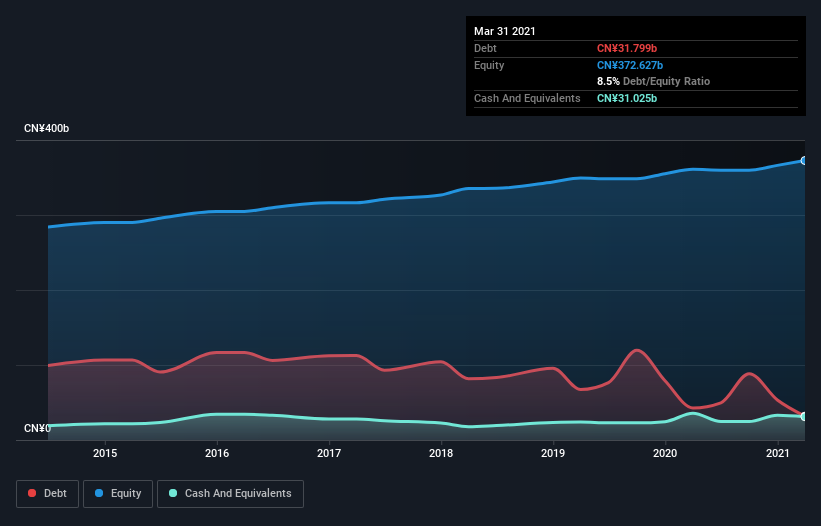

As you can see below, China Telecom had CN¥18.6b of debt at March 2021, down from CN¥42.8b a year prior. However, it does have CN¥31.0b in cash offsetting this, leading to net cash of CN¥12.4b.

How Strong Is China Telecom's Balance Sheet?

The latest balance sheet data shows that China Telecom had liabilities of CN¥262.8b due within a year, and liabilities of CN¥78.3b falling due after that. On the other hand, it had cash of CN¥31.0b and CN¥36.0b worth of receivables due within a year. So its liabilities total CN¥274.1b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the CN¥156.8b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, China Telecom would likely require a major re-capitalisation if it had to pay its creditors today. Given that China Telecom has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

Another good sign is that China Telecom has been able to increase its EBIT by 20% in twelve months, making it easier to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine China Telecom's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. China Telecom may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, China Telecom actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While China Telecom does have more liabilities than liquid assets, it also has net cash of CN¥12.4b. The cherry on top was that in converted 107% of that EBIT to free cash flow, bringing in CN¥46b. So we don't have any problem with China Telecom's use of debt. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check China Telecom's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:728

China Telecom

Provides mobile communications, wireline and satellite communications, internet access, cloud computing and computing power, AI, big data, quantum, ICT integration in the People’s Republic of China.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives