- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:6823

HKT Trust and HKT's (HKG:6823) Shareholders Will Receive A Bigger Dividend Than Last Year

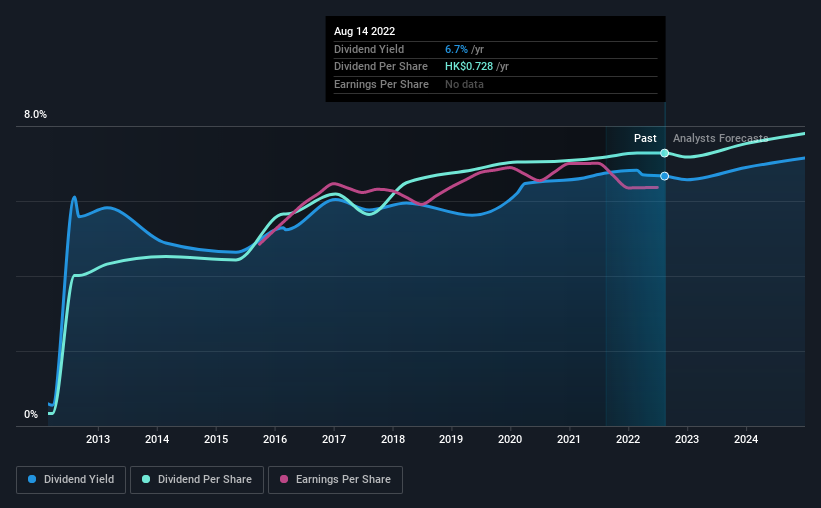

HKT Trust and HKT Limited's (HKG:6823) periodic dividend will be increasing on the 8th of September to HK$0.3136, with investors receiving 2.1% more than last year's HK$0.307. Based on this payment, the dividend yield for the company will be 6.7%, which is fairly typical for the industry.

Check out our latest analysis for HKT Trust and HKT

HKT Trust and HKT Doesn't Earn Enough To Cover Its Payments

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, the company was paying out 115% of what it was earning. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

Over the next year, EPS is forecast to expand by 8.8%. If the dividend continues on its recent course, the payout ratio in 12 months could be 111%, which is a bit high and could start applying pressure to the balance sheet.

HKT Trust and HKT Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2012, the annual payment back then was HK$0.0336, compared to the most recent full-year payment of HK$0.728. This means that it has been growing its distributions at 36% per annum over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

Dividend Growth May Be Hard To Achieve

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. HKT Trust and HKT hasn't seen much change in its earnings per share over the last five years. The company is paying out a lot of its profits, even though it is growing those profits pretty slowly. This gives limited room for the company to raise the dividend in the future.

HKT Trust and HKT's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think HKT Trust and HKT's payments are rock solid. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for HKT Trust and HKT (of which 1 is a bit concerning!) you should know about. Is HKT Trust and HKT not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if HKT Trust and HKT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6823

HKT Trust and HKT

An investment holding company, engages in the provision of technology, and satellite-and network-based telecommunications and related services in Hong Kong, Mainland China, and internationally.

Good value average dividend payer.