- Hong Kong

- /

- Wireless Telecom

- /

- SEHK:3773

Some Confidence Is Lacking In Yinsheng Digifavor Company Limited (HKG:3773) As Shares Slide 28%

The Yinsheng Digifavor Company Limited (HKG:3773) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 19% share price drop.

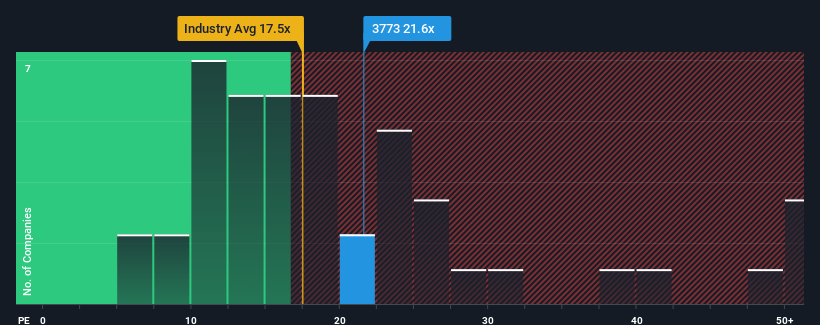

Even after such a large drop in price, Yinsheng Digifavor may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 21.6x, since almost half of all companies in Hong Kong have P/E ratios under 10x and even P/E's lower than 6x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, Yinsheng Digifavor has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Yinsheng Digifavor

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Yinsheng Digifavor's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 191% last year. As a result, it also grew EPS by 29% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Yinsheng Digifavor is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

A significant share price dive has done very little to deflate Yinsheng Digifavor's very lofty P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Yinsheng Digifavor currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Yinsheng Digifavor with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3773

Yinsheng Digifavor

Provides mobile and data usage top-up services to mobile subscribers in the People’s Republic of China.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026