- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1310

HKBN (SEHK:1310): Examining Valuation in Light of Strong FY2025 Revenue and Earnings Growth

Reviewed by Simply Wall St

HKBN (SEHK:1310) has just released its full-year earnings, showing both increased revenues and a substantial gain in net income compared to the previous period. This uptick is catching the attention of investors.

See our latest analysis for HKBN.

HKBN’s latest earnings boost seems to have breathed fresh energy into the stock, reflected in a strong 44.6% share price return over the past 90 days. With a recent one-year total shareholder return of 106.1%, momentum is clearly building as investors take notice of the company’s turnaround and growth potential.

If rising returns like these have you curious about other standout opportunities, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

But with such rapid gains and rising expectations, investors are left to wonder if HKBN’s stellar performance in the share price is justified by its fundamentals, or if there could be further upside if the market is underestimating its growth?

Most Popular Narrative: Fairly Valued

With HKBN’s current price nearly identical to the consensus fair value of HK$6.50, investors are facing a tight valuation debate. The stock’s surge puts its positioning versus analyst assumptions into sharp focus.

The bundling of telecom services with the ICT/System Integration business allows HKBN to increase customer loyalty and upsell, thereby increasing average revenue per user (ARPU) and enhancing profitability.

Curious what sets this valuation apart? The real engine behind the fair value involves a dramatic improvement in margins paired with a future profit multiple that signals an industry outlier. Want the details that could convince you the price is justified? Dig into the full narrative and find out what numbers are moving the needle.

Result: Fair Value of $6.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering risks around HKBN’s reliance on China partnerships and mounting competition in broadband could derail profitability and test the optimism in current forecasts.

Find out about the key risks to this HKBN narrative.

Another View: Is the Valuation Justified?

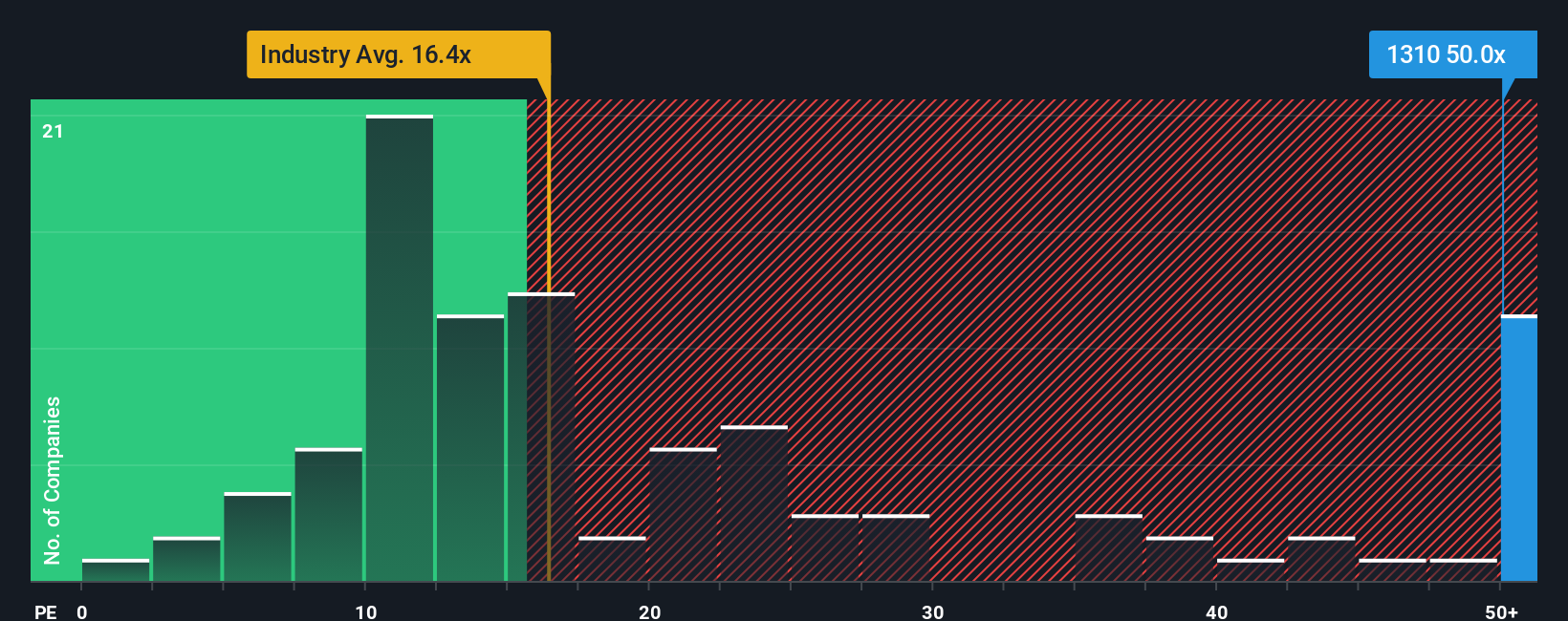

Looking at HKBN through the lens of its price-to-earnings ratio, a different picture emerges. The current ratio sits significantly above both its industry average and its own fair ratio, pointing to a valuation risk that the market could eventually correct. Could optimism be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HKBN for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HKBN Narrative

Feel free to take a hands-on approach. If this analysis does not align with your perspective or you want to dig deeper, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your HKBN research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors broaden their focus and seek out the best market opportunities before everyone else. Don’t let unique growth stories or lucrative trends pass you by; seize your edge now.

- Unlock reliable income by scanning these 20 dividend stocks with yields > 3% with strong yields and solid track records for your portfolio.

- Get ahead of market shifts and target breakthrough potential in the future of medicine using these 33 healthcare AI stocks.

- Spot stocks with major upside by tapping into these 840 undervalued stocks based on cash flows overlooked by most investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HKBN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1310

HKBN

An investment holding company, provides fixed telecommunications network, international telecommunications, and mobile services to residential and enterprise customers in Hong Kong, Mainland China, and Macao.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives