- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8167

Here's Why We Think Neo Telemedia Limited's (HKG:8167) CEO Compensation Looks Fair

The performance at Neo Telemedia Limited (HKG:8167) has been rather lacklustre of late and shareholders may be wondering what CEO Sing Tai Cheung is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 13 May 2021. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Neo Telemedia

How Does Total Compensation For Sing Tai Cheung Compare With Other Companies In The Industry?

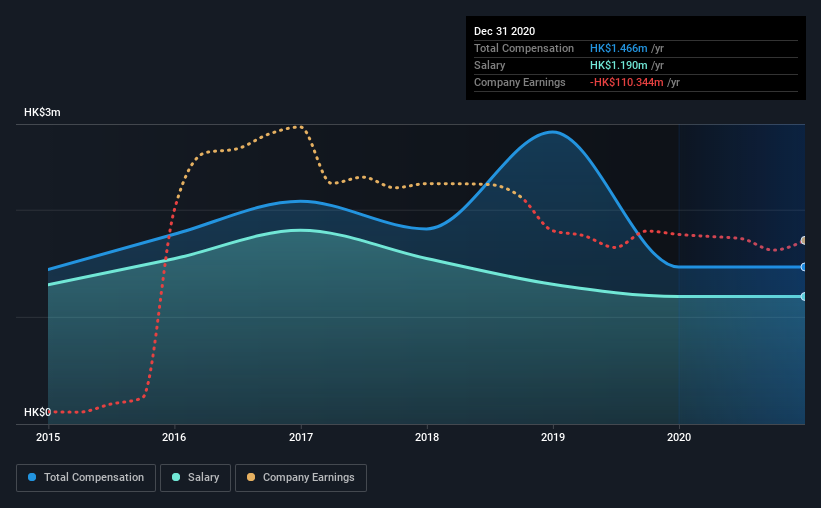

At the time of writing, our data shows that Neo Telemedia Limited has a market capitalization of HK$1.8b, and reported total annual CEO compensation of HK$1.5m for the year to December 2020. There was no change in the compensation compared to last year. Notably, the salary which is HK$1.19m, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from HK$777m to HK$3.1b, we found that the median CEO total compensation was HK$3.1m. This suggests that Sing Tai Cheung is paid below the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$1.2m | HK$1.2m | 81% |

| Other | HK$276k | HK$276k | 19% |

| Total Compensation | HK$1.5m | HK$1.5m | 100% |

Speaking on an industry level, nearly 76% of total compensation represents salary, while the remainder of 24% is other remuneration. Neo Telemedia is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Neo Telemedia Limited's Growth Numbers

Neo Telemedia Limited has reduced its earnings per share by 72% a year over the last three years. Its revenue is down 43% over the previous year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Neo Telemedia Limited Been A Good Investment?

With a total shareholder return of 9.0% over three years, Neo Telemedia Limited has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Neo Telemedia that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Neo Telemedia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8167

Neo Telemedia

An investment holding company, engages in the sale of telecommunication products and services in the People’s Republic of China and other Asian countries.

Weak fundamentals or lack of information.

Market Insights

Community Narratives