- Hong Kong

- /

- Tech Hardware

- /

- SEHK:8111

Here's Why China Technology Industry Group (HKG:8111) Can Manage Its Debt Responsibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, China Technology Industry Group Limited (HKG:8111) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for China Technology Industry Group

What Is China Technology Industry Group's Debt?

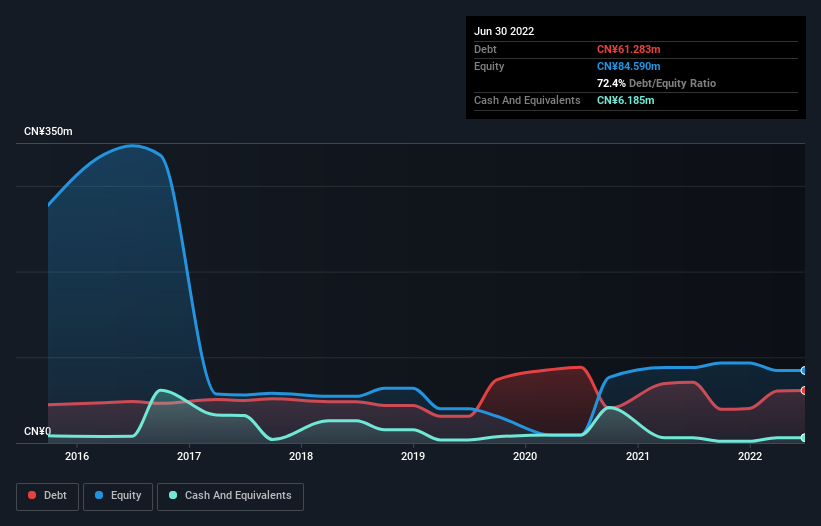

As you can see below, China Technology Industry Group had CN¥61.3m of debt at March 2022, down from CN¥70.9m a year prior. However, because it has a cash reserve of CN¥6.19m, its net debt is less, at about CN¥55.1m.

How Healthy Is China Technology Industry Group's Balance Sheet?

According to the balance sheet data, China Technology Industry Group had liabilities of CN¥81.4m due within 12 months, but no longer term liabilities. Offsetting this, it had CN¥6.19m in cash and CN¥153.4m in receivables that were due within 12 months. So it actually has CN¥78.2m more liquid assets than total liabilities.

This luscious liquidity implies that China Technology Industry Group's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 0.91 times and a disturbingly high net debt to EBITDA ratio of 34.0 hit our confidence in China Technology Industry Group like a one-two punch to the gut. The debt burden here is substantial. Even worse, China Technology Industry Group saw its EBIT tank 95% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But it is China Technology Industry Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, China Technology Industry Group actually produced more free cash flow than EBIT over the last two years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

We weren't impressed with China Technology Industry Group's interest cover, and its EBIT growth rate made us cautious. But its conversion of EBIT to free cash flow was significantly redeeming. When we consider all the elements mentioned above, it seems to us that China Technology Industry Group is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for China Technology Industry Group that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8111

China Technology Industry Group

An investment holding company, engages in the sales of the renewable energy products business and new energy power system integration and electricity business in Hong Kong.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives