- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8070

It's Down 31% But Keen Ocean International Holding Limited (HKG:8070) Could Be Riskier Than It Looks

Keen Ocean International Holding Limited (HKG:8070) shares have had a horrible month, losing 31% after a relatively good period beforehand. The last month has meant the stock is now only up 3.5% during the last year.

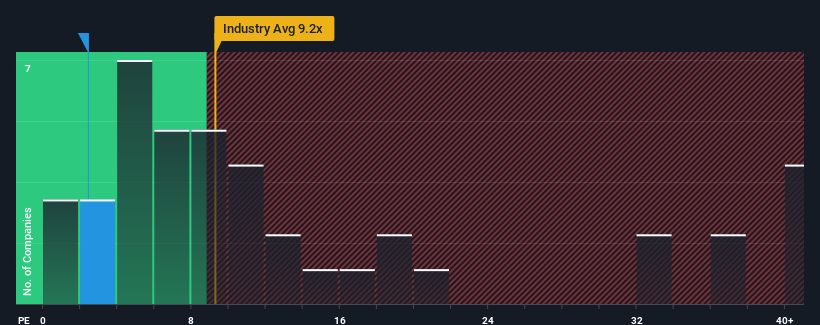

In spite of the heavy fall in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Keen Ocean International Holding as a highly attractive investment with its 2.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

For example, consider that Keen Ocean International Holding's financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Keen Ocean International Holding

How Is Keen Ocean International Holding's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Keen Ocean International Holding's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 1,329% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 20% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Keen Ocean International Holding is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Shares in Keen Ocean International Holding have plummeted and its P/E is now low enough to touch the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Keen Ocean International Holding currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Keen Ocean International Holding (1 is a bit unpleasant) you should be aware of.

If you're unsure about the strength of Keen Ocean International Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Keen Ocean International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8070

Keen Ocean International Holding

An investment holding company, designs, develops, manufactures, and sells transformers, switching mode power supplies, electronic parts and components, and electric healthcare products in Hong Kong and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives