Should You Be Adding K & P International Holdings (HKG:675) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like K & P International Holdings (HKG:675), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for K & P International Holdings

K & P International Holdings's Improving Profits

In the last three years K & P International Holdings's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, K & P International Holdings's EPS shot from HK$0.041 to HK$0.10, over the last year. Year on year growth of 151% is certainly a sight to behold.

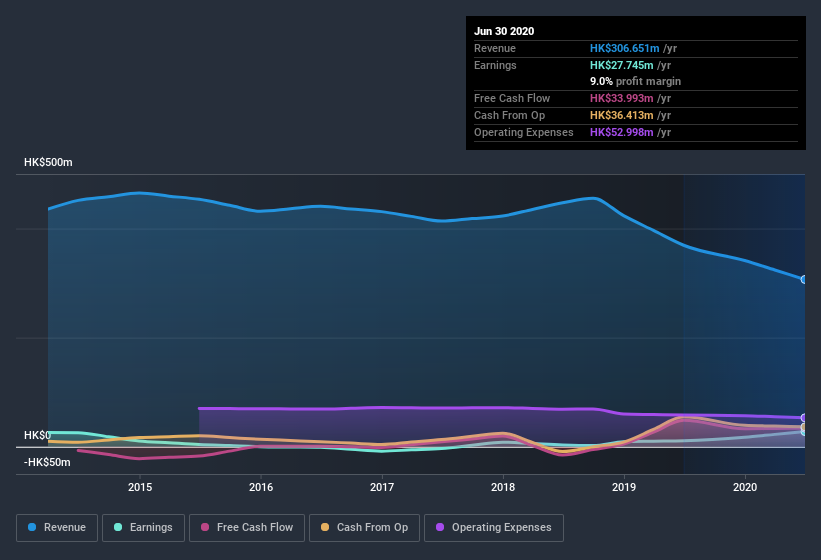

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. K & P International Holdings's EBIT margins have actually improved by 6.8 percentage points in the last year, to reach 10%, but, on the flip side, revenue was down 17%. That's not ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

K & P International Holdings isn't a huge company, given its market capitalization of HK$168m. That makes it extra important to check on its balance sheet strength.

Are K & P International Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first; I didn't see insiders sell K & P International Holdings shares in the last year. But the really good news is that Founder Pei Lai spent HK$2.9m buying stock stock, at an average price of around HK$0.55. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

And the insider buying isn't the only sign of alignment between shareholders and the board, since K & P International Holdings insiders own more than a third of the company. In fact, they own 47% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only HK$168m K & P International Holdings is really small for a listed company. That means insiders only have HK$79m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is K & P International Holdings Worth Keeping An Eye On?

K & P International Holdings's earnings per share have taken off like a rocket aimed right at the moon. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest K & P International Holdings belongs on the top of your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for K & P International Holdings that you should be aware of.

As a growth investor I do like to see insider buying. But K & P International Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading K & P International Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if K & P International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:675

K & P International Holdings

An investment holding company, manufactures and sells precision parts and components in Hong Kong, Mainland China, Japan and other Asian countries, North America, South America, Europe, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives