- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

FIT Hon Teng Limited (HKG:6088) Looks Just Right With A 26% Price Jump

FIT Hon Teng Limited (HKG:6088) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 70%.

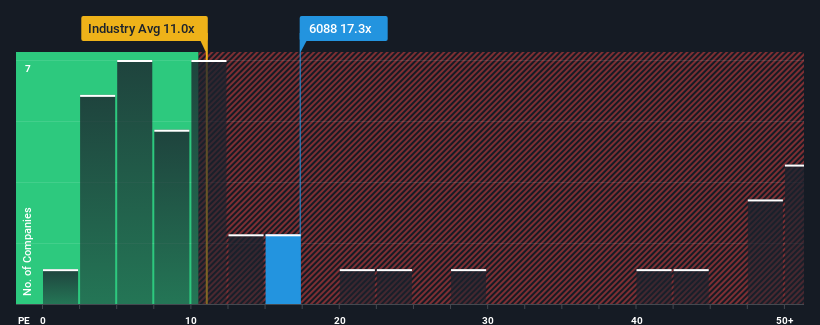

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider FIT Hon Teng as a stock to avoid entirely with its 17.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

FIT Hon Teng hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for FIT Hon Teng

How Is FIT Hon Teng's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like FIT Hon Teng's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 25%. Even so, admirably EPS has lifted 186% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 42% per year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 16% per annum, which is noticeably less attractive.

In light of this, it's understandable that FIT Hon Teng's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On FIT Hon Teng's P/E

FIT Hon Teng's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of FIT Hon Teng's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for FIT Hon Teng you should be aware of.

If you're unsure about the strength of FIT Hon Teng's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives