Stock Analysis

- Hong Kong

- /

- Communications

- /

- SEHK:1523

Exploring High Growth Tech Stocks In Hong Kong October 2024

Reviewed by Simply Wall St

As global markets experience varied movements with U.S. indices reaching new highs and Chinese equities facing declines, the Hong Kong market is also navigating through a complex landscape influenced by broader economic sentiments and regional developments. In this context, identifying high growth tech stocks in Hong Kong requires a focus on companies that demonstrate resilience and adaptability to shifting market dynamics, leveraging innovation and strategic positioning to capture emerging opportunities.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.80% | 59.60% | ★★★★★☆ |

| Akeso | 33.44% | 53.00% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.34 billion.

Operations: The company generates revenue primarily from the sales of software-defined wide area network routers, with notable contributions from both fixed first connectivity (HK$15.19 million) and mobile first connectivity (HK$59.87 million). Additionally, it earns through software licenses and warranty and support services, amounting to HK$31.86 million.

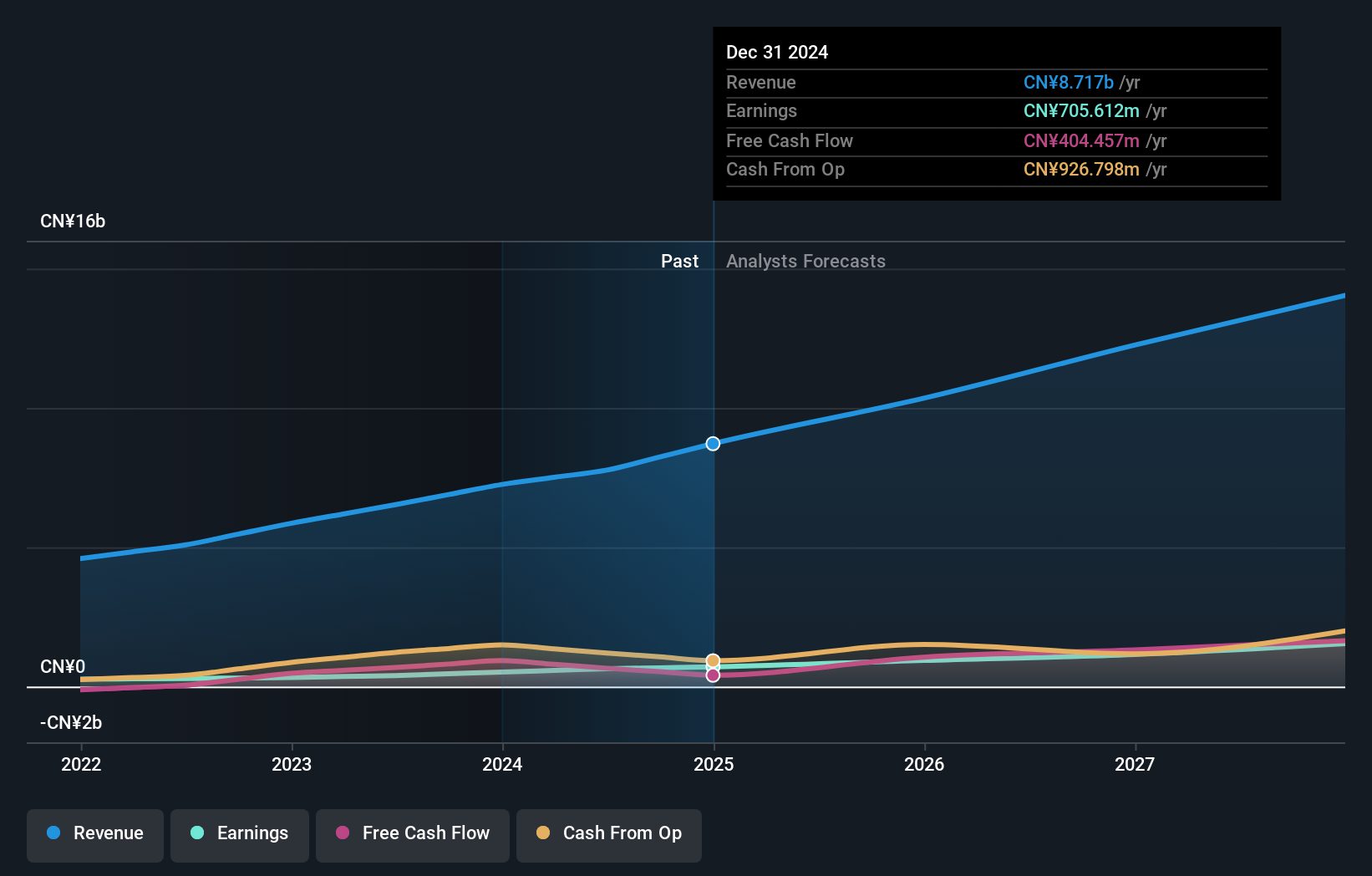

Plover Bay Technologies has demonstrated robust financial performance, with a significant uptick in sales from USD 44.63 million to USD 57.3 million, marking a year-over-year increase of about 28%. This growth is complemented by an earnings surge from USD 12.32 million to USD 19.1 million. Notably, the company's strategic focus on R&D is evident as it aligns with its revenue growth forecasts at an impressive rate of 16.9% annually, outpacing the Hong Kong market's average of 7.3%. The appointment of Ms. Chiu Chi Ying as an executive Director could further enhance governance and innovation strategies, particularly in legal and intellectual property realms crucial for sustaining competitive advantages in high-tech industries.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market cap of approximately HK$6.15 billion.

Operations: The company generates revenue primarily through three segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Advanced Distribution Operations (CN¥2.51 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion). These activities focus on providing solutions for energy supply industries across multiple regions, emphasizing innovation in energy metering and efficiency management.

Wasion Holdings has carved out a significant presence in the smart meter sector, evidenced by recent lucrative contracts in Hungary, Singapore, and Malaysia totaling approximately USD 46.76 million. These developments underscore Wasion's adeptness at capturing international markets and enhancing its brand globally. Financially, the company's half-year results reflect a robust increase with sales rising from CNY 3.23 billion to CNY 3.74 billion and net income improving markedly from CNY 213.82 million to CNY 331.03 million year-over-year—an impressive growth trajectory supported by effective cost controls and expanding revenue streams which are expected to grow at an annual rate of 22.4%, significantly outpacing the Hong Kong market average of 7.3%. This performance is further complemented by an anticipated earnings growth of about 25.5% per year, positioning Wasion well within a highly competitive tech landscape.

- Unlock comprehensive insights into our analysis of Wasion Holdings stock in this health report.

Gain insights into Wasion Holdings' past trends and performance with our Past report.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors, operating both in Taiwan and internationally, with a market capitalization of HK$20.62 billion.

Operations: The company's revenue primarily stems from Intermediate Products, contributing $3.94 billion, followed by Consumer Products at $690.95 million.

FIT Hon Teng's recent performance demonstrates a significant turnaround, with sales soaring to USD 2.07 billion, up from USD 1.78 billion year-over-year, and a swing to a net income of USD 32.52 million from a previous loss of USD 8.95 million. This resurgence is underscored by an earnings growth of 125.6% over the past year, outpacing the electronic industry's average of 11.7%. Looking ahead, FIT Hon Teng is positioned for robust growth with revenue expected to increase by an annual rate of 18.4%, significantly higher than Hong Kong's market average of 7.3%. Moreover, earnings are projected to grow at an impressive rate of 32.2% per year, reflecting the company's potential in leveraging its R&D investments effectively amidst evolving tech landscapes.

- Take a closer look at FIT Hon Teng's potential here in our health report.

Explore historical data to track FIT Hon Teng's performance over time in our Past section.

Key Takeaways

- Explore the 43 names from our SEHK High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1523

Plover Bay Technologies

An investment holding company, designs, develops, and markets software defined wide area network routers.