- Hong Kong

- /

- Tech Hardware

- /

- SEHK:3396

Legend Holdings (HKG:3396) Has Announced That It Will Be Increasing Its Dividend To HK$0.44

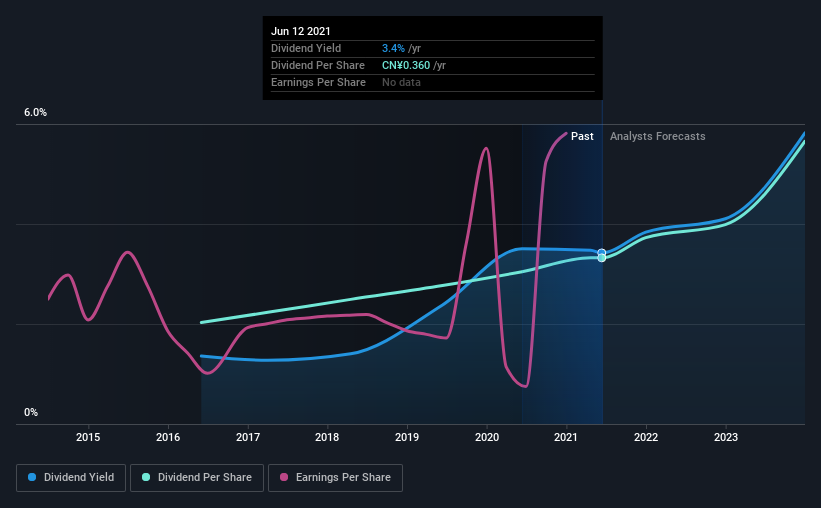

Legend Holdings Corporation (HKG:3396) has announced that it will be increasing its dividend on the 15th of July to HK$0.44, which will be 21% higher than last year. This takes the dividend yield from 3.4% to 3.4%, which shareholders will be pleased with.

See our latest analysis for Legend Holdings

Legend Holdings' Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. However, Legend Holdings' earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

EPS is set to fall by 59.2% over the next 12 months. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 20%, which is comfortable for the company to continue in the future.

Legend Holdings Doesn't Have A Long Payment History

The dividend's track record has been pretty solid, but with only 5 years of history we want to see a few more years of history before making any solid conclusions. The dividend has gone from CN¥0.22 in 2016 to the most recent annual payment of CN¥0.36. This implies that the company grew its distributions at a yearly rate of about 10% over that duration. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Legend Holdings has impressed us by growing EPS at 26% per year over the past five years. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

We Really Like Legend Holdings' Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. Taking this all into consideration, this looks like it could be a good dividend opportunity.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Legend Holdings has 3 warning signs (and 2 which are a bit concerning) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3396

Legend Holdings

Legend Holdings Corporation, along with its subsidiaries, operates in the industrial operations and industrial incubations and investments sectors in the People’s Republic of China and internationally.

Moderate growth potential with questionable track record.

Market Insights

Community Narratives