- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

Even With A 26% Surge, Cautious Investors Are Not Rewarding Wasion Holdings Limited's (HKG:3393) Performance Completely

Despite an already strong run, Wasion Holdings Limited (HKG:3393) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 51% in the last year.

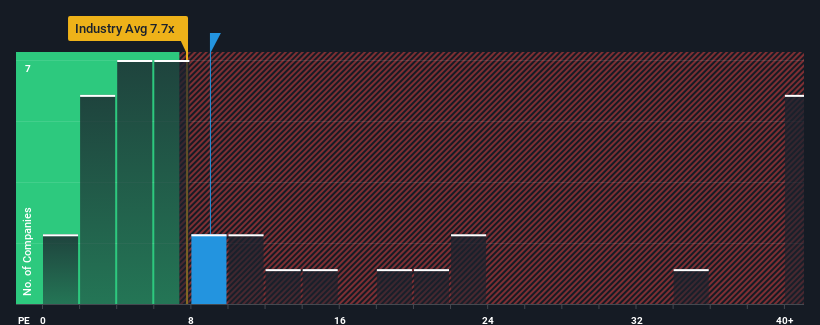

In spite of the firm bounce in price, there still wouldn't be many who think Wasion Holdings' price-to-earnings (or "P/E") ratio of 9x is worth a mention when the median P/E in Hong Kong is similar at about 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Wasion Holdings has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Wasion Holdings

Is There Some Growth For Wasion Holdings?

In order to justify its P/E ratio, Wasion Holdings would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 37%. The strong recent performance means it was also able to grow EPS by 71% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 19% each year over the next three years. With the market only predicted to deliver 16% per year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Wasion Holdings' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Wasion Holdings' P/E?

Its shares have lifted substantially and now Wasion Holdings' P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Wasion Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Wasion Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives