The China Aerospace International Holdings Share Price Is Down 36% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term China Aerospace International Holdings Limited (HKG:31) shareholders have had that experience, with the share price dropping 36% in three years, versus a market return of about 56%. The more recent news is of little comfort, with the share price down 31% in a year. The silver lining is that the stock is up 7.0% in about a week.

Check out our latest analysis for China Aerospace International Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, China Aerospace International Holdings actually saw its earnings per share (EPS) improve by 3.3% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past. It looks to us like the market was probably too optimistic around growth three years ago. However, taking a look at other business metrics might shed a bit more light on the share price action.

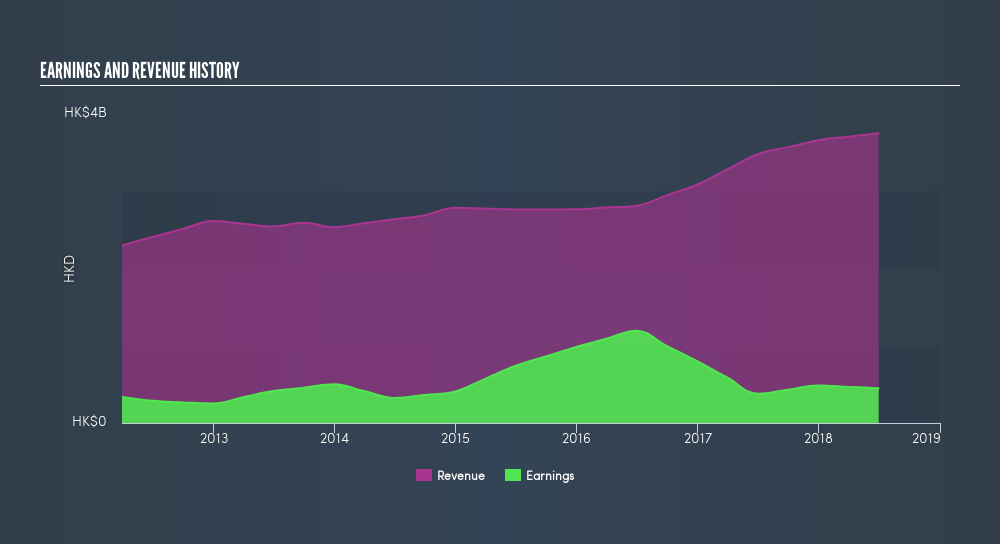

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that China Aerospace International Holdings has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at China Aerospace International Holdings's financial health with this freereport on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for China Aerospace International Holdings the TSR over the last 3 years was -31%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 7.3% in the twelve months, China Aerospace International Holdings shareholders did even worse, losing 28% (even including dividends). Having said that, its inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4.3% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Importantly, we haven't analysed China Aerospace International Holdings's dividend history. This freevisual report on its dividends is a must-read if you're thinking of buying.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:31

China Aerospace International Holdings

An investment holding company, operates hi-tech manufacturing and aerospace service business in Hong Kong, the People’s Republic of China, and internationally.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives