The 10% return this week takes China Aerospace International Holdings' (HKG:31) shareholders one-year gains to 29%

A diverse portfolio of stocks will always have winners and losers. But if you're going to beat the market overall, you need to have individual stocks that outperform. One such company is China Aerospace International Holdings Limited (HKG:31), which saw its share price increase 29% in the last year, slightly above the market return of around 25% (not including dividends). Zooming out, the stock is actually down 13% in the last three years.

Since the stock has added HK$123m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months China Aerospace International Holdings went from profitable to unprofitable. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

We think that the revenue growth of 11% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

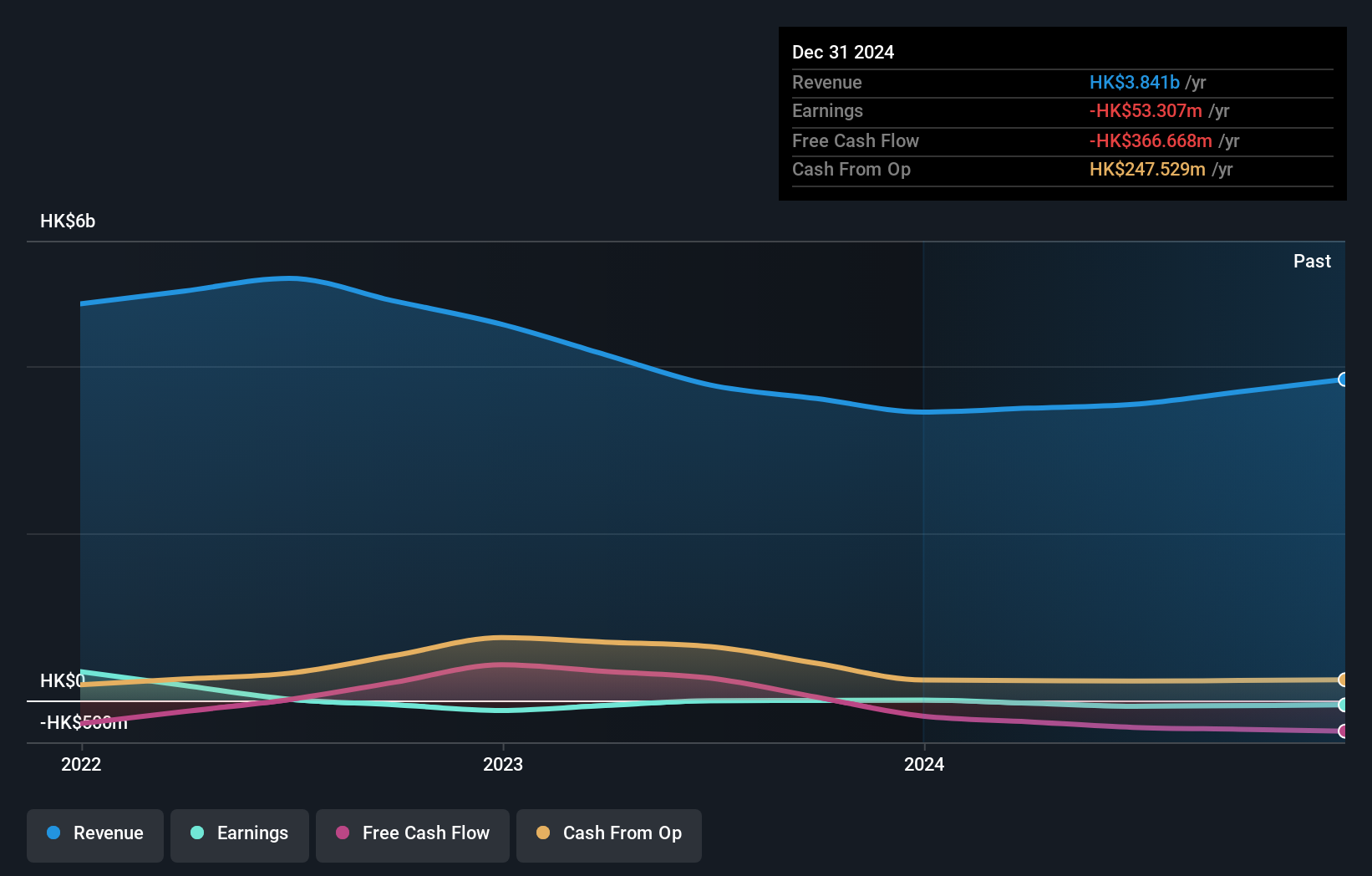

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

China Aerospace International Holdings' TSR for the year was broadly in line with the market average, at 29%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 0.7% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for China Aerospace International Holdings that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:31

China Aerospace International Holdings

An investment holding company, operates hi-tech manufacturing and aerospace service business in Hong Kong, the People’s Republic of China, and internationally.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives