- Taiwan

- /

- Semiconductors

- /

- TWSE:3661

Three Value Stocks That May Be Overlooked In December 2024

Reviewed by Simply Wall St

As global markets experience mixed performances, with major indexes like the S&P 500 and Nasdaq reaching record highs while value stocks lag behind growth shares, investors are keeping a close eye on economic indicators such as job growth and potential interest rate cuts by the Federal Reserve. In this environment of diverse market movements and economic uncertainty, identifying undervalued stocks that may have been overlooked can present unique opportunities for those seeking to capitalize on potential value investments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.06 | US$99.93 | 49.9% |

| S Foods (TSE:2292) | ¥2744.00 | ¥5472.35 | 49.9% |

| Accent Group (ASX:AX1) | A$2.47 | A$4.91 | 49.7% |

| T'Way Air (KOSE:A091810) | ₩2530.00 | ₩5054.93 | 49.9% |

| Acerinox (BME:ACX) | €9.98 | €19.93 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1446.00 | ¥2883.68 | 49.9% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.71 | MX$39.28 | 49.8% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$53.95 | 49.8% |

| Visional (TSE:4194) | ¥8543.00 | ¥16998.76 | 49.7% |

| Equifax (NYSE:EFX) | US$266.82 | US$530.98 | 49.7% |

Here's a peek at a few of the choices from the screener.

BYD Electronic (International) (SEHK:285)

Overview: BYD Electronic (International) Company Limited is an investment holding company that focuses on the design, manufacture, assembly, and sale of mobile handset components and modules both in China and internationally, with a market cap of HK$88.55 billion.

Operations: The company's revenue is primarily derived from the manufacture, assembly, and sale of mobile handset components and modules, amounting to CN¥152.36 billion.

Estimated Discount To Fair Value: 46.1%

BYD Electronic (International) is trading at HK$42.95, significantly below its estimated fair value of HK$79.69, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow substantially at 24% annually, outpacing the Hong Kong market's growth rate of 11.3%. Despite a low forecasted return on equity of 16.8% in three years, BYD's strong earnings growth and current valuation present an intriguing opportunity for investors focused on cash flow metrics.

- Our expertly prepared growth report on BYD Electronic (International) implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of BYD Electronic (International) with our comprehensive financial health report here.

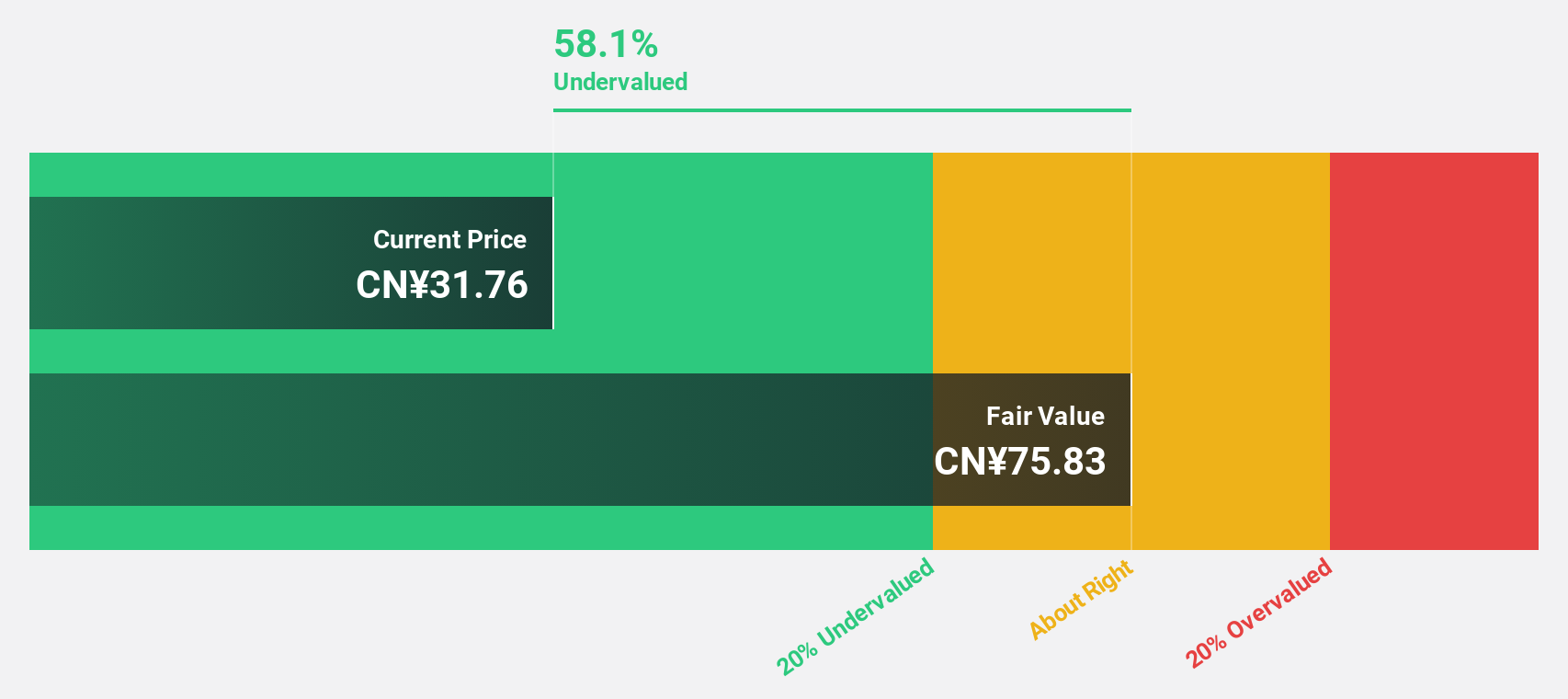

Nancal TechnologyLtd (SHSE:603859)

Overview: Nancal Technology Co., Ltd specializes in smart manufacturing and smart electrical technology products in China, with a market cap of CN¥9.13 billion.

Operations: The company's revenue segments include smart manufacturing products generating CN¥2.45 billion and smart electrical technology products contributing CN¥1.78 billion.

Estimated Discount To Fair Value: 47.2%

Nancal Technology Ltd. is currently trading at CN¥41.04, significantly below its estimated fair value of CN¥77.69, highlighting potential undervaluation based on cash flows. Despite recent declines in revenue and net income for the nine months ending September 2024, earnings are forecast to grow significantly at 36.6% annually, surpassing the Chinese market's growth rate of 25.9%. However, a low projected return on equity of 11.4% in three years warrants consideration for investors focusing on cash flow metrics.

- Our comprehensive growth report raises the possibility that Nancal TechnologyLtd is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Nancal TechnologyLtd stock in this financial health report.

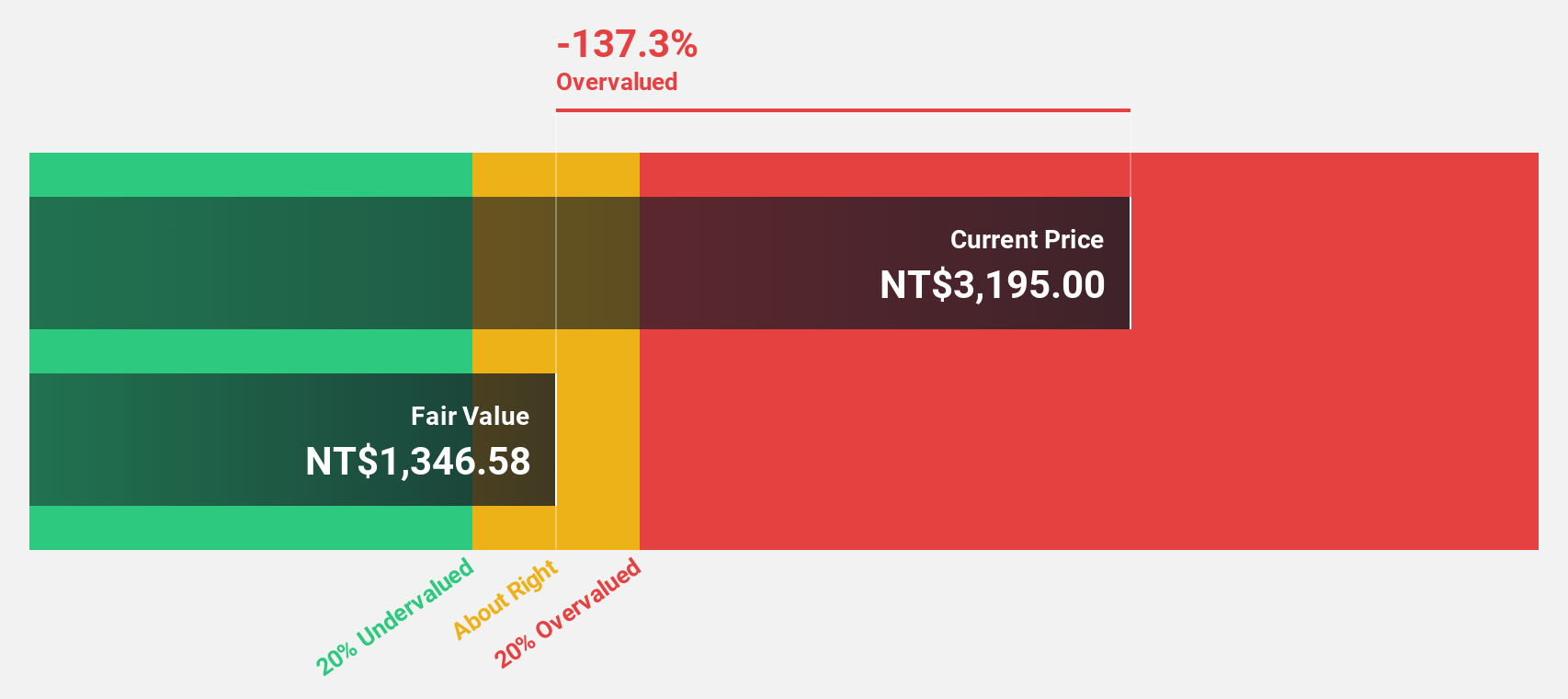

Alchip Technologies (TWSE:3661)

Overview: Alchip Technologies, Limited, along with its subsidiaries, specializes in the research and development, design, and manufacture of fabless application-specific integrated circuits (ASIC) and system on a chip (SOC) across Japan, Taiwan, and China with a market cap of NT$204.54 billion.

Operations: The company's revenue segment primarily comprises NT$48.12 billion from semiconductors.

Estimated Discount To Fair Value: 48.4%

Alchip Technologies is trading at NT$2,670, significantly below its estimated fair value of NT$5,172.07, suggesting potential undervaluation based on cash flows. The company reported strong earnings growth for Q3 2024 with sales reaching NT$14.83 billion and net income doubling from the previous year to NT$1.79 billion. Despite recent shareholder dilution and share price volatility, Alchip's projected revenue and earnings growth surpass Taiwan's market averages, driven by advancements in 2nm ASIC technology development.

- In light of our recent growth report, it seems possible that Alchip Technologies' financial performance will exceed current levels.

- Click here to discover the nuances of Alchip Technologies with our detailed financial health report.

Make It Happen

- Access the full spectrum of 894 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3661

Alchip Technologies

Research, designs, and manufactures fabless application specific integrated circuits (ASIC) and system on a chip (SOC)in Japan, Taiwan, and China.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.