The Hong Kong market has recently experienced a decline, with the Hang Seng Index retreating by 2.28% amid concerns over the economic outlook and unexpected rate cuts by the central bank. Despite this downturn, opportunities may exist for investors seeking stocks that could be trading below their fair value estimates. In such an environment, identifying undervalued stocks involves looking at companies with strong fundamentals that might be temporarily overlooked due to broader market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$38.50 | HK$76.16 | 49.5% |

| COSCO SHIPPING Energy Transportation (SEHK:1138) | HK$8.88 | HK$16.25 | 45.4% |

| Beauty Farm Medical and Health Industry (SEHK:2373) | HK$17.10 | HK$32.96 | 48.1% |

| Bairong (SEHK:6608) | HK$8.79 | HK$15.63 | 43.7% |

| Mobvista (SEHK:1860) | HK$1.90 | HK$3.69 | 48.6% |

| AK Medical Holdings (SEHK:1789) | HK$4.23 | HK$8.05 | 47.5% |

| Q Technology (Group) (SEHK:1478) | HK$4.22 | HK$8.28 | 49% |

| MicroPort Scientific (SEHK:853) | HK$4.95 | HK$9.41 | 47.4% |

| Vobile Group (SEHK:3738) | HK$1.24 | HK$2.31 | 46.4% |

| Chervon Holdings (SEHK:2285) | HK$16.68 | HK$30.31 | 45% |

Let's review some notable picks from our screened stocks.

BYD Electronic (International) (SEHK:285)

Overview: BYD Electronic (International) Company Limited, with a market cap of HK$66.81 billion, focuses on designing, manufacturing, assembling, and selling mobile handset components and modules both in the People’s Republic of China and internationally.

Operations: The company's revenue primarily comes from the manufacture, assembly, and sale of mobile handset components and modules, generating CN¥129.96 billion.

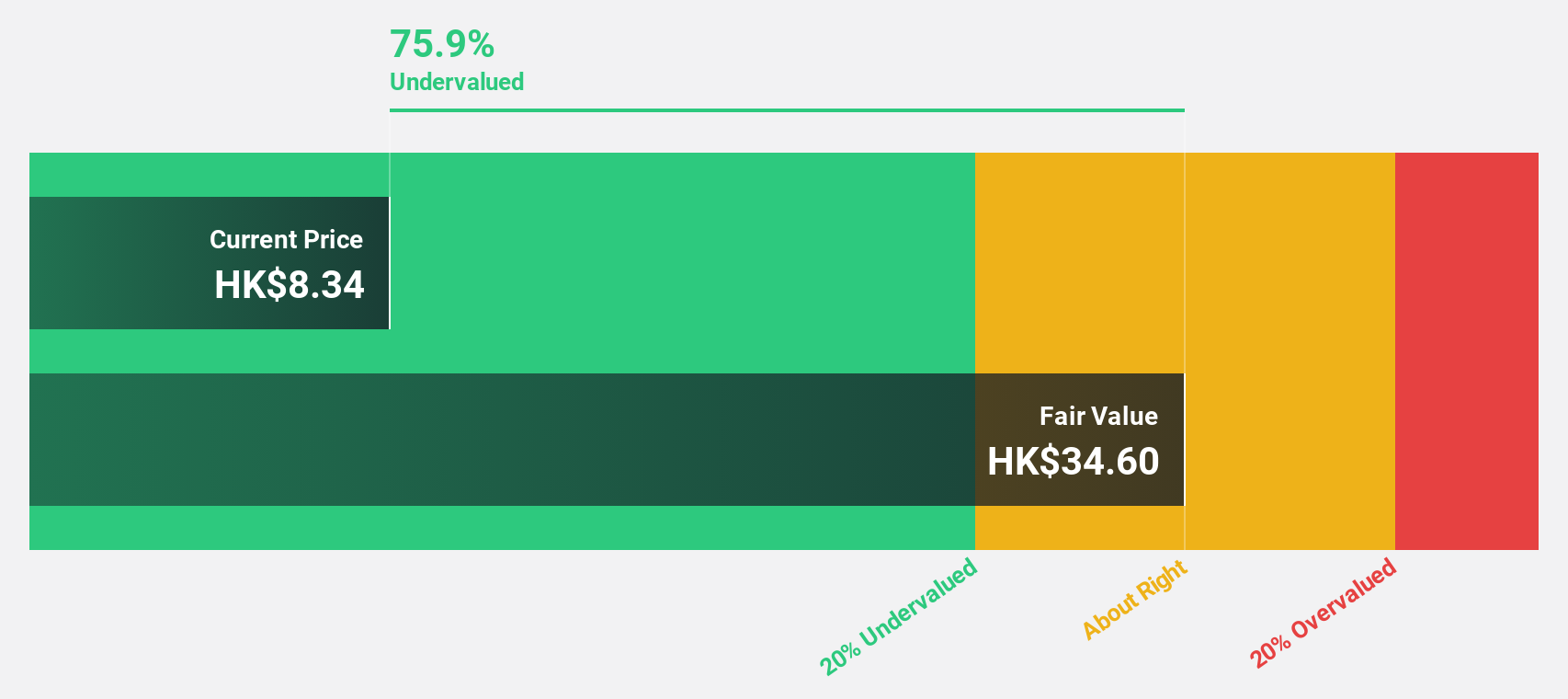

Estimated Discount To Fair Value: 37.1%

BYD Electronic (International) is trading at HK$29.65, significantly below its estimated fair value of HK$47.14, indicating it is undervalued based on cash flows. Earnings grew by 117.6% over the past year and are forecast to grow 22.3% annually, outpacing the Hong Kong market's growth rate of 11.3%. Recent inclusion in the Hang Seng Index and a dividend increase further bolster its investment appeal despite low forecasted return on equity (19%).

- Our expertly prepared growth report on BYD Electronic (International) implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on BYD Electronic (International)'s balance sheet by reading our health report here.

Wasion Holdings (SEHK:3393)

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market cap of approximately HK$6.23 billion.

Operations: The company's revenue segments include Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion).

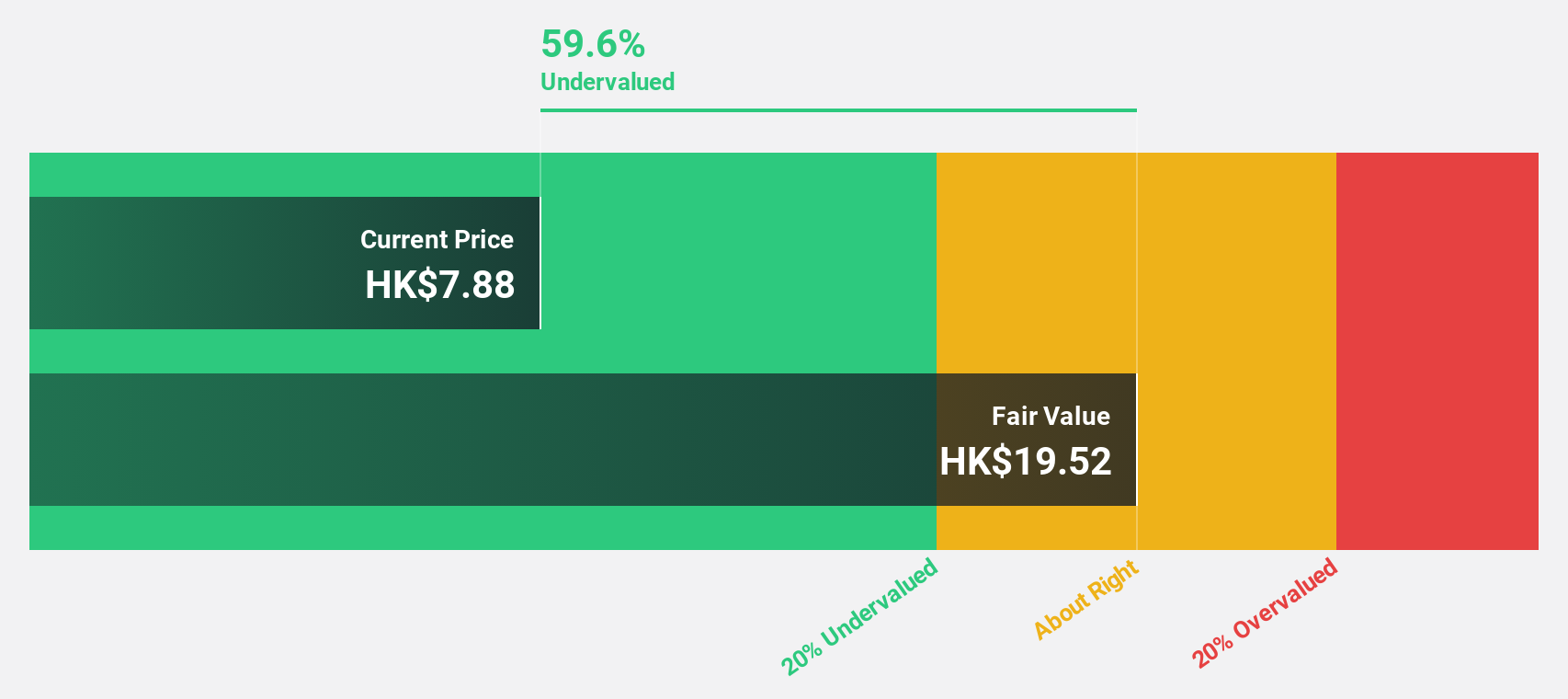

Estimated Discount To Fair Value: 34%

Wasion Holdings, trading at HK$6.26, is undervalued with an estimated fair value of HK$9.49. Earnings grew 61% last year and are forecast to grow 25.8% annually, surpassing the Hong Kong market's growth rate (11.3%). Recent contracts in Hungary (EUR 31.62 million), Singapore (USD 9.42 million), and Malaysia (USD 5.74 million) highlight its international reach and brand recognition despite an unstable dividend track record and low forecasted return on equity (16.6%).

- Our earnings growth report unveils the potential for significant increases in Wasion Holdings' future results.

- Take a closer look at Wasion Holdings' balance sheet health here in our report.

Inspur Digital Enterprise Technology (SEHK:596)

Overview: Inspur Digital Enterprise Technology Limited (SEHK:596) is an investment holding company that offers software development, other software services, and cloud services in the People’s Republic of China, with a market cap of HK$3.33 billion.

Operations: The company's revenue segments include CN¥2.00 billion from Cloud Services, CN¥2.47 billion from Management Software, and CN¥3.83 billion from Internet of Things (IoT) Solutions.

Estimated Discount To Fair Value: 41.2%

Inspur Digital Enterprise Technology, trading at HK$2.92, is significantly undervalued with an estimated fair value of HK$4.96. Earnings are forecast to grow 38% annually over the next three years, outpacing the Hong Kong market's growth rate (11.3%). Revenue is expected to increase by 21.8% per year, also surpassing the market average (7.4%). However, its return on equity is projected to be relatively low at 19.7%.

- The analysis detailed in our Inspur Digital Enterprise Technology growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Inspur Digital Enterprise Technology.

Key Takeaways

- Dive into all 36 of the Undervalued SEHK Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:596

Inspur Digital Enterprise Technology

An investment holding company, provides software development and other software services, and cloud services in the People’s Republic of China.

High growth potential with solid track record.