- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2481

3 Global Penny Stocks With Market Caps Under US$700M

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. stocks climbing on easing trade concerns and better-than-expected earnings, while European indices also posted gains amid de-escalating tariff tensions. In this context, penny stocks—often associated with smaller or newer companies—remain a compelling investment area for those seeking hidden value and potential growth. Despite being an outdated term, penny stocks can still offer significant opportunities when backed by strong financials; we'll explore three such examples that stand out for their financial strength and long-term potential.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.13 | SGD8.38B | ✅ 5 ⚠️ 0 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.94 | MYR1.47B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.315 | MYR914.18M | ✅ 4 ⚠️ 3 View Analysis > |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR2.74 | MYR1.98B | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.40 | MYR669.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.06 | HK$46.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.09 | HK$694.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.885 | £439.03M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,655 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Wise Living Technology (SEHK:2481)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wise Living Technology Co., Ltd. offers heat services in the People’s Republic of China and has a market cap of HK$895.75 million.

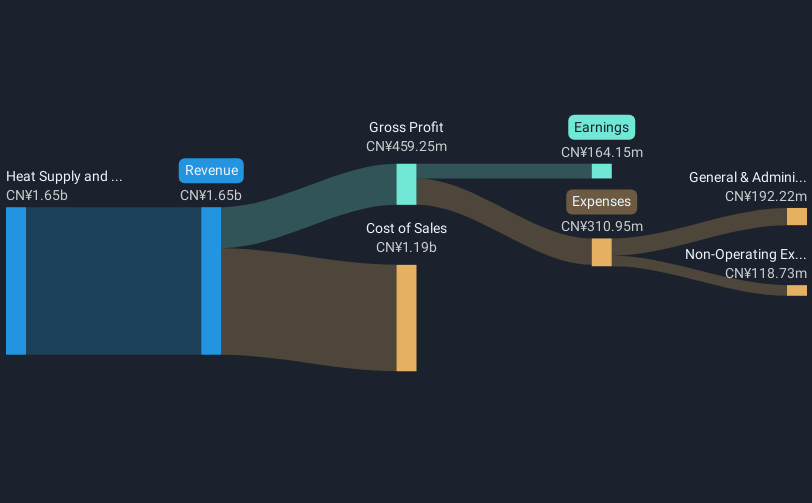

Operations: The company generates revenue primarily from its Heat Supply and Related Services segment, amounting to CN¥1.65 billion.

Market Cap: HK$895.75M

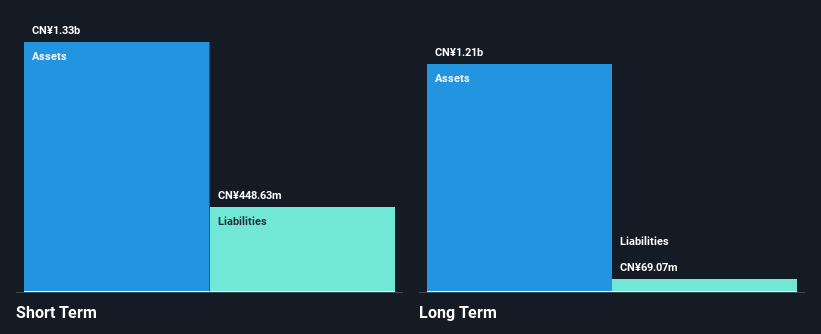

Wise Living Technology Co., Ltd. has shown consistent revenue growth, with sales reaching CN¥1.65 billion, up from the previous year's CN¥1.53 billion, and net income increasing to CN¥164.15 million. Despite this growth, its earnings increase of 10.2% over the past year lags behind its five-year average of 20% per annum and the broader electronic industry performance of 17.1%. The company maintains a low Price-To-Earnings ratio of 5.1x compared to the Hong Kong market's average of 10.9x but faces challenges with short-term liabilities exceeding assets by CN¥400 million and high share price volatility recently observed in its stock performance.

- Dive into the specifics of Wise Living Technology here with our thorough balance sheet health report.

- Gain insights into Wise Living Technology's past trends and performance with our report on the company's historical track record.

Gohigh NetworksLtd (SZSE:000851)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gohigh Networks Co., Ltd. operates in China, focusing on digital intelligence applications, information services, and IT sales, with a market cap of CN¥2.65 billion.

Operations: The company's revenue is derived from its operations in China, amounting to CN¥1.46 billion.

Market Cap: CN¥2.65B

Gohigh Networks Co., Ltd. faces significant challenges, with revenue dropping to CN¥1.46 billion from CN¥5.93 billion year-on-year and net losses widening to CN¥2.28 billion. Despite having short-term assets of CN¥3.8 billion that cover both its short-term and long-term liabilities, the company remains unprofitable with a negative return on equity of -73.2%. The board's inexperience is evident with an average tenure of 1.1 years, and the company's cash runway is limited to less than a year based on current free cash flow levels, highlighting liquidity concerns amidst declining earnings over five years by 75.5% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Gohigh NetworksLtd.

- Explore historical data to track Gohigh NetworksLtd's performance over time in our past results report.

Lecron Industrial Development Group (SZSE:300343)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lecron Industrial Development Group Co., Ltd. (SZSE:300343) operates in the industrial sector with a market cap of approximately CN¥4.55 billion.

Operations: Lecron Industrial Development Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.55B

Lecron Industrial Development Group Co., Ltd. has shown recent profitability, reporting a net income of CN¥5.02 million for Q1 2025 compared to a loss in the same period last year, despite a decline in annual revenue from CN¥1.03 billion to CN¥868.75 million in 2024. The company maintains financial stability with short-term assets of CN¥1.3 billion exceeding liabilities and more cash than debt, though operating cash flow remains negative. A share repurchase program worth up to CN¥100 million was announced, reflecting confidence in future prospects despite its removal from the S&P Global BMI Index recently due to performance concerns.

- Jump into the full analysis health report here for a deeper understanding of Lecron Industrial Development Group.

- Evaluate Lecron Industrial Development Group's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Gain an insight into the universe of 5,655 Global Penny Stocks by clicking here.

- Curious About Other Options? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wise Living Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2481

Wise Living Technology

Provides heat services in the People’s Republic of China.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives