- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2382

Sunny Optical (SEHK:2382): Evaluating Valuation Following Leadership Transition Announcement

Reviewed by Simply Wall St

Sunny Optical Technology (Group) (SEHK:2382) just announced a leadership change, as Mr. Ye Liaoning is stepping down as chairman and executive director. Mr. Wang Tan Jiong will become the new chairman, effective November 1, 2025.

See our latest analysis for Sunny Optical Technology (Group).

The leadership shakeup comes during a period of heightened attention for Sunny Optical Technology (Group). After a modest rise earlier in the year, the stock experienced some volatility, including a sharp 1-month share price decline of 17.7%. Yet, investors who have held on saw a robust 1-year total shareholder return of nearly 20%. However, longer-term performance remains a challenge.

If shifts like this leadership transition spark your curiosity, now is the perfect moment to broaden your opportunity set and discover fast growing stocks with high insider ownership

With the stock still trading well below analyst targets and boasting double-digit annual growth, the question remains: is Sunny Optical Technology (Group) now undervalued, or are investors already factoring in its next steps?

Most Popular Narrative: 30.3% Undervalued

Sunny Optical Technology (Group) is trading at a significant discount to the most popular fair value estimate, which is well above its recent close. This valuation is based on ambitious projections for future earnings and market expansion.

The proliferation of AI-powered IoT devices, robotics, and smart hardware beyond traditional consumer electronics is unlocking new high-growth verticals for Sunny Optical, diversifying revenue streams and expanding the addressable market. This is likely to support multi-year top-line growth.

Curious about what’s driving this aggressive target? One controversial growth forecast could be fueling both the optimism and the debate. Uncover the revenue and profit assumptions that keep Sunny Optical bulls excited and skeptics cautious. Will these numbers hold up? Only the full narrative has the answers.

Result: Fair Value of $99.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker-than-expected smartphone sales or stalled adoption in XR devices could quickly challenge the positive outlook for Sunny Optical Technology (Group).

Find out about the key risks to this Sunny Optical Technology (Group) narrative.

Another View: What Do Multiples Say?

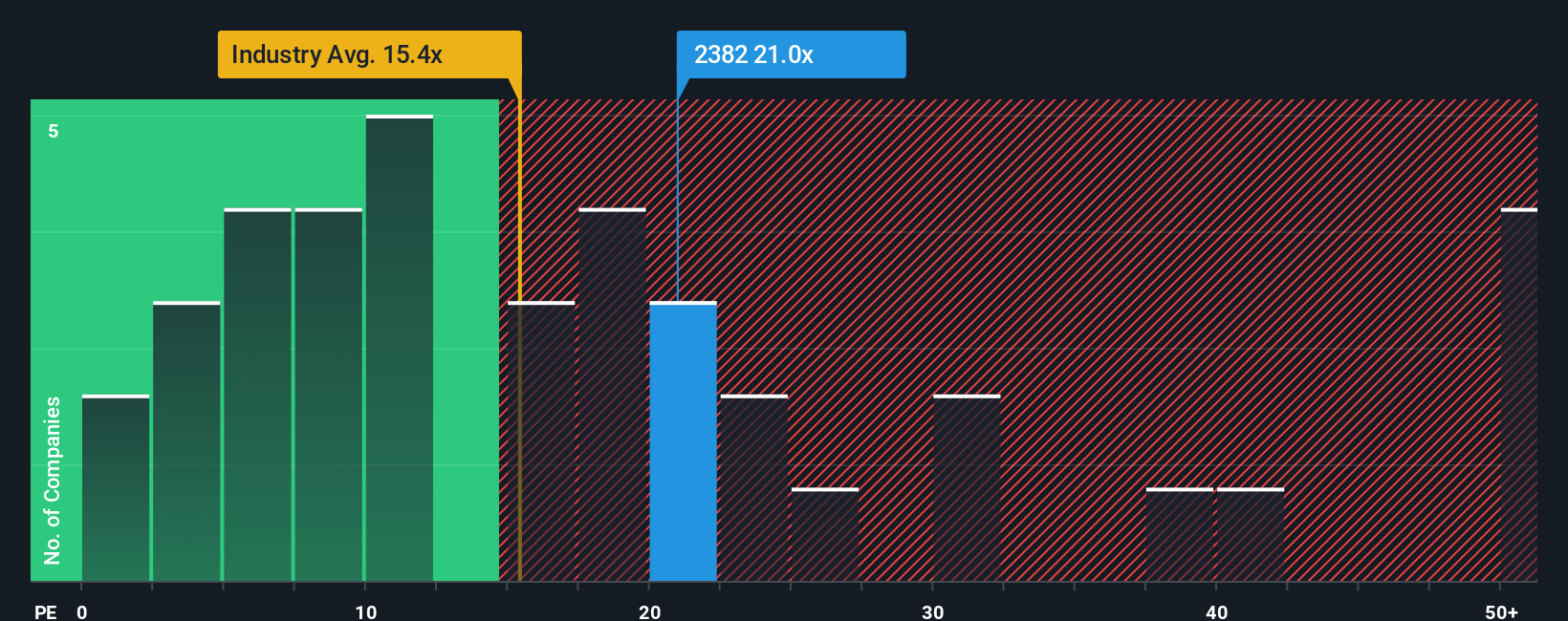

While fair value estimates suggest Sunny Optical Technology (Group) may be undervalued, looking at the price-to-earnings ratio presents a more cautious story. The company trades at 21.2 times earnings, which is higher than the industry average of 13.3 and above the fair ratio of 18.3 that the market could shift toward. This gap implies there is valuation risk if investor sentiment changes. Are expectations justifiably high or overdue for a reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sunny Optical Technology (Group) Narrative

If you see the numbers differently or want to investigate the details firsthand, you have the tools to shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Sunny Optical Technology (Group) research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Moves?

Your next big opportunity could be just a click away. Get ahead of the crowd by checking out breakthrough ideas you might have missed elsewhere.

- Power your portfolio with rising opportunities in artificial intelligence by acting on these 25 AI penny stocks before the buzz turns into a boom.

- Secure income potential by searching for high-yield companies in the market through these 16 dividend stocks with yields > 3%, helping you pursue steady returns over time.

- Be among the first to spot tomorrow’s tech pioneers with these 28 quantum computing stocks, gaining unique access to advances in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2382

Sunny Optical Technology (Group)

An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives