Stock Analysis

- Hong Kong

- /

- Infrastructure

- /

- SEHK:152

Hong Kong Small Caps Undervalued With Insider Buying Action

Reviewed by Simply Wall St

Amid a backdrop of shifting global economic indicators, the Hong Kong small-cap market is drawing attention with its unique investment opportunities. Recent insider buying trends suggest that some undervalued stocks in this segment may be poised for a revaluation, making it an intriguing area for investors looking to potentially capitalize on market inefficiencies.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ferretti | 11.4x | 0.8x | 44.92% | ★★★★★☆ |

| Wasion Holdings | 10.8x | 0.8x | 35.30% | ★★★★☆☆ |

| China Overseas Grand Oceans Group | 2.7x | 0.1x | -0.71% | ★★★★☆☆ |

| Kinetic Development Group | 3.8x | 1.7x | 23.53% | ★★★★☆☆ |

| Nissin Foods | 14.6x | 1.3x | 40.53% | ★★★★☆☆ |

| Transport International Holdings | 11.6x | 0.6x | 43.70% | ★★★★☆☆ |

| China Leon Inspection Holding | 10.1x | 0.7x | 25.19% | ★★★★☆☆ |

| Skyworth Group | 5.8x | 0.1x | -320.03% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.0x | 0.4x | 15.52% | ★★★☆☆☆ |

| Shenzhen International Holdings | 8.0x | 0.7x | 14.46% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shenzhen International Holdings (SEHK:152)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Shenzhen International Holdings operates in logistics, including parks and services, port-related services, toll roads, and environmental protection businesses, with a focus on logistic park transformation and upgrading services.

Operations: The company generates significant revenue from diverse segments including logistics parks, services, and port-related services with notable contributions from toll roads and environmental protection businesses. Gross profit margin has shown variability over the years, highlighting fluctuations in cost management relative to revenue generation across its operations.

PE: 8.0x

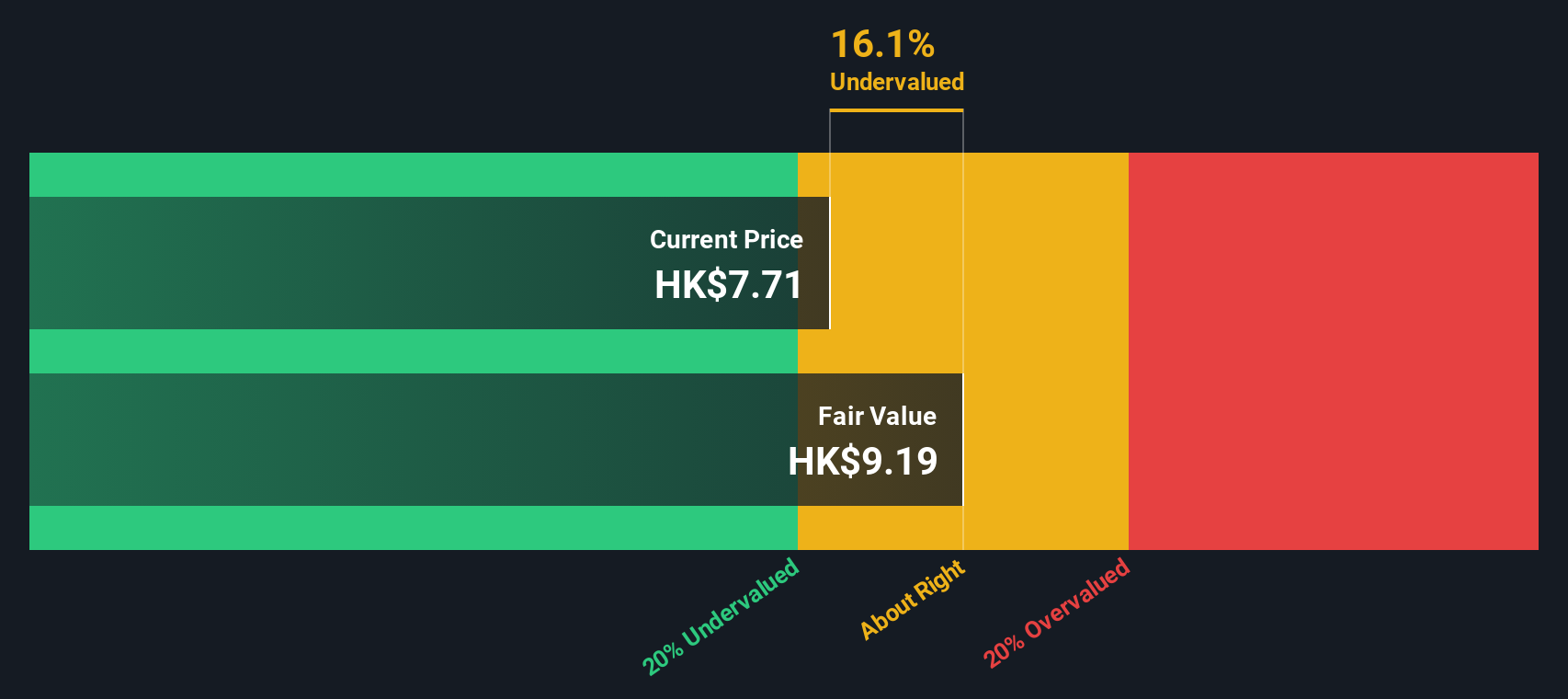

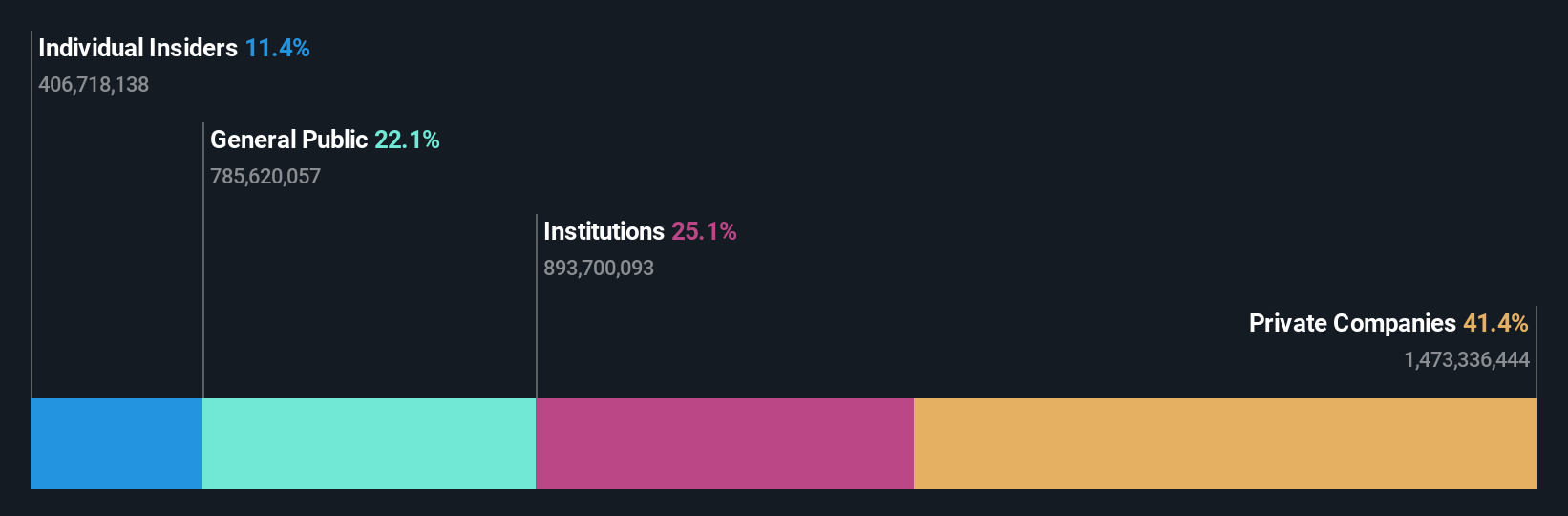

Shenzhen International Holdings, a notable entity in Hong Kong's undervalued market sector, recently saw significant insider confidence with Zhengyu Liu acquiring 693,000 shares for HK$3.97 million. This move underscores a robust belief in the company's prospects amidst its strategic expansions like the Jihe Expressway project, set to enhance connectivity and economic growth in the region. Despite challenges in debt coverage by operating cash flow and reliance on high-risk funding sources, the company is poised for a 16.19% earnings growth annually, reflecting potential for upward valuation adjustments and sustained investor interest.

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings is a company specializing in wireless telecommunications network system equipment and services, with a smaller operation in operator telecommunication services.

Operations: The company generates a significant portion of its revenue from wireless telecommunications network system equipment and services, amounting to HK$5.82 billion, compared to HK$157.83 million from operator telecommunication services. Over recent periods, it has experienced a gross profit margin increase, reaching 0.29% by the end of the last recorded period.

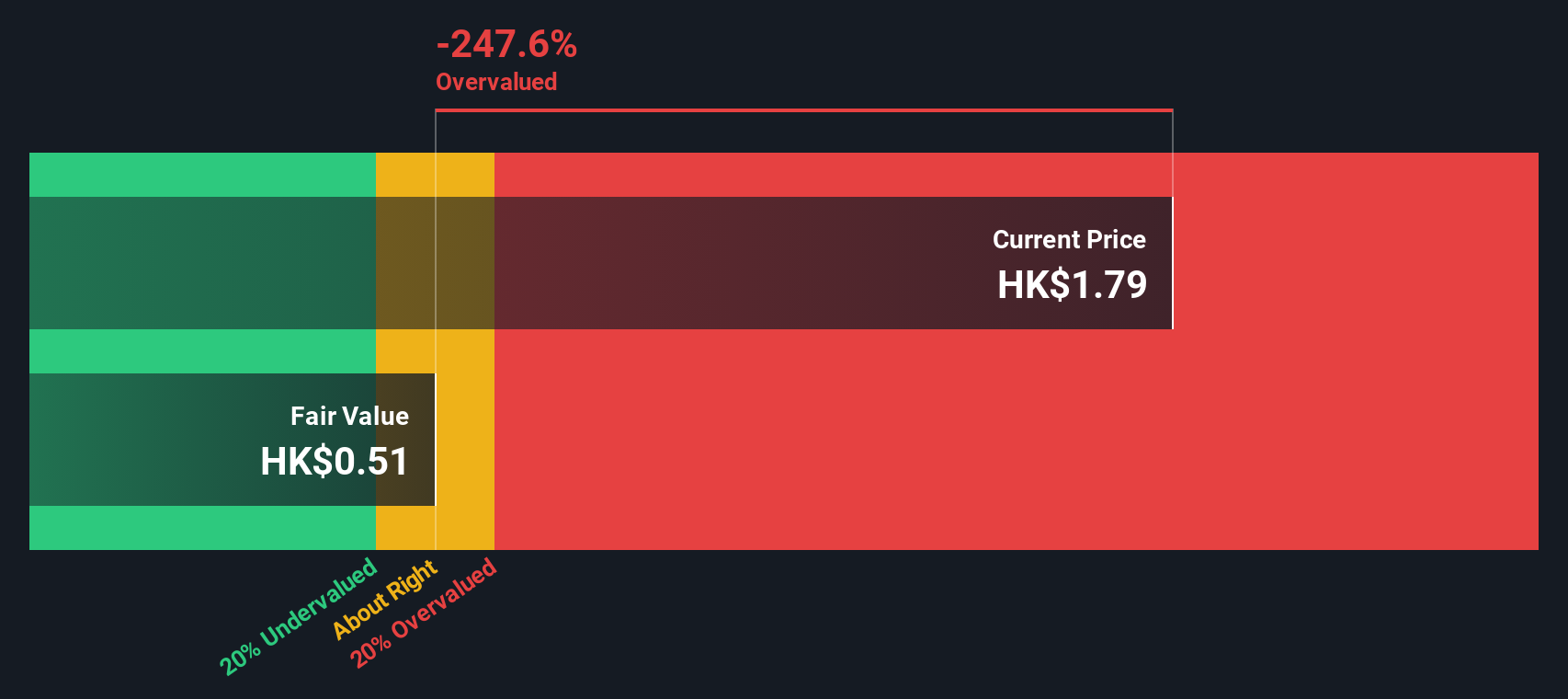

PE: 369.1x

Recently, Comba Telecom Systems Holdings demonstrated insider confidence as Tung Ling Fok acquired 1.83 million shares, signaling potential underappreciation in the market. Despite a volatile share price and low profit margins this past year, the company's complete reliance on external borrowing highlights a bold but risky financing strategy. At a recent conference in Shanghai, leadership underscored strategic initiatives poised to enhance shareholder value, hinting at an optimistic future trajectory for this lesser-known entity in Hong Kong’s dynamic market landscape.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Overseas Grand Oceans Group primarily operates in property investment and development, with additional interests in property leasing and other related activities, boasting a market capitalization of approximately HK$7.33 billion.

Operations: The company generates the majority of its revenue from property investment and development, contributing CN¥56.08 billion, with additional income from property leasing at CN¥0.24 billion. Its gross profit margin has seen fluctuations over recent periods, with a notable increase to 0.29% in the latest recorded period from a previous 0.14%.

PE: 2.7x

Recently, China Overseas Grand Oceans Group Limited has seen a notable decline in property sales and GFA year-on-year, signaling challenges in its core markets. Despite these setbacks, insider confidence is reflected through recent share purchases, suggesting a belief in the company's long-term value amidst current price levels. This action aligns with the appointment of new auditors and board members, potentially heralding strategic shifts aimed at revitalizing performance. These elements together paint a picture of a firm positioned for recovery, making it an intriguing prospect for those looking into undervalued opportunities within Hong Kong's smaller companies.

- Click to explore a detailed breakdown of our findings in China Overseas Grand Oceans Group's valuation report.

Understand China Overseas Grand Oceans Group's track record by examining our Past report.

Taking Advantage

- Delve into our full catalog of 17 Undervalued SEHK Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:152

Shenzhen International Holdings

An investment holding company, invests in, constructs, and operates logistics infrastructure facilities primarily in the People’s Republic of China.

Proven track record and fair value.