Stock Analysis

As of July 2024, the Hong Kong stock market is experiencing a notable downturn, with the Hang Seng Index retreating by 4.79%. This shift in market dynamics presents an intriguing opportunity for investors to explore potential undervalued or lesser-known stocks that may thrive under current economic conditions. In this environment, identifying good stocks often involves looking for companies with robust fundamentals such as strong balance sheets and potential for growth, which might be overlooked during broader market declines.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| JiaXing Gas Group | 17.72% | 26.04% | 22.07% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Changjiu Holdings | 14.09% | 12.87% | -4.74% | ★★★★★☆ |

| Mulsanne Group Holding | 186.88% | -12.02% | -43.54% | ★★★★☆☆ |

| Laopu Gold | 8.43% | 26.56% | 36.28% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 27.21% | 15.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. is a company that specializes in the research, development, production, and marketing of edible bird's nest products within the People’s Republic of China, boasting a market capitalization of HK$6.60 billion.

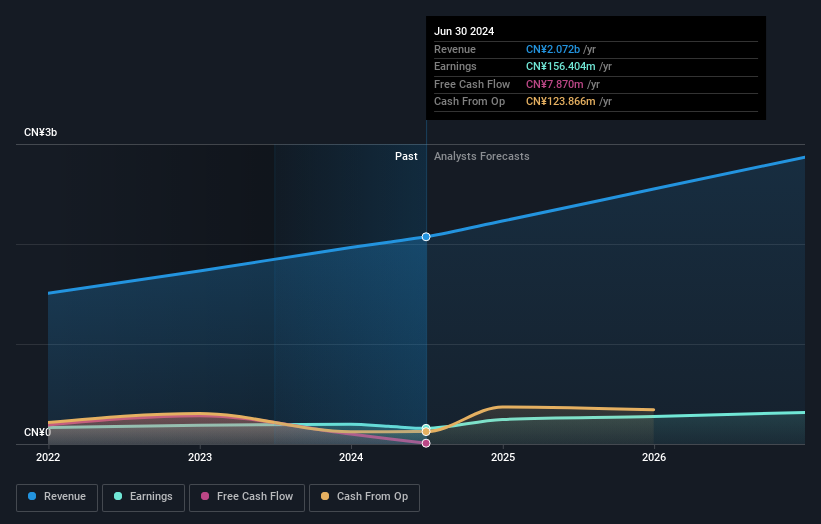

Operations: The company generates revenue through diverse channels including direct sales to online and offline customers, and through sales to distributors and e-commerce platforms. It has seen a steady increase in gross profit, recording CN¥994.92 million in 2023 with a gross profit margin of approximately 50.65%.

Xiamen Yan Palace Bird's Nest Industry, a lesser-known yet robust player in Hong Kong's market, is demonstrating promising dynamics. Despite a projected net profit drop of 40% to 50% for the first half of 2024, the company anticipates revenue growth between 10% and 15%, reaching up to RMB 1,090 million. This growth is driven by an expanding online presence. With no debt and earnings forecasted to grow annually by about 15%, coupled with a recent dividend affirmation of RMB 2.15 per ten shares, the firm presents an intriguing blend of resilience and potential in challenging conditions.

- Click here to discover the nuances of Xiamen Yan Palace Bird's Nest Industry with our detailed analytical health report.

Understand Xiamen Yan Palace Bird's Nest Industry's track record by examining our Past report.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★★

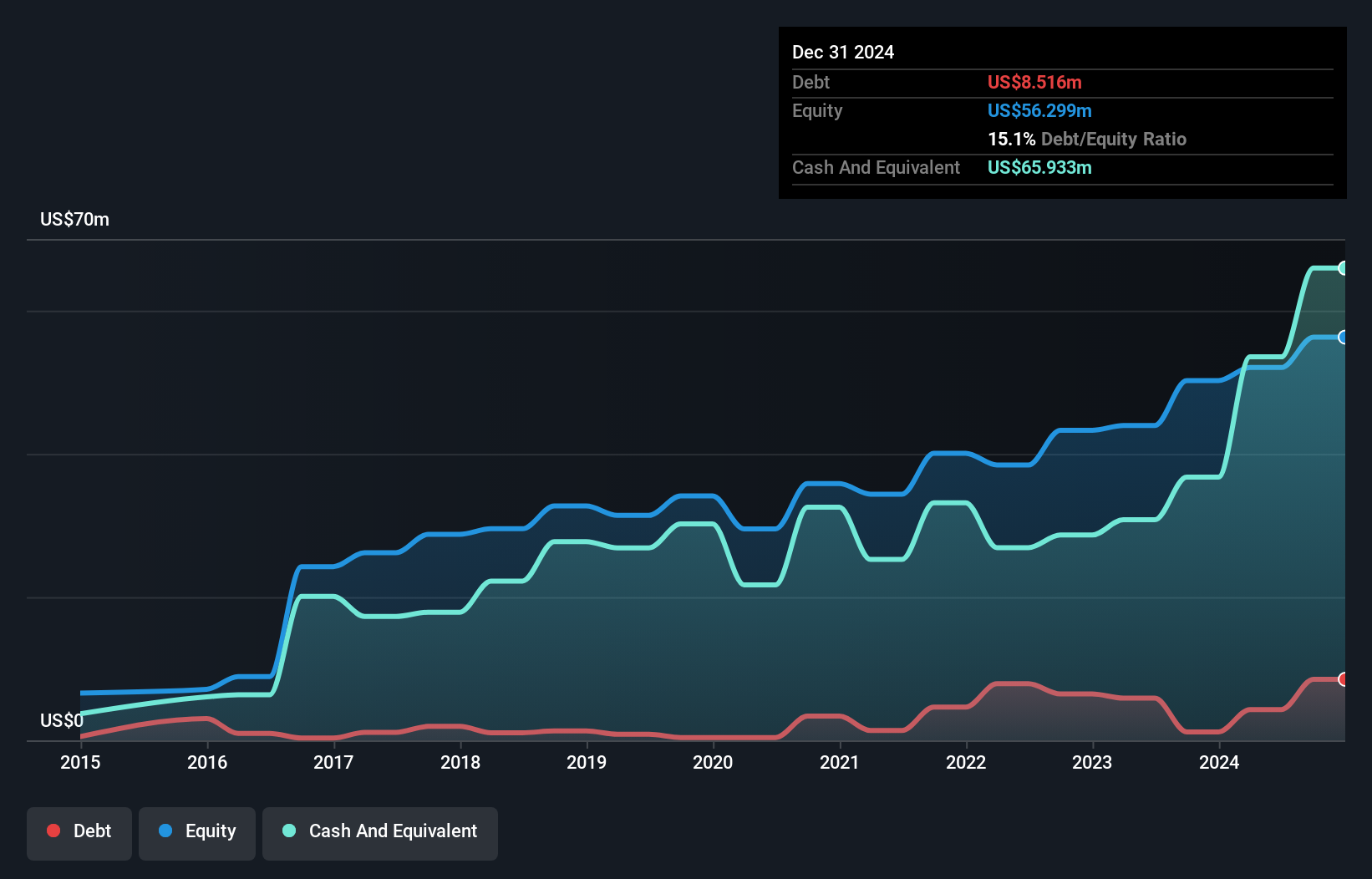

Overview: Plover Bay Technologies Limited is an investment holding company specializing in the design, development, and marketing of software-defined wide area network (SD-WAN) routers, with a market capitalization of HK$4.32 billion.

Operations: The company generates revenue primarily through the sale of SD-WAN routers, both wired and wireless, alongside software licenses and warranty and support services. Its business model reflects a strong focus on research and development to innovate within the network technology space, which is evident from consistent investment in R&D expenses across financial periods.

Plover Bay Technologies, a notable yet under-the-radar entity in Hong Kong's tech sector, has demonstrated robust financial health and growth. Recently reporting a 29% increase in sales to USD 57.3 million for the first half of 2024, the company also saw net income rise to USD 19.1 million from USD 12.32 million year-over-year. These figures underscore its earnings growth of 24% over the past year, outpacing the industry's average of 10.6%. Moreover, Plover Bay declared an interim dividend of HKD 0.1083 per share, reinforcing its commitment to shareholder returns amidst expanding operations and profitability.

MicroPort NeuroTech (SEHK:2172)

Simply Wall St Value Rating: ★★★★★★

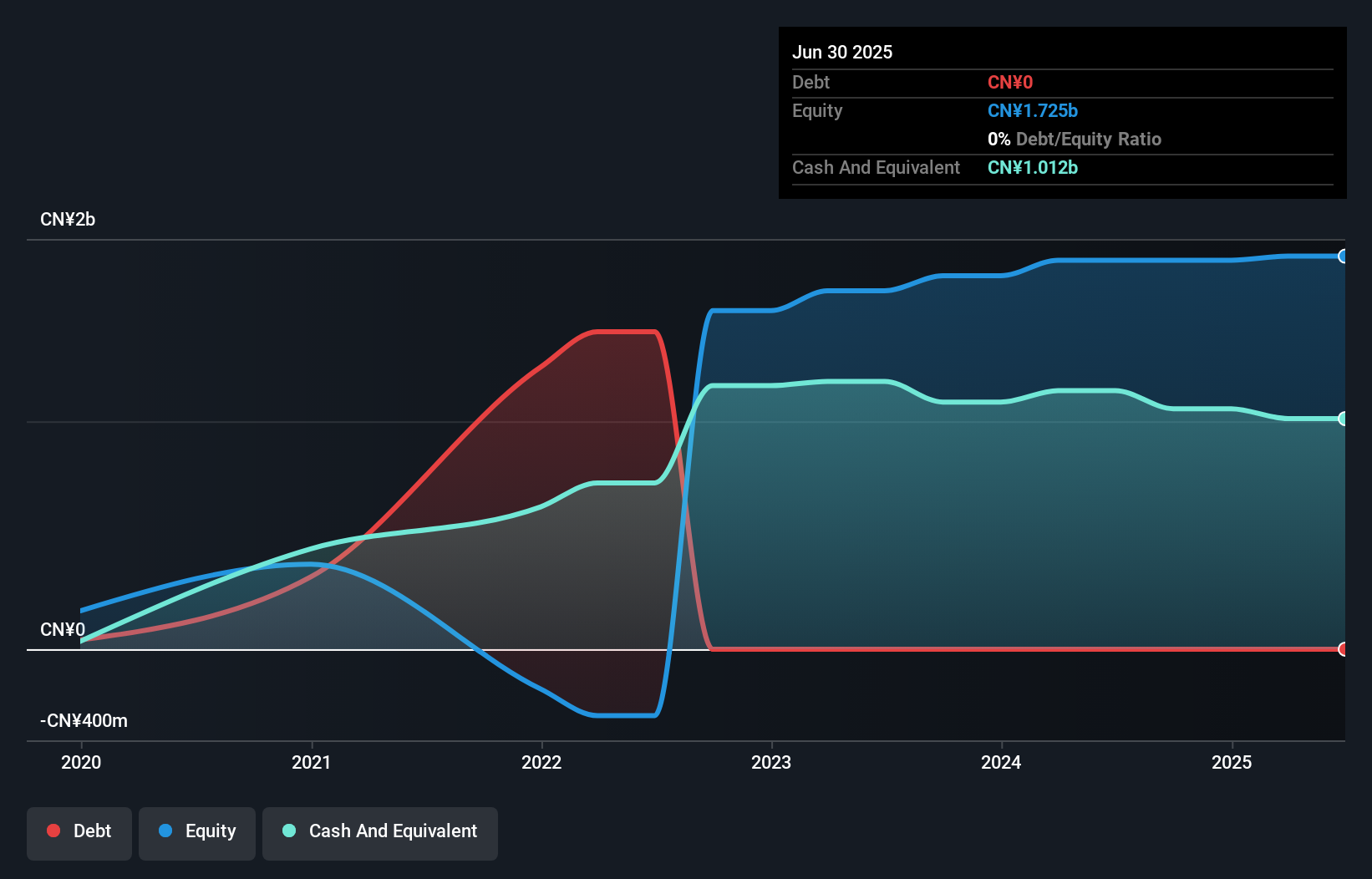

Overview: MicroPort NeuroTech Limited is a company focused on the research, development, and production of neuro-interventional medical devices, serving markets in the People’s Republic of China and globally, with a market capitalization of HK$4.54 billion.

Operations: The company generates its revenue primarily from the sale of surgical and medical equipment, with a recent reported revenue of CN¥665.62 million. It has demonstrated a notable increase in gross profit margin over the years, reaching 76.89% as of the latest report, indicating an efficient control over production costs relative to sales.

MicroPort NeuroTech, recently renamed MicroPort NeuroScientific Corporation, showcases robust growth with a projected revenue increase of 34% to 37%, totaling around RMB 400 million for the first half of 2024. This positive trajectory is underscored by its debt-free status and a significant valuation discount of 53.6% below its estimated fair value. With earnings expected to grow annually by nearly 32%, the company's strategic financial management and recent executive board enhancements signal strong future prospects in the medical equipment sector.

Taking Advantage

- Take a closer look at our SEHK Undiscovered Gems With Strong Fundamentals list of 178 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1497

Xiamen Yan Palace Bird's Nest Industry

Engages in the research, development, production, and marketing of edible bird’s nest (EBN) products in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.