- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2166

Smart-Core Holdings' (HKG:2166) Shareholders Will Receive A Smaller Dividend Than Last Year

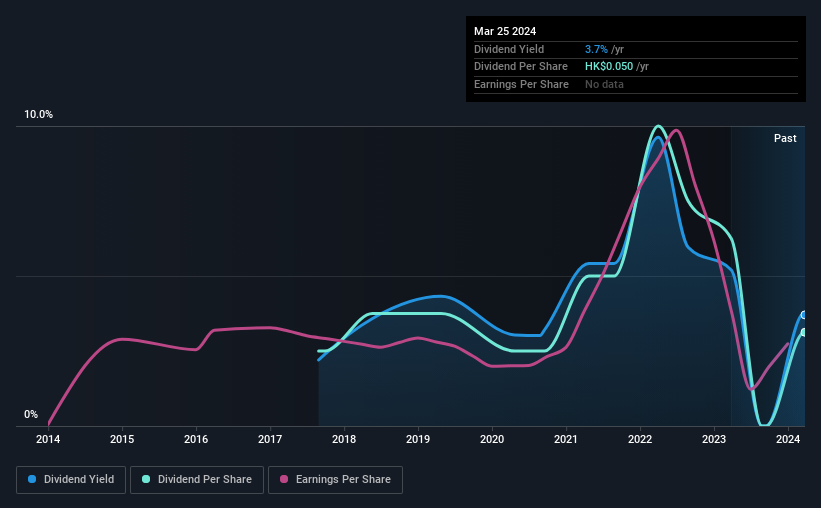

Smart-Core Holdings Limited (HKG:2166) is reducing its dividend from last year's comparable payment to HK$0.05 on the 28th of June. Despite the cut, the dividend yield of 3.7% will still be comparable to other companies in the industry.

See our latest analysis for Smart-Core Holdings

Smart-Core Holdings' Dividend Is Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before making this announcement, Smart-Core Holdings was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

Unless the company can turn things around, EPS could fall by 1.3% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 38%, which is definitely feasible to continue.

Smart-Core Holdings' Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2017, the dividend has gone from HK$0.04 total annually to HK$0.05. This means that it has been growing its distributions at 3.2% per annum over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth May Be Hard To Achieve

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Although it's important to note that Smart-Core Holdings' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 2 warning signs for Smart-Core Holdings that investors should take into consideration. Is Smart-Core Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2166

Smart-Core Holdings

An investment holding company, distributes integrated circuits and other electronic components in the Hong Kong, People’s Republic of China, Singapore, Japan, and internationally.

Slight risk and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion