- Hong Kong

- /

- Tech Hardware

- /

- SEHK:2086

Leadway Technology Investment Group Limited's (HKG:2086) 26% Price Boost Is Out Of Tune With Revenues

Those holding Leadway Technology Investment Group Limited (HKG:2086) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

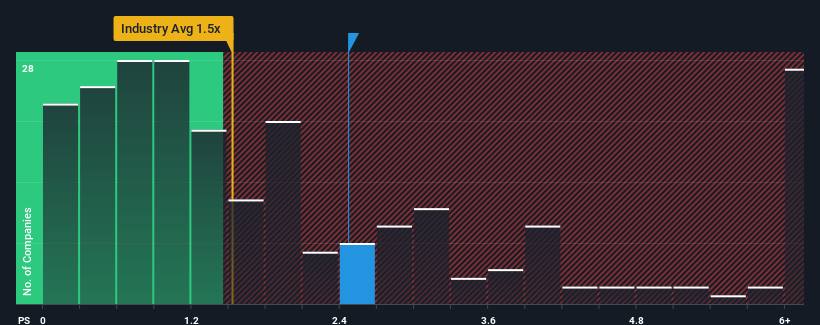

Since its price has surged higher, given around half the companies in Hong Kong's Tech industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Leadway Technology Investment Group as a stock to avoid entirely with its 2.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Leadway Technology Investment Group

How Has Leadway Technology Investment Group Performed Recently?

As an illustration, revenue has deteriorated at Leadway Technology Investment Group over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Leadway Technology Investment Group's earnings, revenue and cash flow.How Is Leadway Technology Investment Group's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Leadway Technology Investment Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 36% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Leadway Technology Investment Group's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Leadway Technology Investment Group's P/S

Shares in Leadway Technology Investment Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Leadway Technology Investment Group currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Leadway Technology Investment Group has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2086

Leadway Technology Investment Group

An investment holding company, develops, sells, and distributes smart card products, software, and hardware in Europe, the Asia Pacific, the Americas, the Middle East, and Africa.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives