- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Xiaomi (SEHK:1810): Assessing Valuation After a Period of Strong Share Price Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 8% Overvalued

According to Panayiotis, Xiaomi is seen as overvalued based on this popular narrative, with its current share price trading above the calculated fair value.

"Xiaomi’s revenue could realistically reach $80 to $100B by 2028, driven by: • EV success (the biggest swing factor). • IoT/services monetization (high-margin growth). • Premium smartphone adoption offsetting market saturation. Its ability to pivot from a hardware vendor to an integrated tech ecosystem (phones + AI + EVs) will determine if it joins the $100B revenue club. Watch for EV progress in 2024 to 2025 and margin trends in services."

Want to discover the strategy fueling this bold valuation? The narrative hints at powerful profit engines and a daring leap into new markets. Think record growth rates, margin improvements, and a valuation usually reserved for elite tech. What are the growth levers hidden in the full forecast? There is one stand-out factor driving their future revenue, and you may not guess what it is.

Result: Fair Value of $51.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, EV market uncertainty and ongoing margin pressure could quickly shift expectations and challenge the optimistic outlook for Xiaomi’s growth story.

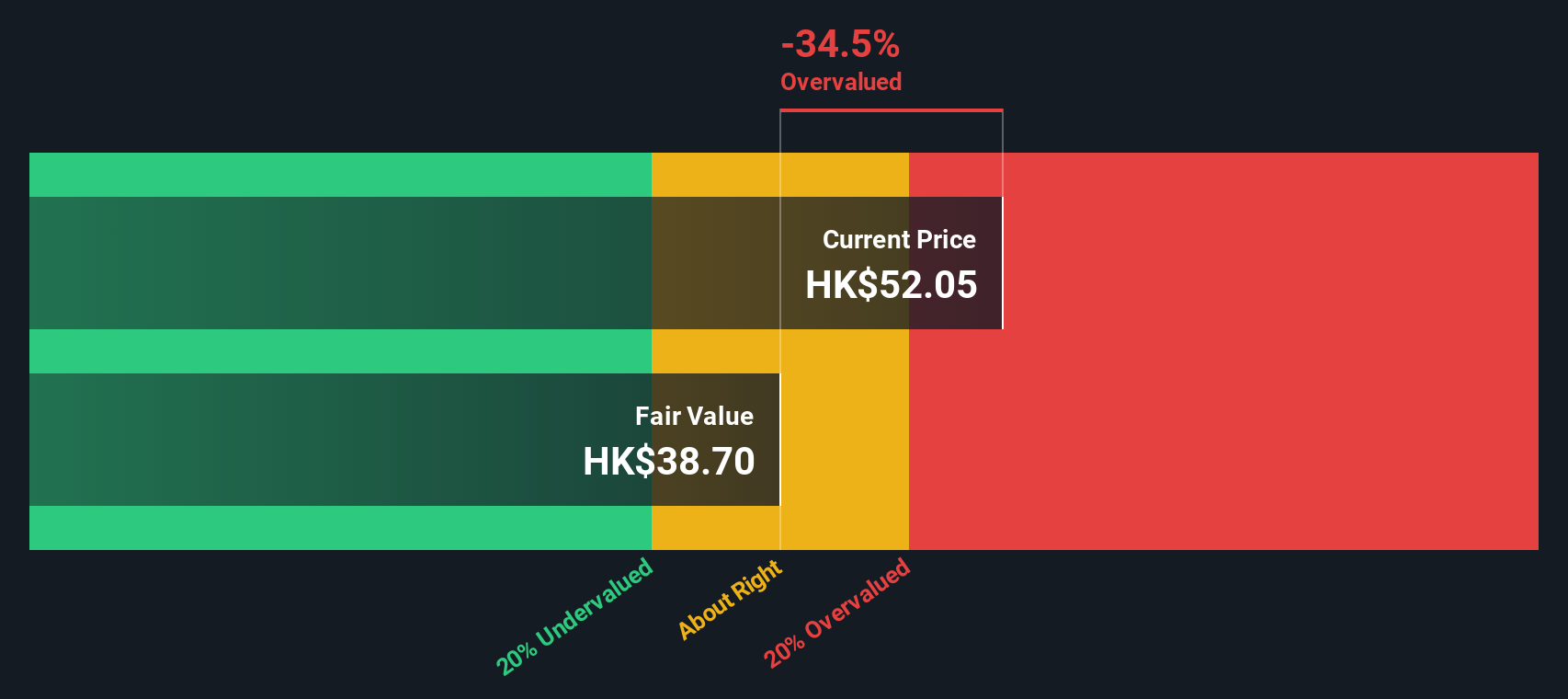

Find out about the key risks to this Xiaomi narrative.Another View: Our DCF Model Challenges Market Optimism

Taking a step back, the SWS DCF model tells a different story. This cash flow approach points to Xiaomi being overvalued, which contrasts with the optimism seen in growth-focused forecasts. Which method will ultimately prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Xiaomi Narrative

If you have a different take or want to dig into the details on your own terms, you can put together your own Xiaomi outlook in just a few minutes. Do it your way.

A great starting point for your Xiaomi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your search to just one opportunity. Supercharge your portfolio by checking out these powerful strategies only available with Simply Wall Street’s screener.

- Tap into high-growth potential by targeting companies at the frontier of artificial intelligence, using our AI penny stocks for tomorrow’s tech leaders.

- Boost your returns with stocks trading below their estimated worth. Find undervalued gems faster through the insights in our undervalued stocks based on cash flows.

- Strengthen your income stream by uncovering shares known for robust yields, all with the help of our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives