- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Xiaomi (HKG:1810) shareholders have earned a 13% CAGR over the last five years

When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. For example, the Xiaomi Corporation (HKG:1810) share price is up 86% in the last 5 years, clearly besting the market decline of around 14% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 34% in the last year.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Xiaomi

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Xiaomi actually saw its EPS drop 10% per year.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 7.9% per year is probably viewed as evidence that Xiaomi is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

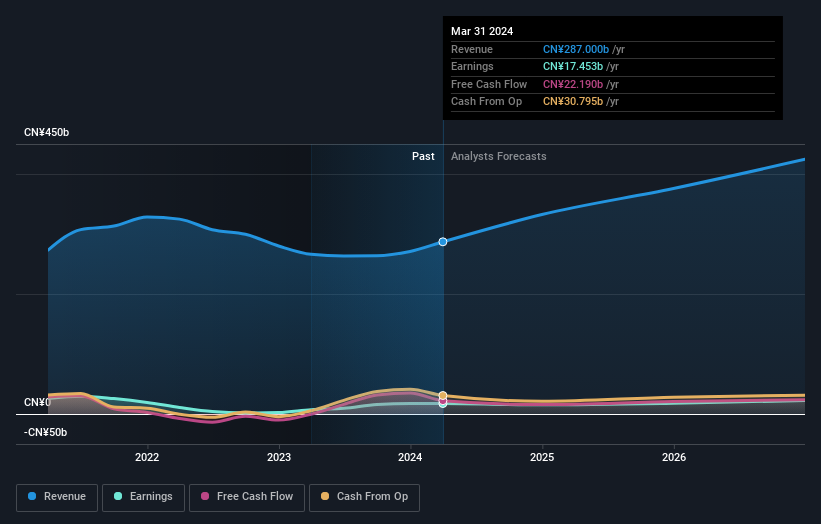

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Xiaomi is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Xiaomi stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that Xiaomi shareholders have received a total shareholder return of 34% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is Xiaomi cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Xiaomi better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, provides hardware and software services in Mainland China and internationally.

Flawless balance sheet with moderate growth potential.