- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1723

Here's What HK Asia Holdings Limited's (HKG:1723) Shareholder Ownership Structure Looks Like

If you want to know who really controls HK Asia Holdings Limited (HKG:1723), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

HK Asia Holdings is a smaller company with a market capitalization of HK$1.3b, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don't own shares in the company. We can zoom in on the different ownership groups, to learn more about HK Asia Holdings.

Check out our latest analysis for HK Asia Holdings

What Does The Lack Of Institutional Ownership Tell Us About HK Asia Holdings?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

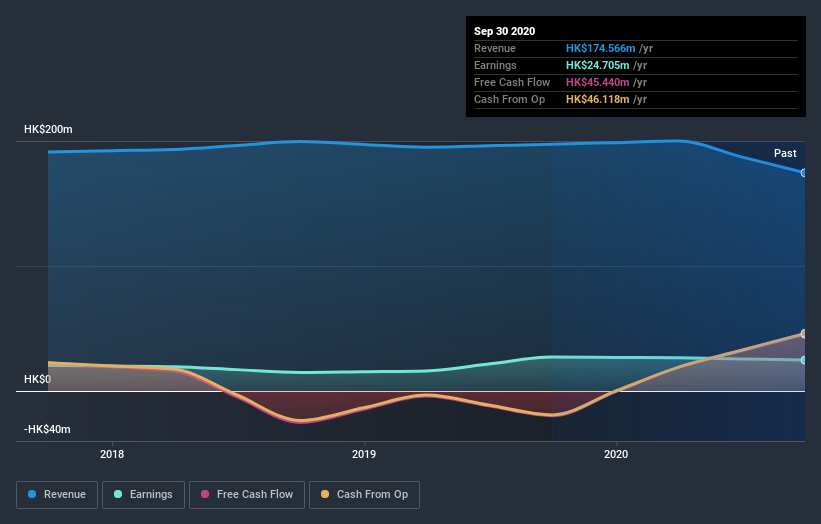

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. HK Asia Holdings' earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

HK Asia Holdings is not owned by hedge funds. Because actions speak louder than words, we consider it a good sign when insiders own a significant stake in a company. In HK Asia Holdings' case, its Top Key Executive, Muk Lung Siu, is the largest shareholder, holding 71% of shares outstanding.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of HK Asia Holdings

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own the majority of HK Asia Holdings Limited. This means they can collectively make decisions for the company. Given it has a market cap of HK$1.3b, that means they have HK$923m worth of shares. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public holds a 29% stake in HK Asia Holdings. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with HK Asia Holdings .

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade HK Asia Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1723

Moon

An investment holding company, engages in the wholesale and retail sale of the pre-paid products in Hong Kong.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026