- Hong Kong

- /

- Communications

- /

- SEHK:1720

Putian Communication Group Limited (HKG:1720) Shares Fly 34% But Investors Aren't Buying For Growth

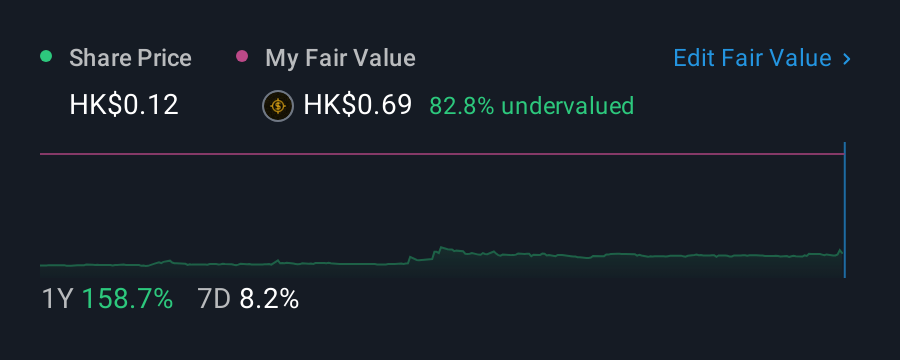

The Putian Communication Group Limited (HKG:1720) share price has done very well over the last month, posting an excellent gain of 34%. The annual gain comes to 193% following the latest surge, making investors sit up and take notice.

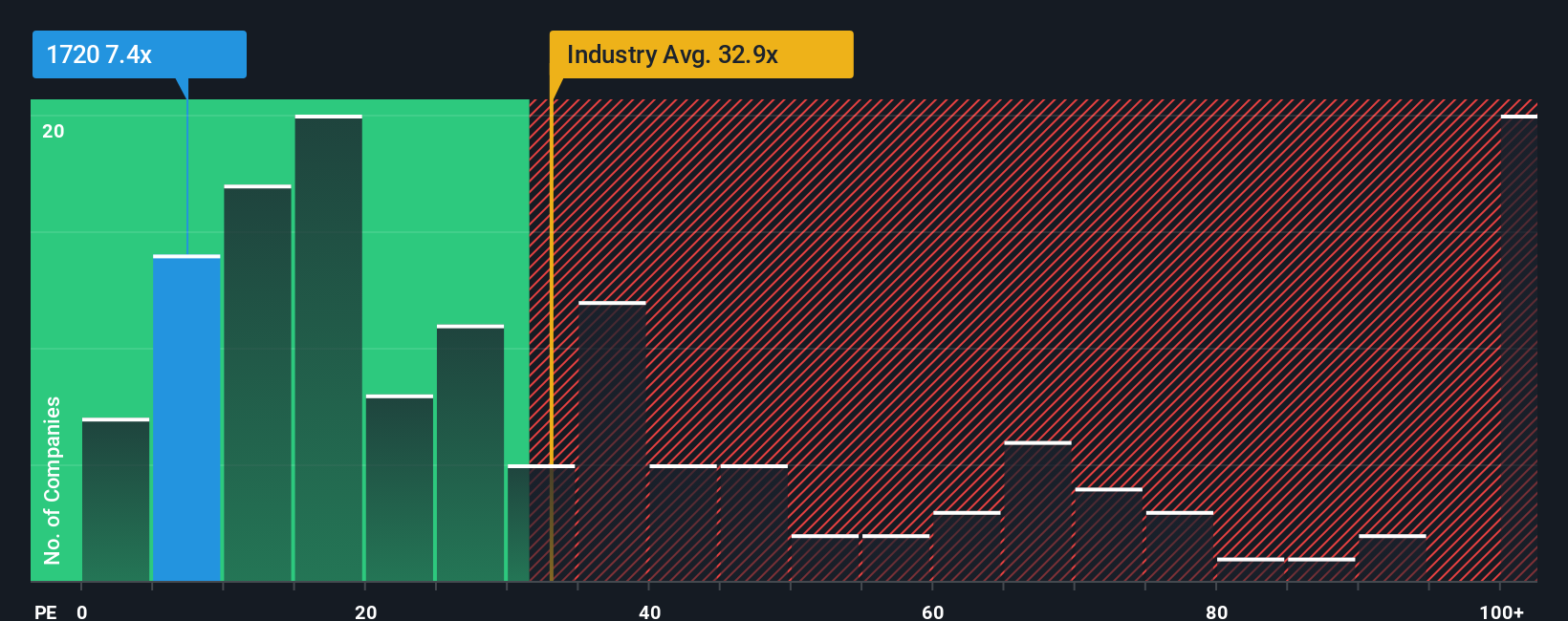

Although its price has surged higher, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 13x, you may still consider Putian Communication Group as an attractive investment with its 7.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Putian Communication Group as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Putian Communication Group

Is There Any Growth For Putian Communication Group?

In order to justify its P/E ratio, Putian Communication Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 142%. Still, incredibly EPS has fallen 58% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's an unpleasant look.

With this information, we are not surprised that Putian Communication Group is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Putian Communication Group's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Putian Communication Group revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Putian Communication Group (including 2 which don't sit too well with us).

You might be able to find a better investment than Putian Communication Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1720

Putian Communication Group

An investment holding company, produces and sells optical fiber cables, communication copper cables, and structured cabling system products under the Hanphy brand name in the People's Republic of China, Hong Kong, and internationally.

Proven track record with slight risk.

Market Insights

Community Narratives