- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1710

Some Investors May Be Worried About Trio Industrial Electronics Group's (HKG:1710) Returns On Capital

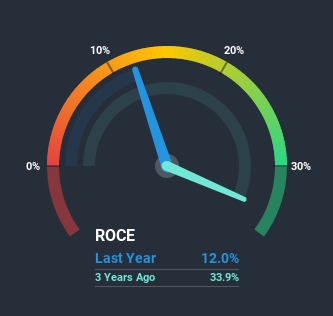

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Trio Industrial Electronics Group (HKG:1710) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Trio Industrial Electronics Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = HK$46m ÷ (HK$544m - HK$159m) (Based on the trailing twelve months to December 2020).

Thus, Trio Industrial Electronics Group has an ROCE of 12%. On its own, that's a standard return, however it's much better than the 8.1% generated by the Electronic industry.

View our latest analysis for Trio Industrial Electronics Group

Historical performance is a great place to start when researching a stock so above you can see the gauge for Trio Industrial Electronics Group's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Trio Industrial Electronics Group, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

When we looked at the ROCE trend at Trio Industrial Electronics Group, we didn't gain much confidence. Around five years ago the returns on capital were 41%, but since then they've fallen to 12%. Given the business is employing more capital while revenue has slipped, this is a bit concerning. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

On a related note, Trio Industrial Electronics Group has decreased its current liabilities to 29% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

Our Take On Trio Industrial Electronics Group's ROCE

In summary, we're somewhat concerned by Trio Industrial Electronics Group's diminishing returns on increasing amounts of capital. Investors haven't taken kindly to these developments, since the stock has declined 56% from where it was three years ago. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

One more thing: We've identified 4 warning signs with Trio Industrial Electronics Group (at least 1 which is a bit unpleasant) , and understanding these would certainly be useful.

While Trio Industrial Electronics Group may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Trio Industrial Electronics Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Trio Industrial Electronics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1710

Trio Industrial Electronics Group

An investment holding company, provides engineering and contract manufacturing services in the People's Republic of China, South-east Asia, North America, Europe, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success