- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1415

Cowell e Holdings Inc.'s (HKG:1415) 30% Jump Shows Its Popularity With Investors

Cowell e Holdings Inc. (HKG:1415) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

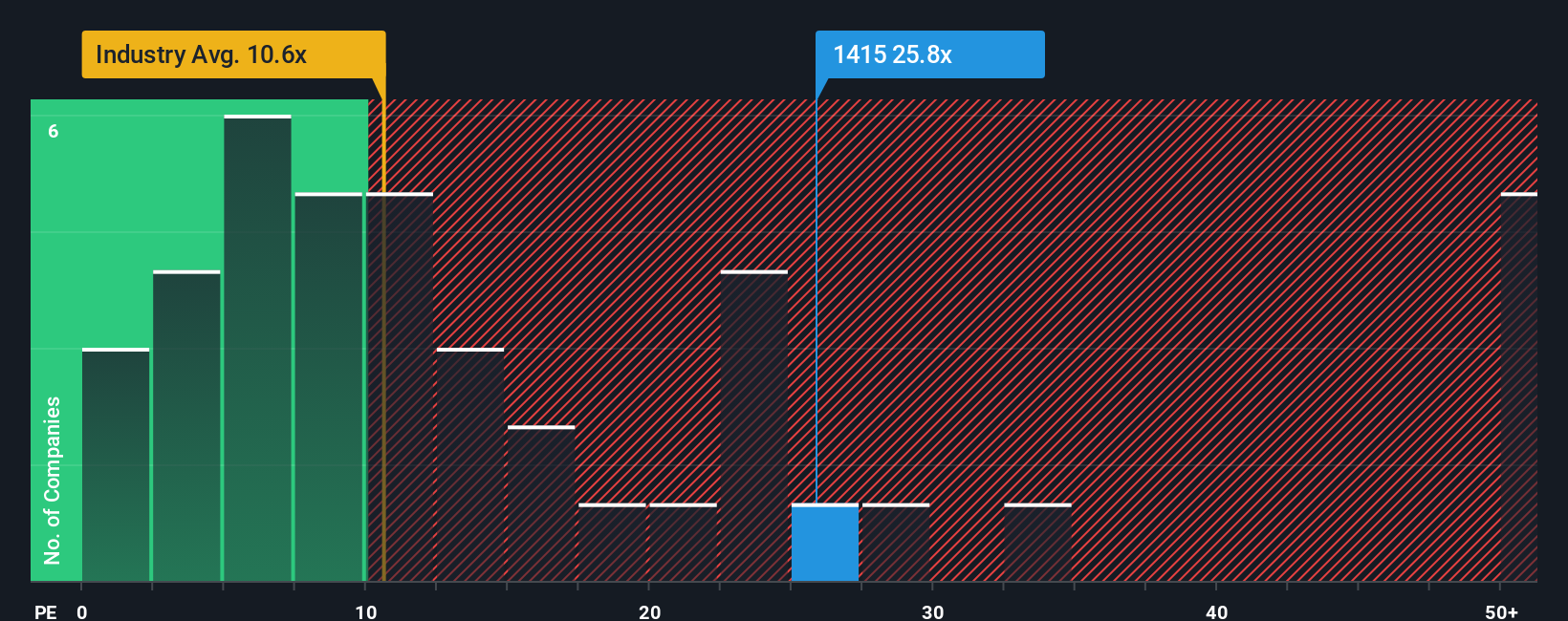

After such a large jump in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 11x, you may consider Cowell e Holdings as a stock to avoid entirely with its 25.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Cowell e Holdings has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Cowell e Holdings

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Cowell e Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 152%. The strong recent performance means it was also able to grow EPS by 131% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 40% per year during the coming three years according to the nine analysts following the company. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Cowell e Holdings is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Cowell e Holdings' P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Cowell e Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Cowell e Holdings (1 shouldn't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1415

Cowell e Holdings

An investment holding company, engages in the design, development, manufacture and sale of modules and system integration products for smartphones, multimedia tablets and other mobile devices.

Outstanding track record and undervalued.

Market Insights

Community Narratives