- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1401

Sprocomm Intelligence And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Global markets have recently experienced a wave of optimism, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs despite geopolitical tensions and tariff concerns. In such a climate, investors often look beyond established giants to discover potential in lesser-known avenues. Penny stocks, although an older term, still represent opportunities for significant growth by focusing on smaller or newer companies that exhibit strong financial fundamentals. This article explores three promising penny stocks that stand out for their balance sheet strength and potential for substantial returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.245 | £825.11M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £425.17M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £70.37M | ★★★★☆☆ |

Click here to see the full list of 5,687 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and internationally with a market cap of HK$1.39 billion.

Operations: The company's revenue primarily comes from its wireless communications equipment segment, generating CN¥3.27 billion.

Market Cap: HK$1.39B

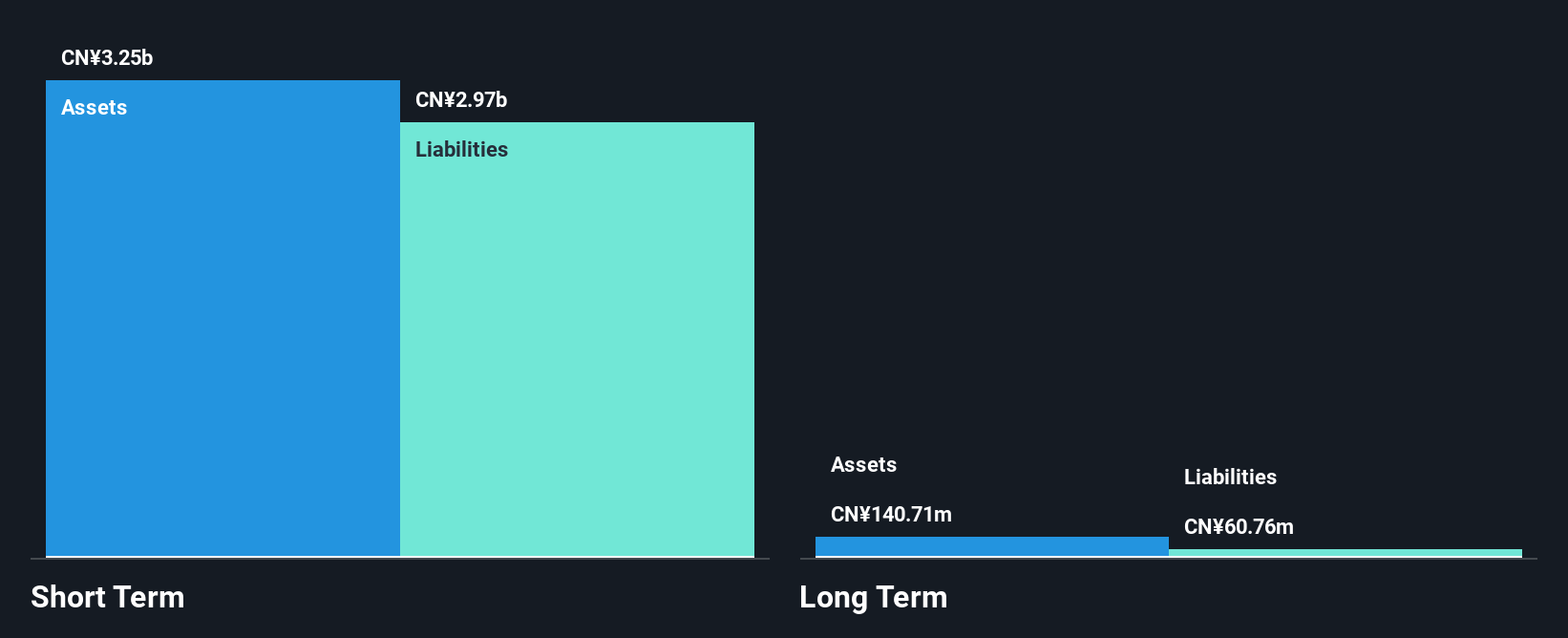

Sprocomm Intelligence has demonstrated significant earnings growth, with a 301.3% increase over the past year, surpassing industry averages. This growth is partially influenced by a large one-off gain of CN¥18.1 million. Despite this, its return on equity remains low at 8.7%, and interest coverage is weak at 1.8 times EBIT, indicating potential financial strain if revenue does not improve sustainably. The company's debt situation has improved significantly over five years, with a net debt to equity ratio now at a satisfactory 29.4%. Recent executive changes may impact strategic direction and operational focus moving forward.

- Dive into the specifics of Sprocomm Intelligence here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Sprocomm Intelligence's track record.

Heilongjiang Interchina Water TreatmentLtd (SHSE:600187)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Heilongjiang Interchina Water Treatment Co., Ltd operates in the construction and management of water treatment and environmental protection projects, as well as energy-saving and clean energy transformation initiatives in China, with a market cap of CN¥6.86 billion.

Operations: Heilongjiang Interchina Water Treatment Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥6.86B

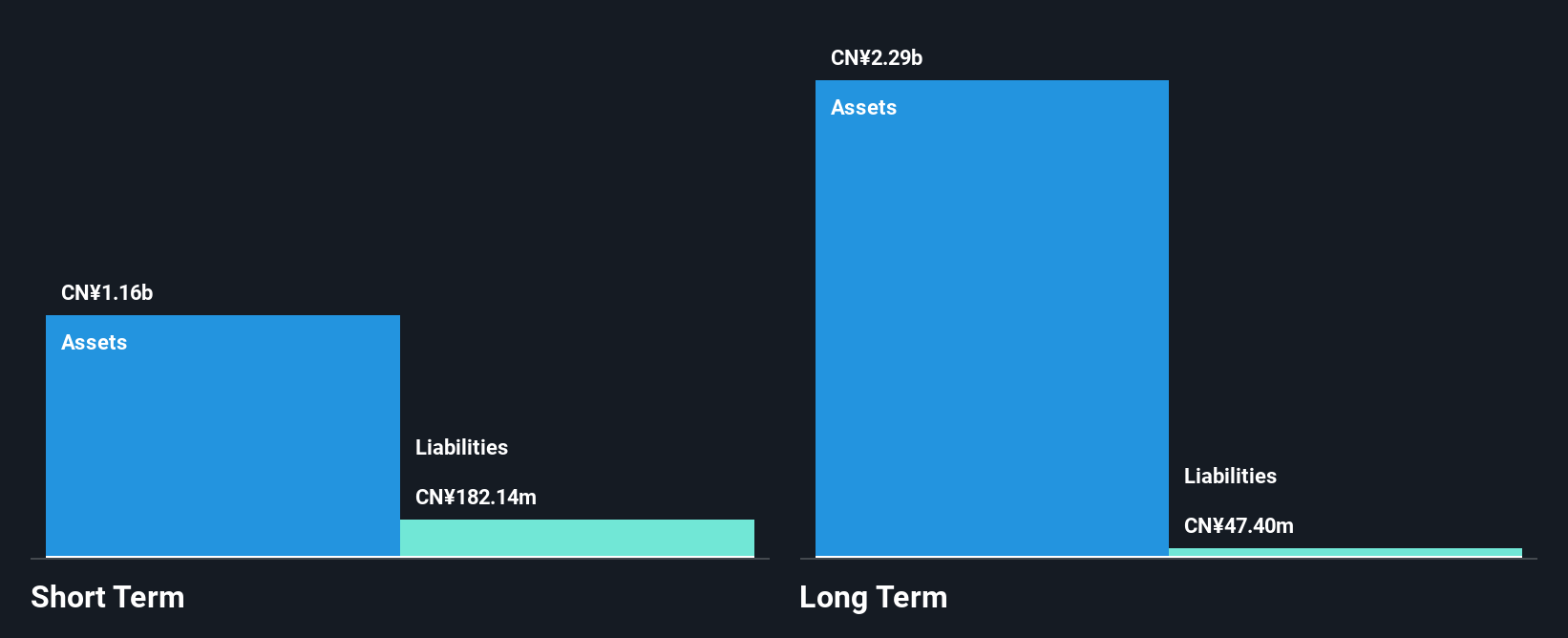

Heilongjiang Interchina Water Treatment Co., Ltd has faced declining financial performance, with sales dropping to CN¥125.45 million from CN¥170.43 million year-over-year and net income plummeting to CN¥9 million from CN¥67.31 million. The company remains unprofitable, with negative operating cash flow and a negative return on equity of -0.99%. However, its financial position shows resilience as short-term assets exceed both short-term and long-term liabilities, indicating liquidity strength. Despite high share price volatility over the past three months, there has been no significant shareholder dilution recently, suggesting stability in capital structure amidst operational challenges.

- Unlock comprehensive insights into our analysis of Heilongjiang Interchina Water TreatmentLtd stock in this financial health report.

- Examine Heilongjiang Interchina Water TreatmentLtd's past performance report to understand how it has performed in prior years.

Shandong Chiway Industry DevelopmentLtd (SZSE:002374)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Chiway Industry Development Co., Ltd. operates in the industrial sector and has a market capitalization of CN¥3.52 billion.

Operations: Shandong Chiway Industry Development Co., Ltd. has not reported any revenue segments.

Market Cap: CN¥3.52B

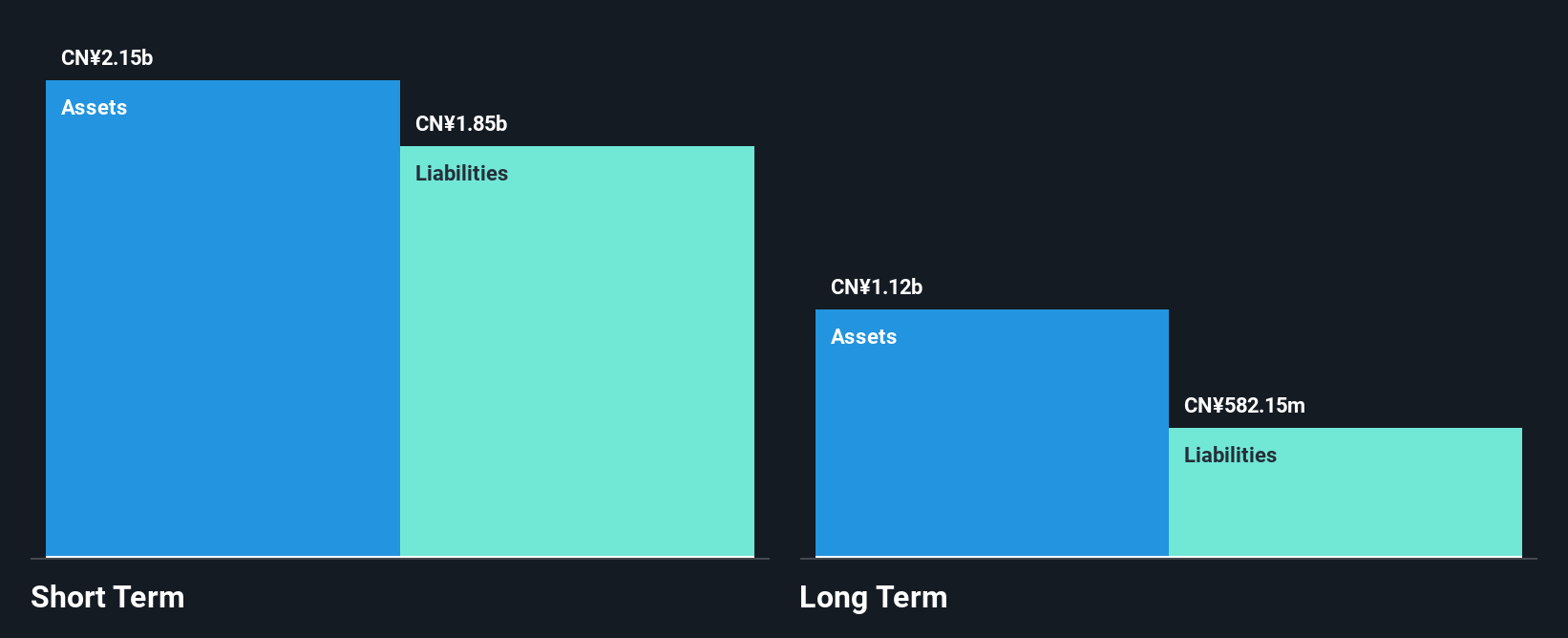

Shandong Chiway Industry Development Co., Ltd. has experienced financial challenges, with sales declining to CN¥459.31 million from CN¥479.38 million year-over-year and a net loss widening to CN¥82.67 million from CN¥40.74 million. Despite these setbacks, the company maintains liquidity strength as its short-term assets of CN¥2.2 billion exceed both short-term and long-term liabilities, totaling CN¥1.8 billion and CN¥711.3 million respectively. The company's debt level is high with a net debt to equity ratio of 149.4%, but it benefits from an experienced management team and board, providing some operational stability amidst ongoing losses.

- Click here and access our complete financial health analysis report to understand the dynamics of Shandong Chiway Industry DevelopmentLtd.

- Explore historical data to track Shandong Chiway Industry DevelopmentLtd's performance over time in our past results report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 5,684 Penny Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1401

Future Machine

An investment holding company, engages in the research and development, design, manufacture, and sale of mobile phones, PCBAs for mobile phones, and IoT related products in the People’s Republic of China, India, Algeria, Bangladesh, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives