As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are nearing record highs, driven by growth stocks outperforming their value counterparts. In this context, penny stocks—often considered a niche investment—remain an intriguing area for potential growth opportunities. These smaller or newer companies can offer attractive prospects when supported by robust financial health and solid fundamentals, making them worth watching for investors seeking under-the-radar opportunities with long-term potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.59B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £319.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.96 | £152.99M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.855 | £468.01M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.09 | £307.32M | ★★★★☆☆ |

Click here to see the full list of 5,694 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research, development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market cap of HK$1.48 billion.

Operations: The company generates revenue of CN¥3.27 billion from its wireless communications equipment segment.

Market Cap: HK$1.48B

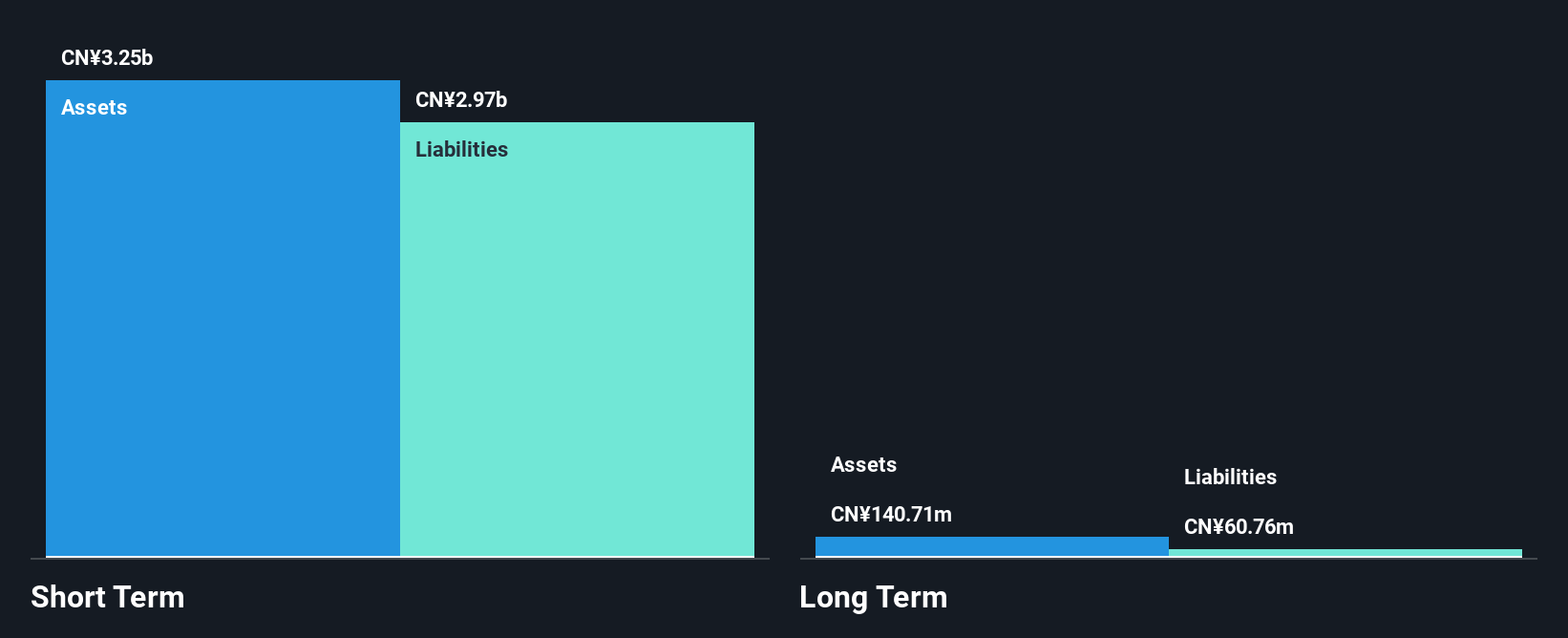

Sprocomm Intelligence, with a market cap of HK$1.48 billion and revenue of CN¥3.27 billion from its wireless communications equipment segment, shows mixed signals as a penny stock. The company's short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. However, while debt is well covered by operating cash flow and the net debt to equity ratio is satisfactory at 29.4%, interest coverage remains weak at 1.8 times EBIT. The recent executive board changes could bring new strategic direction but the management team lacks experience with an average tenure of 1.9 years, potentially affecting stability amidst high share price volatility over recent months.

- Click to explore a detailed breakdown of our findings in Sprocomm Intelligence's financial health report.

- Examine Sprocomm Intelligence's past performance report to understand how it has performed in prior years.

Eastern Polymer Group (SET:EPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eastern Polymer Group Public Company Limited, with a market cap of THB9.46 billion, operates through its subsidiaries to manufacture and distribute rubber insulation, automotive products, and plastic packing both in Thailand and internationally.

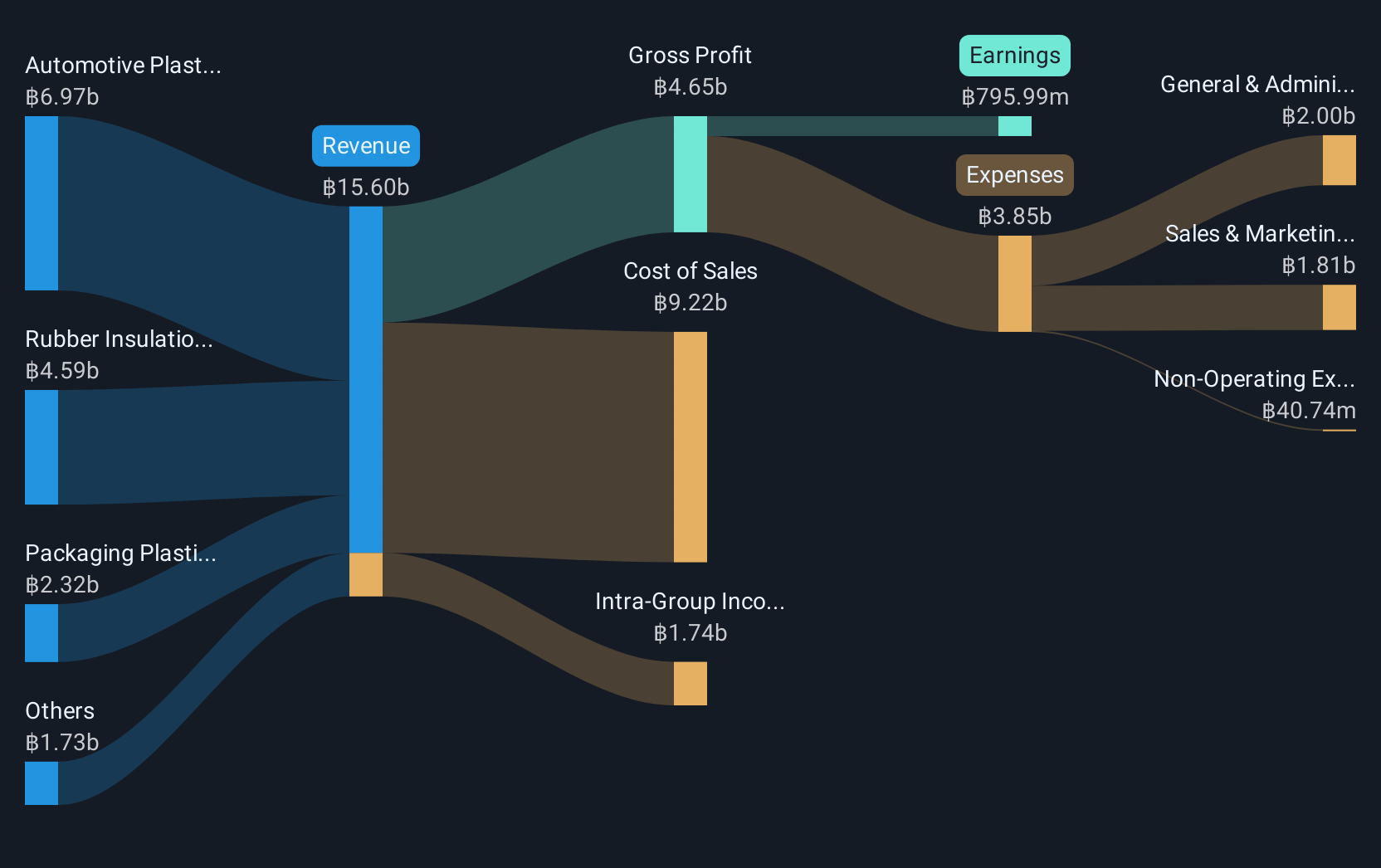

Operations: The company's revenue is primarily generated from three segments: Rubber Insulation (THB4.46 billion), Automotive Plastics (THB7.16 billion), and Packaging Plastics (THB2.36 billion).

Market Cap: THB9.46B

Eastern Polymer Group, with a market cap of THB9.46 billion, presents a mixed picture in the penny stock landscape. The company shows solid liquidity with short-term assets exceeding both short and long-term liabilities. However, recent earnings have declined significantly, with net income for the third quarter dropping to THB163.96 million from THB297.04 million year-on-year, reflecting challenges in maintaining profit margins which fell from 10.1% to 5%. Despite seasoned management and board experience, low return on equity at 5.8% and unstable dividend history highlight potential concerns for investors seeking consistent returns amidst volatile earnings performance.

- Dive into the specifics of Eastern Polymer Group here with our thorough balance sheet health report.

- Learn about Eastern Polymer Group's future growth trajectory here.

North East Rubber (SET:NER)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: North East Rubber Public Company Limited manufactures and sells rubber products in Thailand with a market cap of THB8.98 billion.

Operations: North East Rubber Public Company Limited does not report specific revenue segments.

Market Cap: THB8.98B

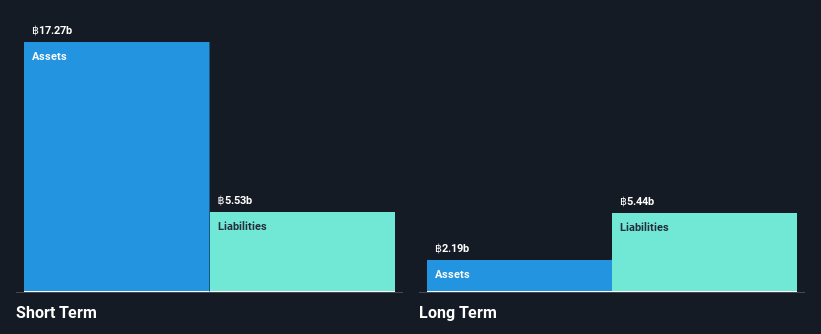

North East Rubber, with a market cap of THB8.98 billion, demonstrates a complex profile in the penny stock domain. The company's financial health is underscored by strong liquidity, as short-term assets significantly exceed liabilities. Recent earnings growth of 6.9% outpaces the industry average but lags behind its five-year growth rate of 16.8%. Despite high debt levels—evidenced by a net debt to equity ratio of 122.3%—interest payments are well covered by EBIT at 4.7 times coverage. The proposed dividend increase aligns with its policy but remains unsupported by free cash flows, posing sustainability questions for investors focused on dividends.

- Take a closer look at North East Rubber's potential here in our financial health report.

- Review our growth performance report to gain insights into North East Rubber's future.

Seize The Opportunity

- Investigate our full lineup of 5,694 Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Polymer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:EPG

Eastern Polymer Group

Through its subsidiaries, engages in the manufacture and distribution of rubber insulation, automotive, and plastic packing products in Thailand and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives