The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like PC Partner Group (HKG:1263). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for PC Partner Group

PC Partner Group's Improving Profits

Over the last three years, PC Partner Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Impressively, PC Partner Group's EPS catapulted from HK$2.96 to HK$5.79, over the last year. Year on year growth of 96% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that PC Partner Group is growing revenues, and EBIT margins improved by 7.8 percentage points to 19%, over the last year. Both of which are great metrics to check off for potential growth.

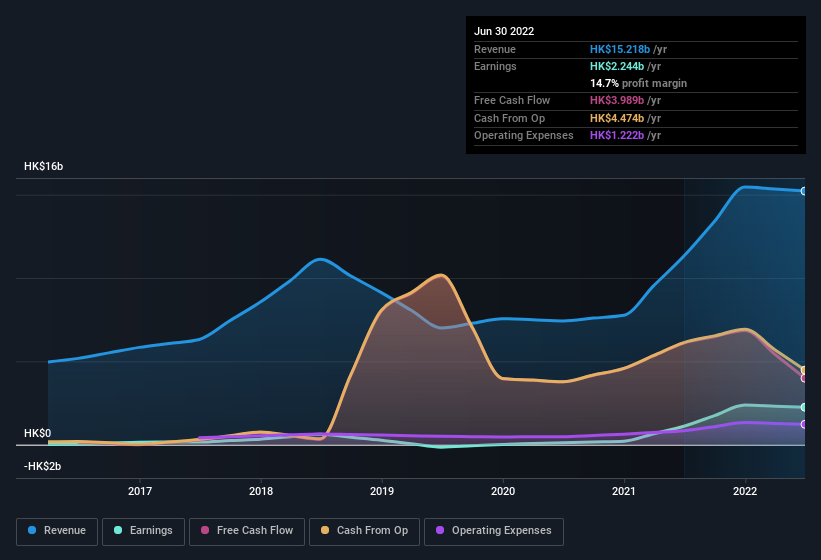

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

PC Partner Group isn't a huge company, given its market capitalisation of HK$2.1b. That makes it extra important to check on its balance sheet strength.

Are PC Partner Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's nice to see that there have been no reports of any insiders selling shares in PC Partner Group in the previous 12 months. Add in the fact that Nai Ho, the Executive Director of the company, paid HK$99k for shares at around HK$9.85 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in PC Partner Group.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for PC Partner Group will reveal that insiders own a significant piece of the pie. In fact, they own 49% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about HK$1.0b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add PC Partner Group To Your Watchlist?

PC Partner Group's earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest PC Partner Group belongs near the top of your watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for PC Partner Group that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of PC Partner Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1263

PC Partner Group

An investment holding company, designs, develops, manufactures, and sells computer electronics.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives