- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1263

Discovering 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In a week marked by volatility and competitive pressures in the tech sector, global markets have been reacting to shifts in economic policy and corporate earnings reports. While major indices like the Nasdaq Composite faced declines due to AI competition fears, small-cap stocks represented by indices such as the S&P 600 continue to navigate these turbulent waters with unique opportunities for growth. In this environment, identifying stocks with strong fundamentals and resilience becomes crucial for uncovering potential gems that may thrive amidst broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gem-Year IndustrialLtd | 1.70% | -3.85% | -33.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 19.07% | 20.23% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Shanghai Feilo AcousticsLtd | 35.63% | -20.15% | 40.51% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

We'll examine a selection from our screener results.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★★★

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions via

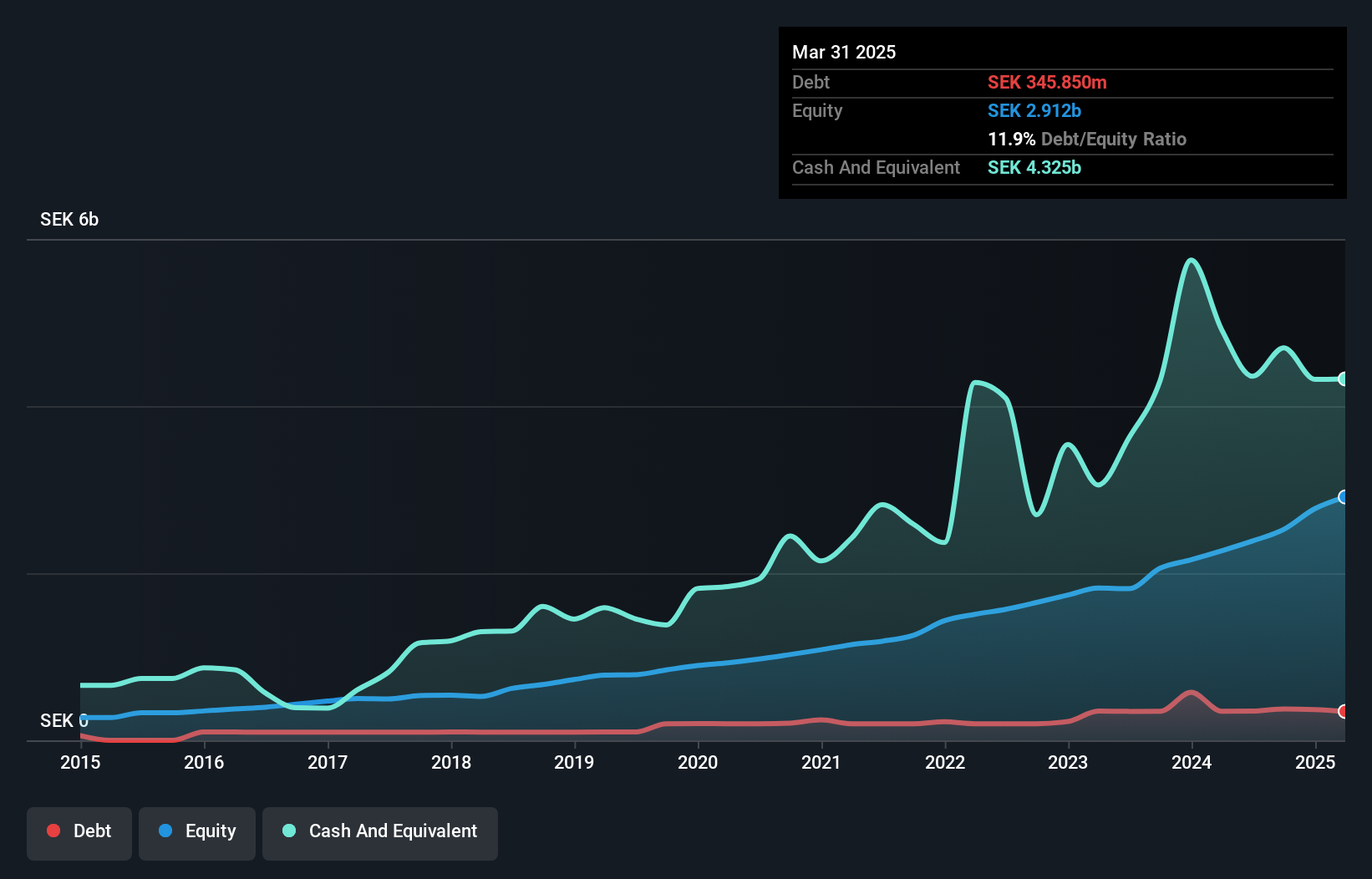

Operations: TF Bank generates revenue primarily from three segments: Credit Cards (SEK 616.31 million), Consumer Lending (SEK 609.26 million), and E-commerce Solutions excluding Credit Cards (SEK 393.34 million).

TF Bank, a smaller player in the financial sector, is trading at 49.5% below its estimated fair value, making it an intriguing prospect. Over the past year, earnings surged by 60.1%, outpacing the industry average of -0.3%. The bank's strong financial health is underscored by total assets of SEK25.1 billion and equity of SEK2.8 billion, with customer deposits forming a low-risk funding base covering 95% of liabilities. It has a sufficient allowance for bad loans at 282% and non-performing loans are appropriately low at 1.3%. A recent special dividend announcement reflects confidence in sustained profitability.

- Click here to discover the nuances of TF Bank with our detailed analytical health report.

Examine TF Bank's past performance report to understand how it has performed in the past.

PC Partner Group (SEHK:1263)

Simply Wall St Value Rating: ★★★★★★

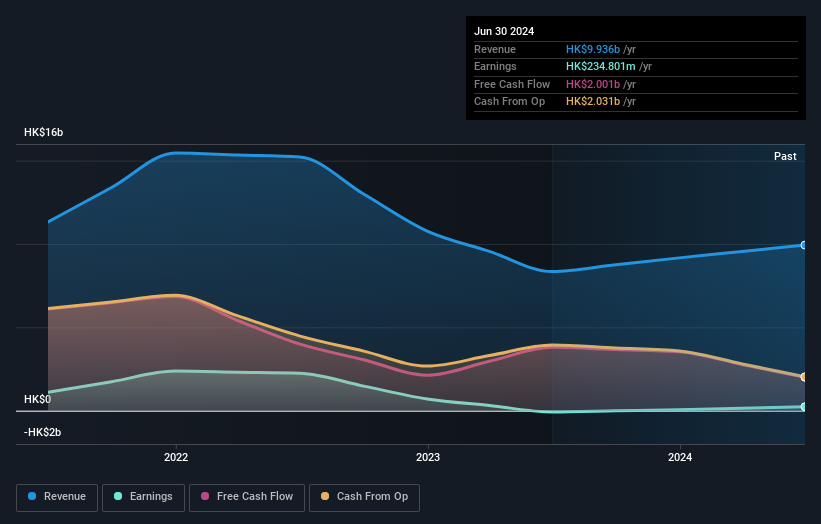

Overview: PC Partner Group Limited is an investment holding company that specializes in the design, development, manufacturing, and sale of computer electronics with a market capitalization of approximately HK$2.16 billion.

Operations: PC Partner Group generates revenue primarily from the design, manufacturing, and trading of electronics and PC parts, amounting to HK$9.94 billion.

PC Partner Group, a smaller player in the tech space, has made significant strides recently. It became profitable this year and is trading at 84.6% below its estimated fair value, suggesting potential undervaluation. Over the past five years, its debt to equity ratio impressively decreased from 174.8% to 33.2%, indicating improved financial health. The company also boasts more cash than total debt and generates high-quality earnings with sufficient interest coverage from profits. Recent board changes and relocation of headquarters to Singapore signal strategic shifts that could bolster future growth prospects in competitive markets.

- Take a closer look at PC Partner Group's potential here in our health report.

Assess PC Partner Group's past performance with our detailed historical performance reports.

Jinmao Property Services (SEHK:816)

Simply Wall St Value Rating: ★★★★★★

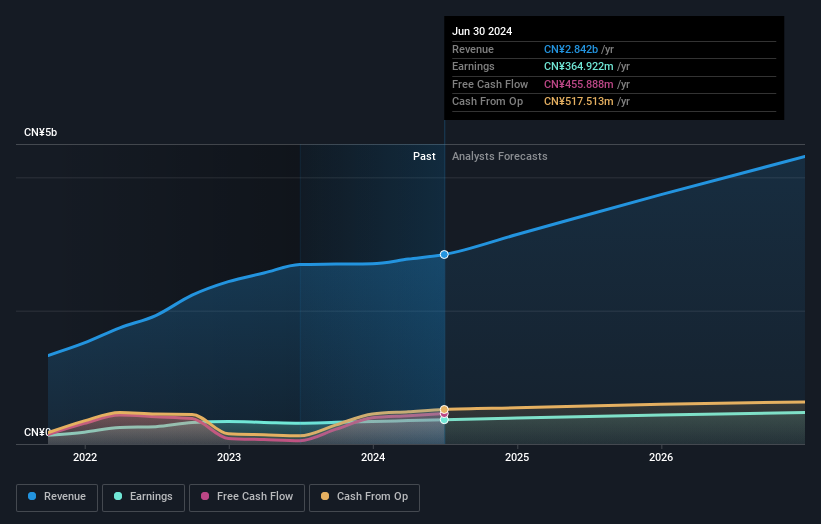

Overview: Jinmao Property Services Co., Limited is an investment holding company offering property management services in the People’s Republic of China, with a market capitalization of HK$2.32 billion.

Operations: The company generates revenue primarily from property management services (CN¥1.83 billion), supplemented by community value-added services (CN¥550.32 million) and value-added services to non-property owners (CN¥458.12 million).

Jinmao Property Services, a relatively smaller player in its industry, has shown impressive financial resilience. The company boasts high-quality earnings and is currently trading at 76% below its estimated fair value. Over the past year, Jinmao's earnings surged by 16.7%, outpacing the Real Estate industry's negative growth of 13%. This performance seems bolstered by being debt-free now compared to five years ago when its debt-to-equity ratio was a staggering 1365%. With an anticipated annual earnings growth of over 10%, Jinmao appears poised for continued positive momentum in the sector.

Where To Now?

- Unlock our comprehensive list of 4678 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1263

PC Partner Group

An investment holding company, designs, develops, manufactures, and sells computer electronics.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives