Some Beisen Holding Limited (HKG:9669) Shareholders Look For Exit As Shares Take 29% Pounding

To the annoyance of some shareholders, Beisen Holding Limited (HKG:9669) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

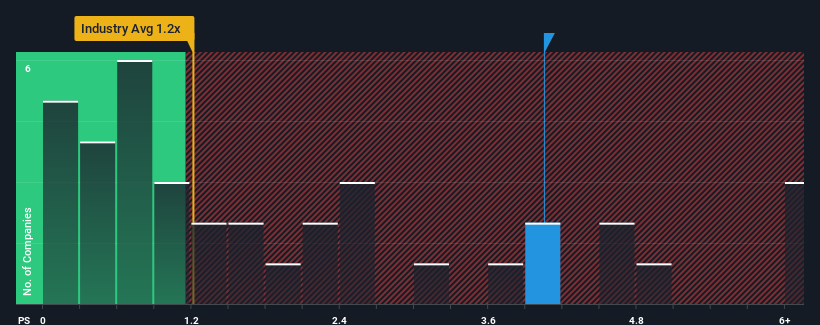

Even after such a large drop in price, when almost half of the companies in Hong Kong's Software industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider Beisen Holding as a stock not worth researching with its 4.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Beisen Holding

How Beisen Holding Has Been Performing

With revenue growth that's superior to most other companies of late, Beisen Holding has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beisen Holding.How Is Beisen Holding's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Beisen Holding's to be considered reasonable.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. Pleasingly, revenue has also lifted 64% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 21% each year during the coming three years according to the two analysts following the company. With the industry predicted to deliver 20% growth per annum, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Beisen Holding is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Beisen Holding's P/S

Even after such a strong price drop, Beisen Holding's P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Beisen Holding currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 3 warning signs for Beisen Holding (1 can't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beisen Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9669

Beisen Holding

An investment holding company, provides cloud-based human capital management (HCM) solutions for enterprises in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives