Little Excitement Around Kinetix Systems Holdings Limited's (HKG:8606) Revenues As Shares Take 26% Pounding

To the annoyance of some shareholders, Kinetix Systems Holdings Limited (HKG:8606) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

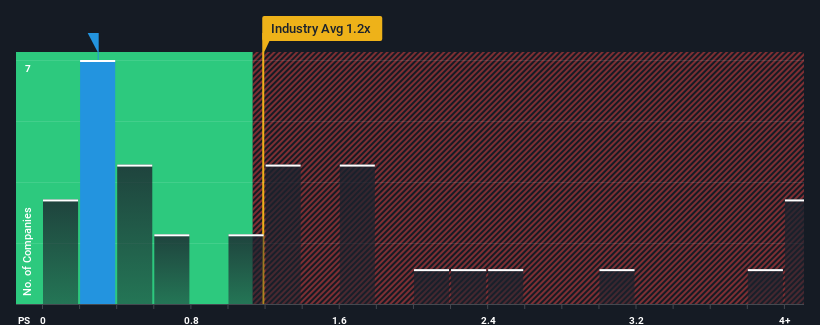

Since its price has dipped substantially, given about half the companies operating in Hong Kong's IT industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Kinetix Systems Holdings as an attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Kinetix Systems Holdings

What Does Kinetix Systems Holdings' P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Kinetix Systems Holdings, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. Those who are bullish on Kinetix Systems Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Kinetix Systems Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Kinetix Systems Holdings?

In order to justify its P/S ratio, Kinetix Systems Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 4.9% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 9.5% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 15% shows it's noticeably less attractive.

In light of this, it's understandable that Kinetix Systems Holdings' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

Kinetix Systems Holdings' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Kinetix Systems Holdings revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Having said that, be aware Kinetix Systems Holdings is showing 3 warning signs in our investment analysis, and 2 of those make us uncomfortable.

If these risks are making you reconsider your opinion on Kinetix Systems Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kinetix Systems Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8606

Kinetix Systems Holdings

An investment holding company, provides information technology (IT) services in Hong Kong, Macau, Singapore, the People’s Republic of China, and the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.