The CEO of Thiz Technology Group Limited (HKG:8119) is Albert Wong, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Thiz Technology Group.

Check out our latest analysis for Thiz Technology Group

Comparing Thiz Technology Group Limited's CEO Compensation With the industry

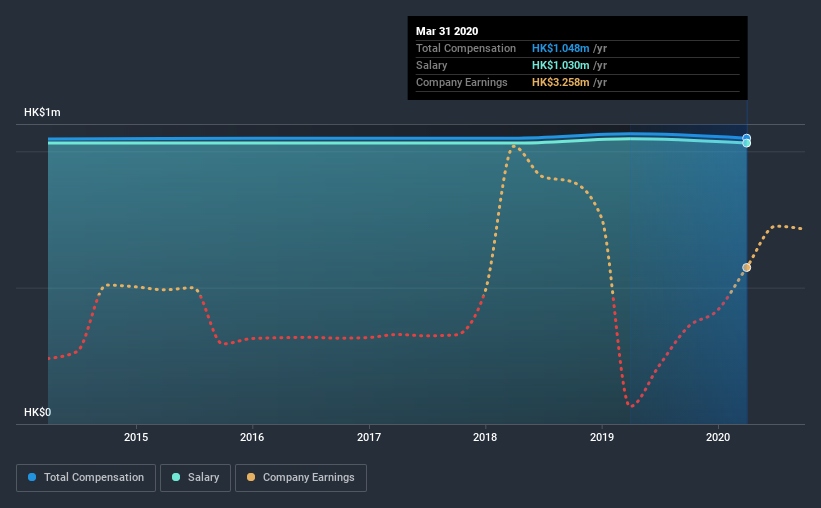

At the time of writing, our data shows that Thiz Technology Group Limited has a market capitalization of HK$35m, and reported total annual CEO compensation of HK$1.0m for the year to March 2020. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at HK$1.03m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.0m. From this we gather that Albert Wong is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$1.0m | HK$1.0m | 98% |

| Other | HK$18k | HK$18k | 2% |

| Total Compensation | HK$1.0m | HK$1.1m | 100% |

On an industry level, around 82% of total compensation represents salary and 18% is other remuneration. Thiz Technology Group pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Thiz Technology Group Limited's Growth Numbers

Over the last three years, Thiz Technology Group Limited has shrunk its earnings per share by 15% per year. It achieved revenue growth of 53% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Thiz Technology Group Limited Been A Good Investment?

With a three year total loss of 84% for the shareholders, Thiz Technology Group Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Thiz Technology Group pays its CEO a majority of compensation through a salary. As we touched on above, Thiz Technology Group Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Still, the company is logging healthy revenue growth over the last year. On the other hand, shareholder returns for Albert are negative over the same period. EPS growth is also negative, adding insult to injury. It's tough for us to say Albert is overpaid but a mixed bag in terms of performance will surely irk shareholders and reduce chances of a raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Thiz Technology Group (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Thiz Technology Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Thiz Technology Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion