3 Asian Penny Stocks With Market Caps Under US$700M To Consider

Reviewed by Simply Wall St

The Asian markets have been navigating a complex landscape, with China's recent economic indicators suggesting potential for further government stimulus to support growth. Amid these broader market dynamics, penny stocks present intriguing opportunities for investors willing to explore smaller or newer companies. While the term "penny stocks" might seem dated, these investments can offer significant value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.099 | SGD42.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.16 | HK$1.8B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 3 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.24 | HK$2.07B | ✅ 4 ⚠️ 2 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.64 | THB792M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.182 | SGD36.26M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.15 | SGD864.2M | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.58 | HK$52.47B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,147 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Frontage Holdings (SEHK:1521)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontage Holdings Corporation, with a market cap of HK$2.65 billion, operates as a contract research organization offering laboratory and related services to pharmaceutical, biotechnology, and agrochemical companies.

Operations: The company generates revenue from its operations in North America and Europe, amounting to $198.21 million, and from the People's Republic of China (PRC), contributing $56.70 million.

Market Cap: HK$2.65B

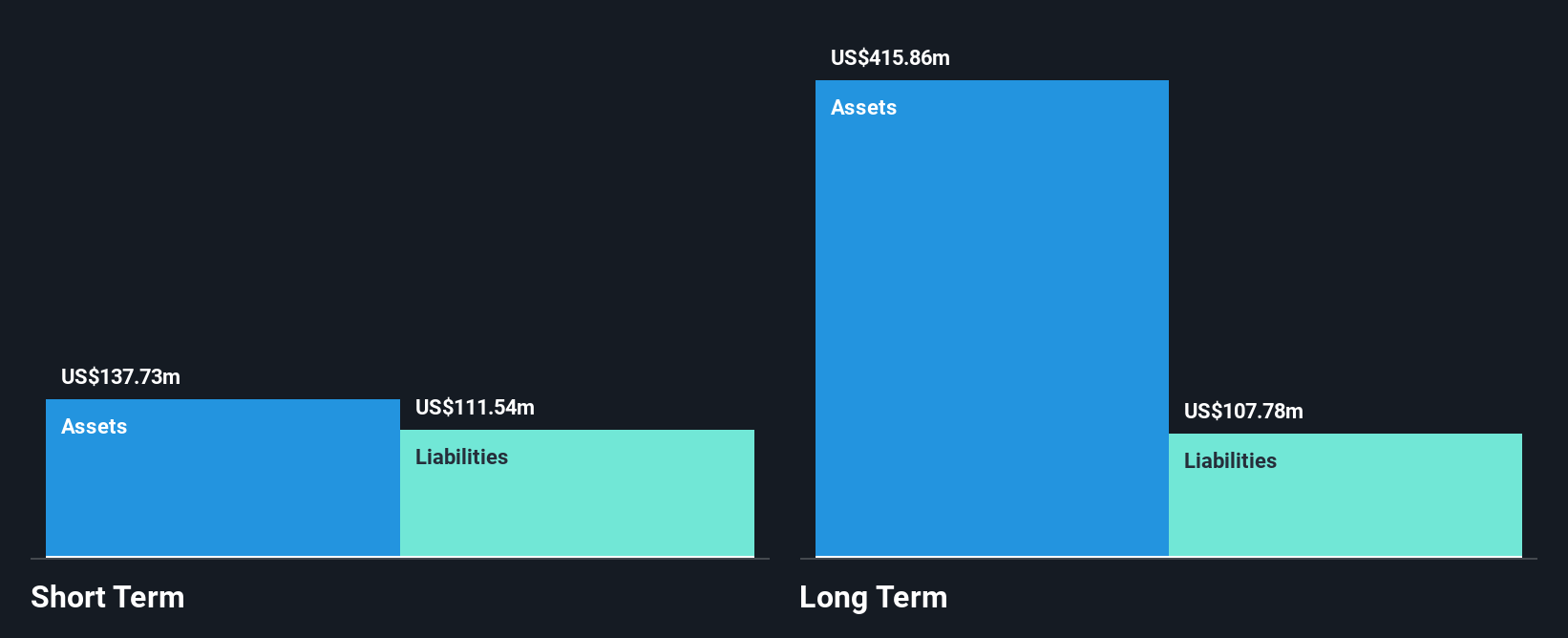

Frontage Holdings Corporation, with a market cap of HK$2.65 billion, has faced challenges in recent financial performance. The company's revenue for 2024 was US$254.91 million, slightly down from the previous year, and net income dropped significantly to US$0.791 million from US$10.81 million. Despite having short-term assets exceeding both long-term and short-term liabilities, the company struggles with low return on equity (0.2%) and interest coverage issues (0.9x EBIT). Recent executive changes include the retirement of Non-executive Director Zhihe Li without board disagreement, reflecting potential stability in governance amidst financial volatility.

- Jump into the full analysis health report here for a deeper understanding of Frontage Holdings.

- Learn about Frontage Holdings' future growth trajectory here.

Fenbi (SEHK:2469)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fenbi Ltd. is an investment holding company that offers non-formal vocational education and training services in the People's Republic of China, with a market cap of HK$5.34 billion.

Operations: The company generates revenue through two primary segments: Sales of Books, contributing CN¥600.78 million, and Tutoring Services, which account for CN¥2.34 billion.

Market Cap: HK$5.34B

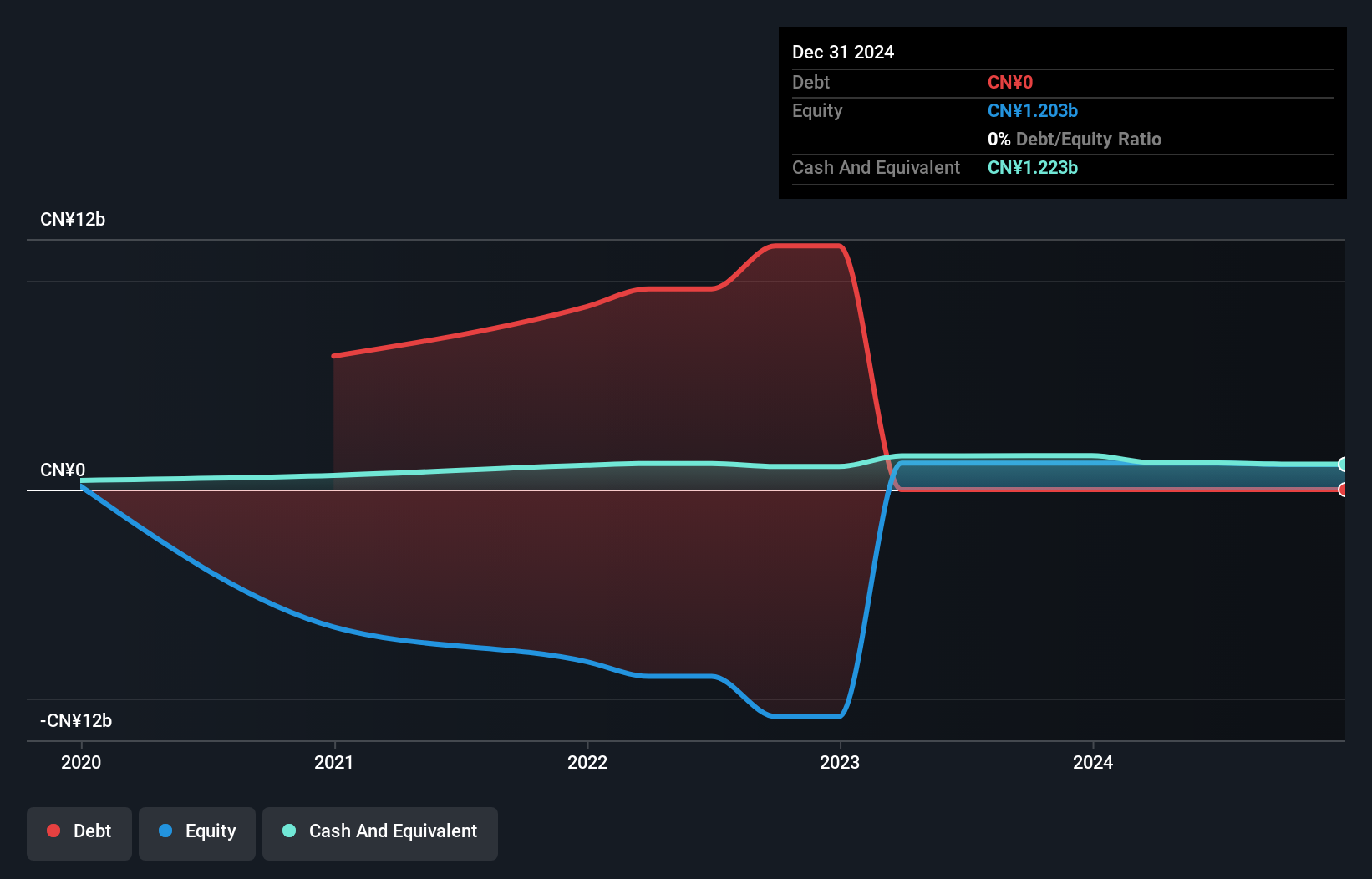

Fenbi Ltd., with a market cap of HK$5.34 billion, has demonstrated robust financial health, being debt-free and having short-term assets (CN¥1.5 billion) that exceed both its short-term (CN¥621.9 million) and long-term liabilities (CN¥51.5 million). The company reported CN¥2.79 billion in sales for 2024, with net income rising to CN¥239.57 million from the previous year, showcasing strong profit growth of 27%. Despite a relatively inexperienced board and low return on equity at 19.9%, Fenbi's earnings are projected to grow by 17.1% annually, supported by high-quality earnings performance and stable volatility levels over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Fenbi.

- Evaluate Fenbi's prospects by accessing our earnings growth report.

Youzan Technology (SEHK:8083)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Youzan Technology Limited is an investment holding company offering online and offline e-commerce solutions in China, Japan, and Canada, with a market cap of HK$3.39 billion.

Operations: The company's revenue is primarily derived from Merchant Services, which generated CN¥1.18 billion, and Third Party Payment Services, contributing CN¥313.19 million.

Market Cap: HK$3.39B

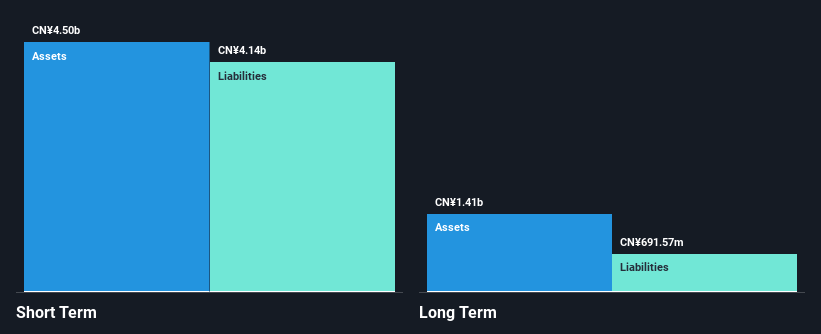

Youzan Technology's financial landscape is characterized by a strong cash position, with short-term assets of CN¥4.5 billion surpassing both its short-term and long-term liabilities, ensuring a stable cash runway for over three years despite being unprofitable. The company reported revenue of CN¥1.44 billion for 2024, primarily from Merchant Services and Third Party Payment Services, but faced a net loss of CN¥176.62 million. Recent strategic moves include a significant share repurchase program aimed at enhancing net asset value per share, reflecting proactive capital management amid ongoing operational challenges in the e-commerce sector across China, Japan, and Canada.

- Click to explore a detailed breakdown of our findings in Youzan Technology's financial health report.

- Assess Youzan Technology's future earnings estimates with our detailed growth reports.

Next Steps

- Reveal the 1,147 hidden gems among our Asian Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8083

Youzan Technology

An investment holding company, provides online and offline e-commerce solutions in the People’s Republic of China, Japan, and Canada.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives