We Think Hang Tai Yue Group Holdings (HKG:8081) Has A Fair Chunk Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hang Tai Yue Group Holdings Limited (HKG:8081) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Hang Tai Yue Group Holdings

What Is Hang Tai Yue Group Holdings's Debt?

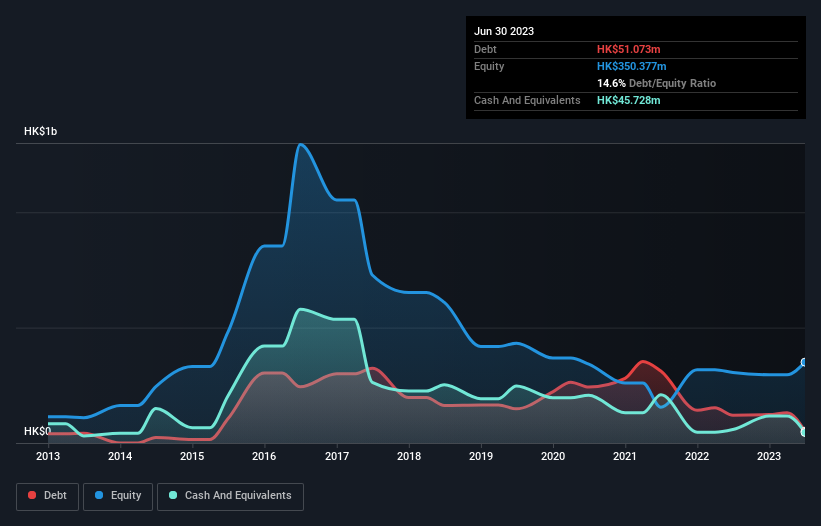

You can click the graphic below for the historical numbers, but it shows that Hang Tai Yue Group Holdings had HK$51.1m of debt in June 2023, down from HK$120.6m, one year before. However, it does have HK$45.7m in cash offsetting this, leading to net debt of about HK$5.35m.

How Healthy Is Hang Tai Yue Group Holdings' Balance Sheet?

We can see from the most recent balance sheet that Hang Tai Yue Group Holdings had liabilities of HK$63.2m falling due within a year, and liabilities of HK$32.2m due beyond that. Offsetting these obligations, it had cash of HK$45.7m as well as receivables valued at HK$56.2m due within 12 months. So it can boast HK$6.56m more liquid assets than total liabilities.

Having regard to Hang Tai Yue Group Holdings' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the HK$536.2m company is struggling for cash, we still think it's worth monitoring its balance sheet. But either way, Hang Tai Yue Group Holdings has virtually no net debt, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Hang Tai Yue Group Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Hang Tai Yue Group Holdings had a loss before interest and tax, and actually shrunk its revenue by 93%, to HK$69m. To be frank that doesn't bode well.

Caveat Emptor

Not only did Hang Tai Yue Group Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost HK$38m at the EBIT level. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. So it seems too risky for our taste. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Hang Tai Yue Group Holdings (1 can't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Hang Tai Yue Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8081

Hang Tai Yue Group Holdings

An investment holding company, engages in the hospitality and related services, money lending, and assets investments businesses in Hong Kong and Australia.

Excellent balance sheet with low risk.

Market Insights

Community Narratives