3 Penny Stocks With Growth Potential And Market Caps Larger Than US$20M

Reviewed by Simply Wall St

As global markets experience fluctuating trends, with recent gains in major stock indexes tempered by declines later in the week, investors are keenly observing potential opportunities. Penny stocks, a term that may seem outdated but remains relevant, often represent smaller or newer companies poised for growth. These stocks can offer value and potential upside when backed by strong financials and clear growth prospects, making them an intriguing option for those seeking to explore emerging market players.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,830 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Zhidao International (Holdings) (SEHK:1220)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhidao International (Holdings) Limited is an investment holding company that offers construction and engineering services in Hong Kong and Macau, with a market capitalization of HK$217.80 million.

Operations: The company's revenue is derived from its money lending operations, which generated HK$3.08 million, while its construction projects segment reported a loss of HK$102.17 million.

Market Cap: HK$217.8M

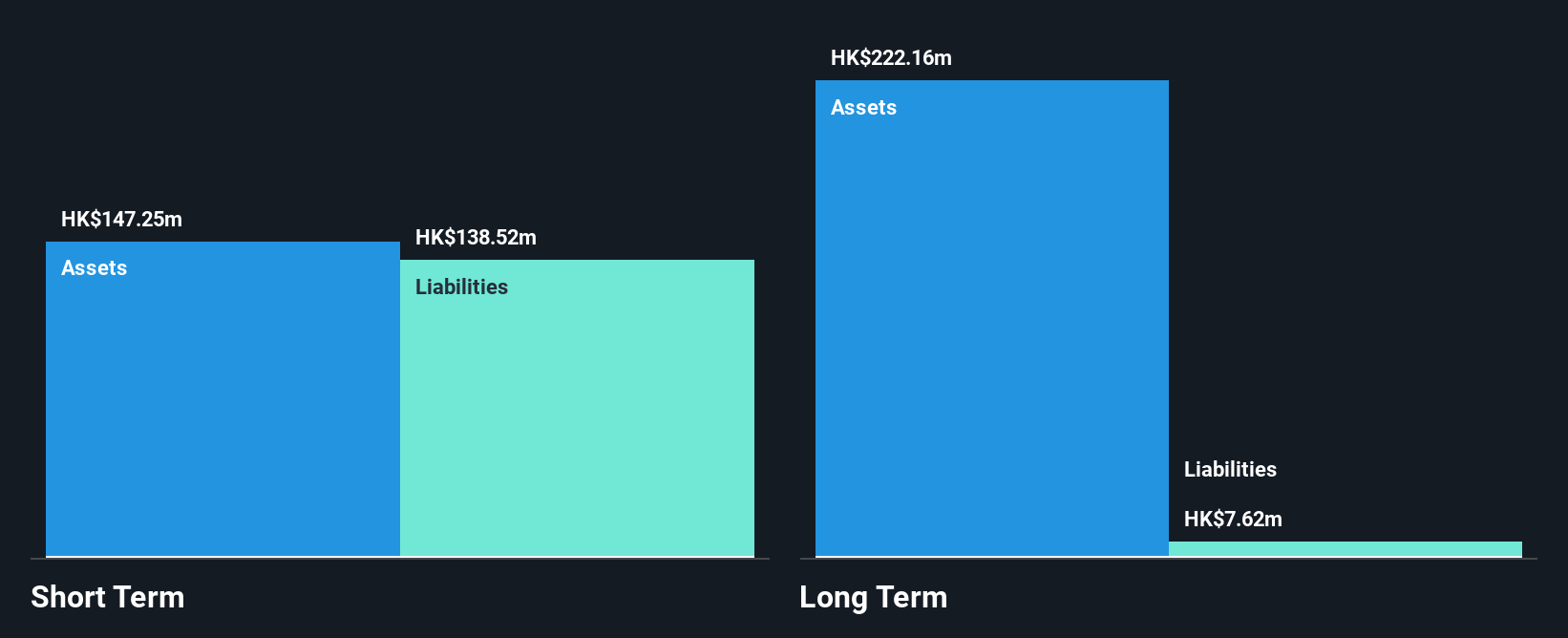

Zhidao International (Holdings) Limited, with a market cap of HK$217.80 million, faces challenges as it remains pre-revenue and unprofitable, reporting a significant net loss for the recent half-year period. Despite this, the company has secured contracts worth HK$25.1 million in Hong Kong and is exploring a joint venture in Indonesia under a framework agreement with Belt and Road EPC Capital Limited. The company's short-term assets exceed both its long-term and short-term liabilities, indicating some financial stability despite its volatile share price and ongoing losses over the past five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhidao International (Holdings).

- Gain insights into Zhidao International (Holdings)'s historical outcomes by reviewing our past performance report.

Giordano International (SEHK:709)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Giordano International Limited is an investment holding company involved in the retail and distribution of fashion apparel and accessories for men, women, and children across Mainland China, Hong Kong, Macau, Taiwan, Southeast Asia and Australia, Gulf Cooperation Council regions and internationally with a market cap of HK$2.67 billion.

Operations: The company's revenue is primarily derived from Southeast Asia and Australia (HK$1.48 billion), followed by the Gulf Cooperation Council (HK$676 million), Mainland China (HK$631 million), Taiwan (HK$420 million), Hong Kong and Macau (HK$374 million), and wholesale to overseas franchisees (HK$229 million).

Market Cap: HK$2.67B

Giordano International, with a market cap of HK$2.67 billion, has shown resilience despite recent challenges in the retail sector. The company reported stable revenue for the year to date at HK$2.81 billion, slightly down from last year. Its financial health is supported by more cash than total debt and strong interest coverage by EBIT (20.8x). However, its dividend yield of 12.8% is not well covered by earnings, reflecting potential sustainability concerns. While past profit growth was robust at 21.5% annually over five years, recent earnings have declined significantly by 23.8%, highlighting volatility in performance.

- Jump into the full analysis health report here for a deeper understanding of Giordano International.

- Explore Giordano International's analyst forecasts in our growth report.

Hang Tai Yue Group Holdings (SEHK:8081)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hang Tai Yue Group Holdings Limited is an investment holding company involved in hospitality and related services, network media, money lending, and asset investments in Hong Kong and Australia, with a market cap of HK$252.65 million.

Operations: The company's revenue is primarily derived from the Provision of Hospitality and Related Services in Australia, which generated HK$60.17 million, followed by the Money Lending Business at HK$8.16 million and Provision of Services through Network Media at HK$0.02 million.

Market Cap: HK$252.65M

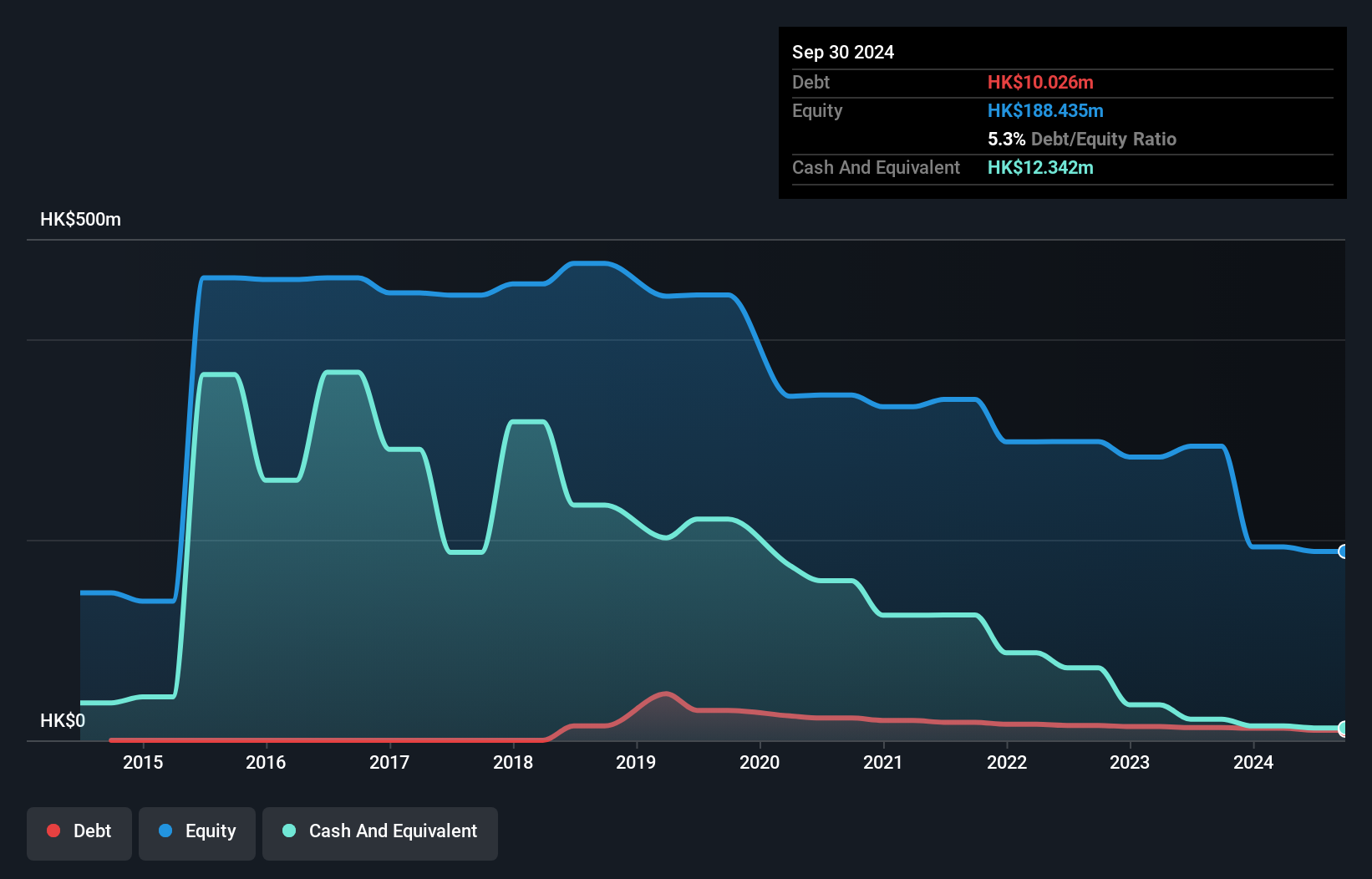

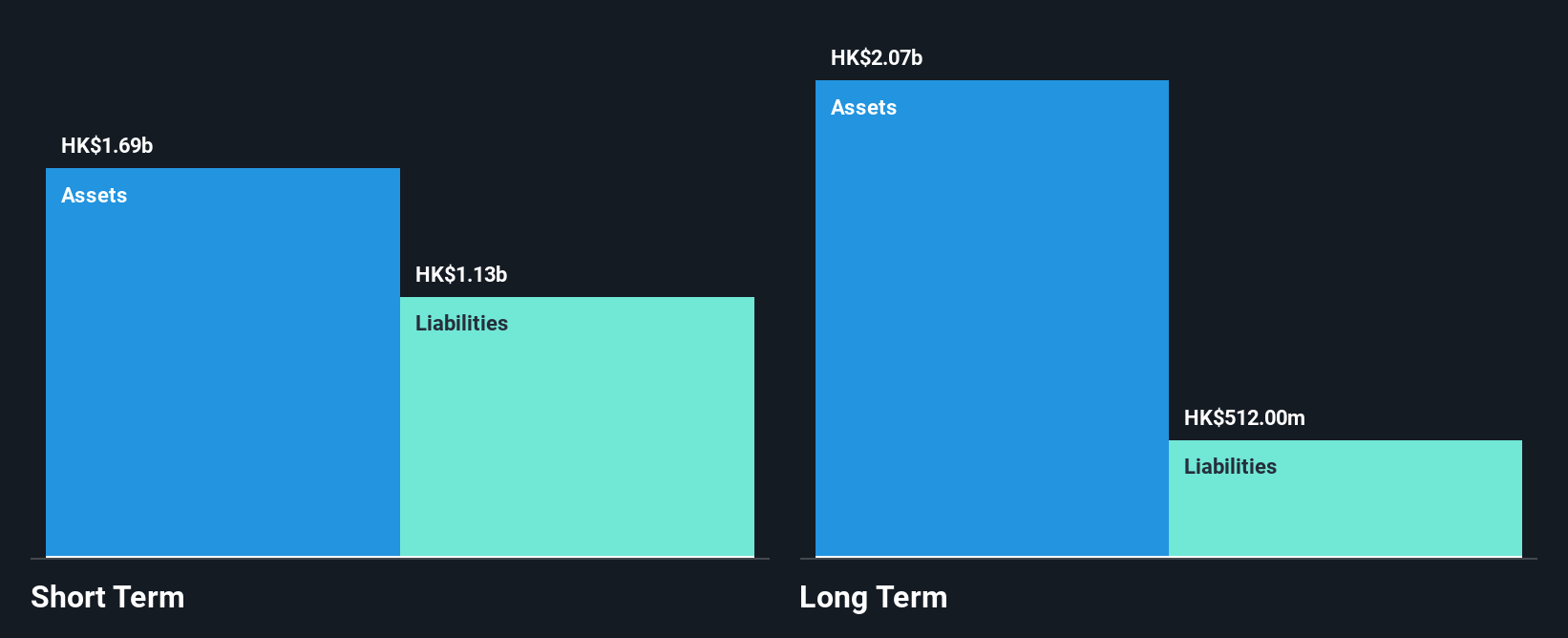

Hang Tai Yue Group Holdings, with a market cap of HK$252.65 million, derives most revenue from its hospitality services in Australia (HK$60.17 million). Despite being unprofitable, it has reduced losses over five years and maintains a satisfactory net debt to equity ratio of 21.9%. The company boasts a cash runway exceeding three years due to positive free cash flow and stable asset coverage for liabilities. However, high share price volatility and negative return on equity (-19.88%) present challenges. The experienced management team (3.3-year tenure) remains focused amid these dynamics without shareholder dilution in the past year.

- Get an in-depth perspective on Hang Tai Yue Group Holdings' performance by reading our balance sheet health report here.

- Explore historical data to track Hang Tai Yue Group Holdings' performance over time in our past results report.

Where To Now?

- Jump into our full catalog of 5,830 Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hang Tai Yue Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8081

Hang Tai Yue Group Holdings

An investment holding company, engages in the hospitality and related services, money lending, and assets investments businesses in Hong Kong and Australia.

Excellent balance sheet with low risk.

Market Insights

Community Narratives