Vobile Group Limited's (HKG:3738) CEO Will Probably Have Their Compensation Approved By Shareholders

It would be hard to discount the role that CEO Bernard Wang has played in delivering the impressive results at Vobile Group Limited (HKG:3738) recently. Shareholders will have this at the front of their minds in the upcoming AGM on 30 June 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

Check out our latest analysis for Vobile Group

Comparing Vobile Group Limited's CEO Compensation With the industry

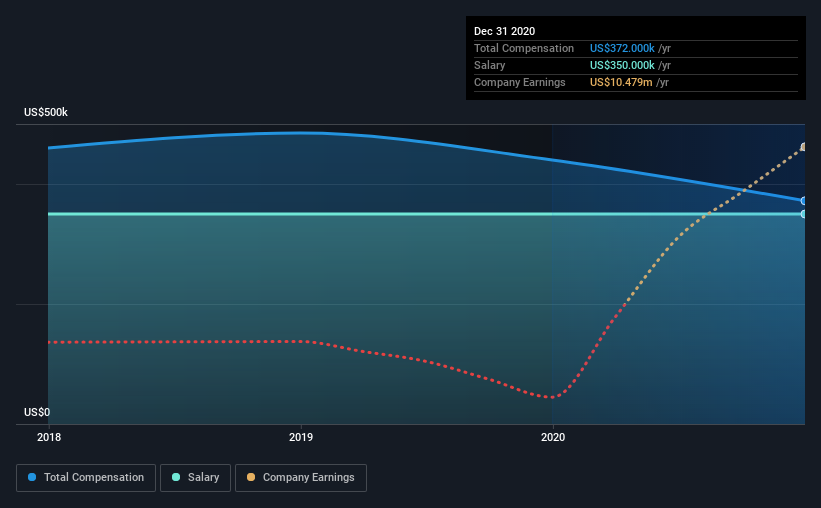

According to our data, Vobile Group Limited has a market capitalization of HK$15b, and paid its CEO total annual compensation worth US$372k over the year to December 2020. That's a notable decrease of 15% on last year. In particular, the salary of US$350.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from HK$7.8b to HK$25b, the reported median CEO total compensation was US$372k. From this we gather that Bernard Wang is paid around the median for CEOs in the industry. What's more, Bernard Wang holds HK$2.1b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$350k | US$350k | 94% |

| Other | US$22k | US$90k | 6% |

| Total Compensation | US$372k | US$440k | 100% |

On an industry level, roughly 88% of total compensation represents salary and 12% is other remuneration. There isn't a significant difference between Vobile Group and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Vobile Group Limited's Growth Numbers

Vobile Group Limited's earnings per share (EPS) grew 82% per year over the last three years. Its revenue is up 133% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Vobile Group Limited Been A Good Investment?

We think that the total shareholder return of 841%, over three years, would leave most Vobile Group Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 3 warning signs for Vobile Group that investors should be aware of in a dynamic business environment.

Switching gears from Vobile Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3738

Vobile Group

An investment holding company, provides software as a service for digital content asset protection and transaction in the United States, Mainland China, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives