Ruihe Data Technology Holdings Limited's (HKG:3680) 79% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Ruihe Data Technology Holdings Limited (HKG:3680) shares have been powering on, with a gain of 79% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

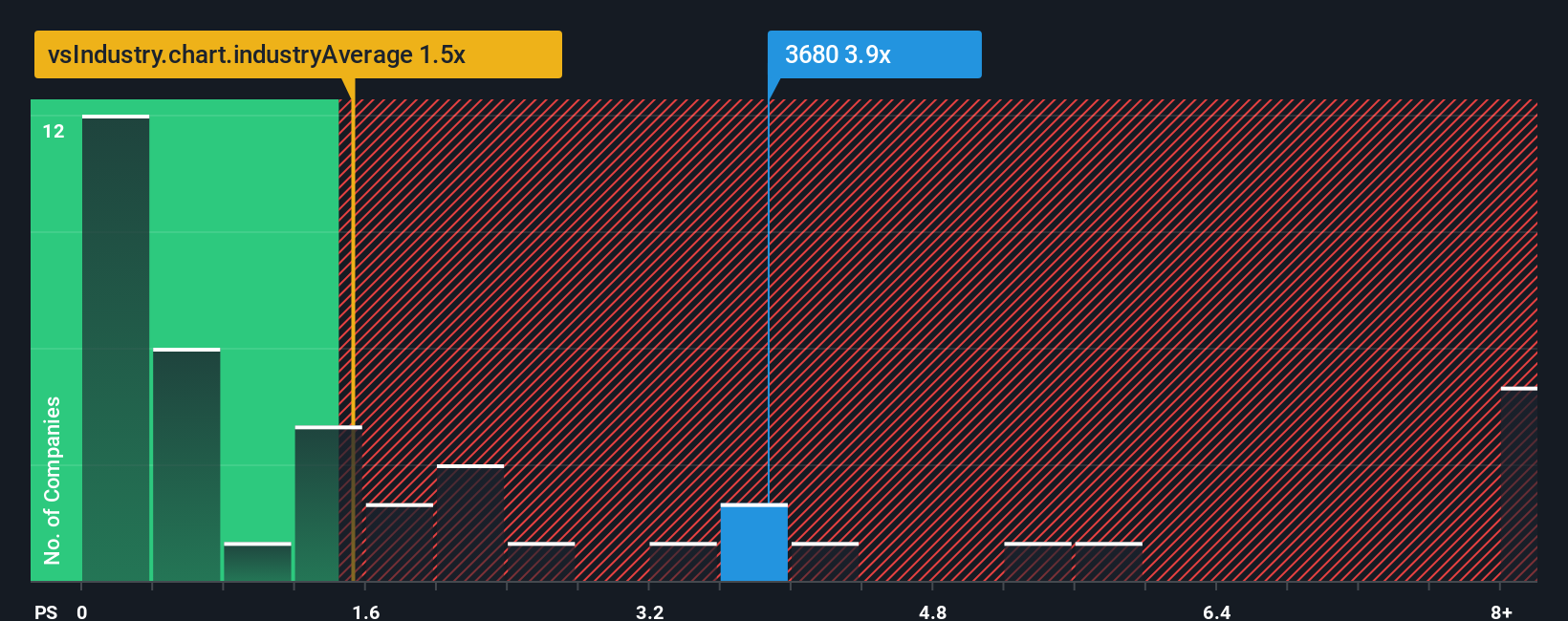

Since its price has surged higher, when almost half of the companies in Hong Kong's IT industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Ruihe Data Technology Holdings as a stock not worth researching with its 3.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Ruihe Data Technology Holdings

What Does Ruihe Data Technology Holdings' Recent Performance Look Like?

The recent revenue growth at Ruihe Data Technology Holdings would have to be considered satisfactory if not spectacular. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Ruihe Data Technology Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Ruihe Data Technology Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Ruihe Data Technology Holdings' is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 2.7%. Still, lamentably revenue has fallen 4.9% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.9% shows it's an unpleasant look.

With this in mind, we find it worrying that Ruihe Data Technology Holdings' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Ruihe Data Technology Holdings' P/S?

Shares in Ruihe Data Technology Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ruihe Data Technology Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Ruihe Data Technology Holdings (of which 2 don't sit too well with us!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3680

Ruihe Data Technology Holdings

An investment holding company, develops and delivers data, artificial intelligence, and digital marketing solutions in the People’s Republic of China.

Low risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success