WellCell Holdings Co., Limited's (HKG:2477) Popularity With Investors Under Threat As Stock Sinks 31%

The WellCell Holdings Co., Limited (HKG:2477) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 418% in the last year.

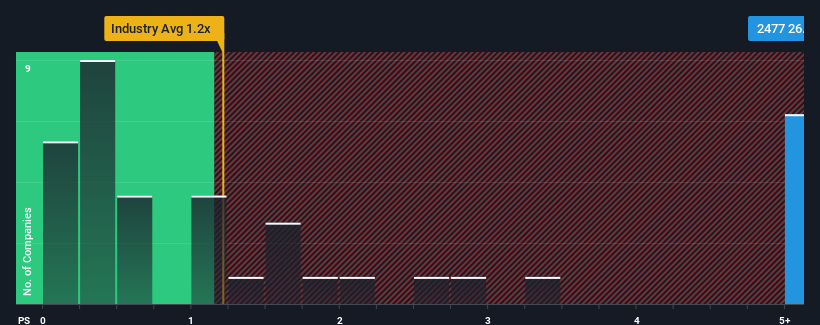

In spite of the heavy fall in price, when almost half of the companies in Hong Kong's IT industry have price-to-sales ratios (or "P/S") below 1.2x, you may still consider WellCell Holdings as a stock not worth researching with its 26.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for WellCell Holdings

How Has WellCell Holdings Performed Recently?

WellCell Holdings has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for WellCell Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is WellCell Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, WellCell Holdings would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.7%. This was backed up an excellent period prior to see revenue up by 37% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 9.6% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that WellCell Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What Does WellCell Holdings' P/S Mean For Investors?

A significant share price dive has done very little to deflate WellCell Holdings' very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't expect to see WellCell Holdings trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - WellCell Holdings has 3 warning signs (and 2 which are significant) we think you should know about.

If these risks are making you reconsider your opinion on WellCell Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WellCell Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2477

WellCell Holdings

Through its subsidiaries, operates as a telecommunication network support, and information and communication technology (ICT) integration services provider in the People’s Republic of China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success