Xuan Wu Cloud Technology Holdings (HKG:2392 shareholders incur further losses as stock declines 15% this week, taking one-year losses to 66%

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that Xuan Wu Cloud Technology Holdings Limited (HKG:2392) stock has had a really bad year. In that relatively short period, the share price has plunged 66%. We wouldn't rush to judgement on Xuan Wu Cloud Technology Holdings because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 24% in the last three months. Of course, this share price action may well have been influenced by the 12% decline in the broader market, throughout the period.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Xuan Wu Cloud Technology Holdings

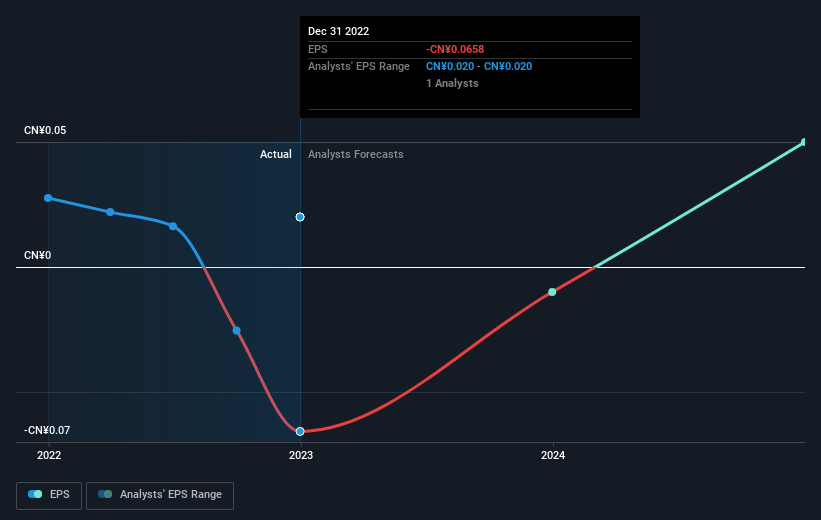

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Xuan Wu Cloud Technology Holdings fell to a loss making position during the year. Some investors no doubt dumped the stock as a result. We hope for shareholders' sake that the company becomes profitable again soon.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Xuan Wu Cloud Technology Holdings' earnings, revenue and cash flow.

A Different Perspective

We doubt Xuan Wu Cloud Technology Holdings shareholders are happy with the loss of 66% over twelve months. That falls short of the market, which lost 4.1%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 24%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2392

Xuan Wu Cloud Technology Holdings

An investment holding company, provides intelligent customer relationship management (CRM) services in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.